Operating Profit Plunged 97.7% Last Year

Concerns Over Competitiveness of General Steel Products

Domestic Construction Slump Hits Hard

Reduced Operations at Pohang Plant 2 Become Reality

Hyundai Steel, which has been embroiled in labor-management conflicts, has finally declared an emergency management system. This drastic measure was taken just one day after the breakdown of wage and collective bargaining negotiations between labor and management. It is evaluated that the underlying factors include the worsening growth and profitability due to the onslaught of low-priced Chinese steel and sluggish domestic demand, as well as the deteriorating external business environment such as the impact of the 25% steel tariffs imposed by the second Trump administration.

Seoganghyun, President of Hyundai Steel (left), and Lee Heegeun, President of POSCO, are attending a meeting of the steel industry responding to U.S. tariffs held on the 13th at the POSCO Center in Gangnam-gu, Seoul, listening to remarks by Ahn Deokgeun, Minister of Trade, Industry and Energy. Photo by Yonhap News

Seoganghyun, President of Hyundai Steel (left), and Lee Heegeun, President of POSCO, are attending a meeting of the steel industry responding to U.S. tariffs held on the 13th at the POSCO Center in Gangnam-gu, Seoul, listening to remarks by Ahn Deokgeun, Minister of Trade, Industry and Energy. Photo by Yonhap News

On the morning of the 14th, Hyundai Steel announced the launch of an emergency management system, stating, "We will cut the salaries of all executives by 20% and are reviewing voluntary retirement for all employees." The company explained, "We judged that without strong self-help measures, it would be difficult to improve management amid the recent severe domestic and international crisis situations," and added, "We plan to pursue extreme cost-cutting measures in various ways."

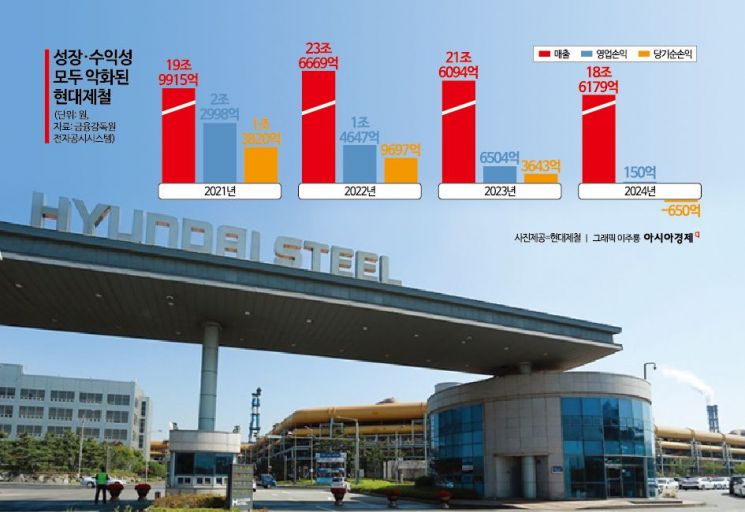

Hyundai Steel's shift to an emergency management system is due to deteriorating profitability amid a complex domestic and international crisis surrounding the steel industry. According to the Financial Supervisory Service's electronic disclosure system, Hyundai Steel's operating profit on a separate basis last year was 15 billion KRW, a staggering 97.7% decrease from the previous year (650.4 billion KRW). Sales, considered an indicator of external growth, also recorded 18.6176 trillion KRW, down 13.8% from the previous year (21.6094 trillion KRW).

This deterioration in business performance is mainly attributed to the sharp downturn in the domestic construction market. It is also the reason Hyundai Steel recently reduced operations at its Pohang Plant 2. Pohang Plant 2 has primarily produced long steel products (rebar and H-beams) mainly used in construction. However, due to the construction industry slump, demand decreased, and last year's sales volume (5.401 million tons) also dropped about 15% compared to the previous year (6.327 million tons). A Hyundai Steel official said, "We changed the working system at Pohang Plant 2 from the existing four shifts to two shifts and are accepting voluntary retirement applications from technical staff as well as requests for reassignment to Dangjin Steelworks or the Incheon plant."

The invasion of low-priced Chinese steel also contributed to the shift to an emergency management system. According to the Korea Iron & Steel Association, steel imports from China to Korea last year totaled 8.77 million tons, marking the highest level in seven years since 2017 (11.53 million tons). Chinese steel was imported at prices up to about 30% lower than products produced by domestic steel companies, including Hyundai Steel, directly impacting the domestic steel industry's operations. Hyundai Steel also filed anti-dumping complaints last year regarding thick plates and hot-rolled products.

The bleak outlook for the future also seems to have heightened Hyundai Steel's sense of crisis. In particular, the Trump administration in the United States decided on the 12th to impose a 25% tariff on steel and aluminum products, increasing export uncertainties. Kang In-soo, a professor in the Department of Economics at Sookmyung Women's University, said, "With the Trump administration imposing a 25% tariff, our steel companies' price competitiveness inevitably falls compared to U.S. steel companies." He added, "It appears that such variables influenced Hyundai Steel's emergency management decision."

Inside and outside the industry, it is expected that the export competitiveness of general steel products, excluding high value-added products, will significantly deteriorate as the price of Korean steel products exported to the U.S. market rises by 25%. The steel industry now faces the burden of breaking into new markets where high value-added products are used. Professor Kang said, "Since competition is on equal terms with other countries that have large export volumes to the U.S., it is necessary to seize opportunity factors such as the Alaska natural gas development project and consider increasing investment within the U.S."

The labor union strike is also identified as a factor exacerbating Hyundai Steel's crisis. Currently, Hyundai Steel is struggling with wage negotiations with the union that have continued since September last year. As negotiations stalled over issues such as performance bonuses, the union has continued total strikes, partial strikes, and temporary strikes until recently. A Hyundai Steel official said, "The union's ongoing strikes are causing production disruptions," and added, "With the plant operating rate falling, first-quarter performance this year is also expected to be poor."

The union will begin another partial strike at Dangjin Steelworks from 7 p.m. yesterday until the 20th. Hyundai Steel management proposed a performance bonus payment plan averaging 26.5 million KRW per person (450% of base salary + 10 million KRW), but the union rejected this and is reportedly demanding performance bonuses at the level of Hyundai Motor Company, a group affiliate, which is "500% of base salary + 18 million KRW."

Whether Hyundai Steel will accept the union's demands amid worsening business conditions is uncertain. Earlier, Hyundai Steel announced in January that its net profit last year was 47.3 billion KRW. However, if performance bonuses are paid, it would turn into a deficit of 65 billion KRW. A Hyundai Steel official said, "We proposed a performance bonus payment plan averaging 26.5 million KRW per person despite the deterioration in business performance," and added, "As labor-management conflicts are expected to continue, there are concerns that negative impacts on the domestic industrial sector are inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.