International Oil Prices Drop... Mineral Products with High Import Share, Such as Crude Oil, Also Fall

Won-Dollar Exchange Rate Stabilizes... Down 0.8% from Previous Month

Attention on Impact on Consumer Price Stabilization in 1 to 3 Months

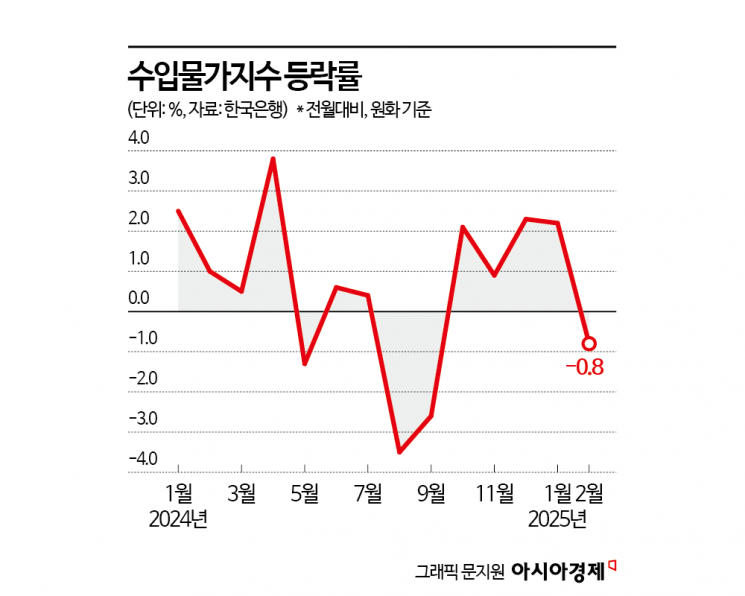

Import prices have turned to a decline for the first time in five months. The main factor was the drop in prices of mineral products such as crude oil, which have a large share in imports, due to the fall in international oil prices. The won-dollar exchange rate also saw a slight adjustment compared to the previous month, supporting the shift to a decline in import prices. Attention is also focused on whether import prices will stabilize in the long term as international oil prices, which continue to fall this month, exert downward pressure.

According to the 'February 2025 Export and Import Price Index and Trade Index (Provisional)' released by the Bank of Korea on the 14th, last month's import prices (based on the Korean won) fell by 0.8% month-on-month, marking a decline for the first time in five months. International oil prices and the won-dollar exchange rate adjusted, leading to a decrease mainly in mineral products such as crude oil. Compared to the same period last year, import prices rose by 4.6%.

The decline in import prices was due to the fall in international oil prices and the won-dollar exchange rate. The monthly average price of Dubai crude oil fell by 3.1%, from $80.41 per barrel in January to $77.92 last month. It also decreased by 3.7% compared to the same month last year. The average won-dollar exchange rate also slightly eased by 0.7%, from 1,455.79 won in January to 1,445.56 won last month. However, compared to the same period last year, it rose by 8.5%.

By use, raw materials, centered on mineral products such as crude oil (-2.7%), fell by 2.3% month-on-month. Intermediate goods, including computers, electronics, and optical devices (-0.9%), adjusted and decreased by 0.2% month-on-month. Consumer goods fell by 0.2% compared to the previous month, while capital goods rose by 0.3%. Capital goods showed an upward trend due to factors such as rising raw material prices and labor costs on the supplying countries' side. Capital goods are affected more in the long term rather than immediately by international oil prices, and their price fluctuations tend not to be abrupt. Excluding the exchange rate effect, import prices based on contract currency fell by 0.4% month-on-month last month and decreased by 2.8% compared to the same month last year.

Following last month, the continued decline in international oil prices this month is supporting the fall in import prices. Lee Moon-hee, head of the Price Statistics Team at the Bank of Korea's Economic Statistics Department 1, said, "The main factors affecting import prices are international oil prices and the won-dollar exchange rate," adding, "Although the won-dollar exchange rate slightly increased, it remained stable, and international oil prices have fallen about 9% compared to the previous month's average, which will exert downward pressure on import prices."

Import prices typically affect consumer prices with a lag of 1 to 3 months, so there is interest in whether the stabilization of import prices will influence consumer price stability in the future. Lee explained, "Due to uncertainties in domestic and international conditions, it remains to be seen whether the trend of stabilization will continue."

Following President Donald Trump's signing of a proclamation imposing a 25% tariff without exceptions on imported steel and aluminum products into the United States, and his announcement that tariffs on automobiles and semiconductors are also under consideration, export vehicles are waiting to be loaded at Pyeongtaek Port in Gyeonggi Province on the 13th of last month.

Following President Donald Trump's signing of a proclamation imposing a 25% tariff without exceptions on imported steel and aluminum products into the United States, and his announcement that tariffs on automobiles and semiconductors are also under consideration, export vehicles are waiting to be loaded at Pyeongtaek Port in Gyeonggi Province on the 13th of last month.

Last month, export prices fell by 0.6% month-on-month as the won-dollar exchange rate declined and prices of coal and petroleum products (-2.5%) dropped. Compared to the same month last year, export prices rose by 6.3%. By item, agricultural, forestry, and fishery products fell by 0.4% month-on-month. Manufactured goods, centered on coal and petroleum products and computers·electronics and optical devices (-1.0%), decreased by 0.5% month-on-month. Export prices based on contract currency remained unchanged from the previous month. Compared to the same month last year, they fell by 1.5%.

The export volume index, which shows changes in export and import volumes, rose by 2.8% in February compared to the same month last year. This was due to an increase in working days and growth in transport equipment and chemical products. The export value index rose by 1.3%. During the same period, the import volume index increased by 2.4% due to growth in computers, electronics and optical devices, machinery, and equipment. The import value index decreased by 0.2%.

The net barter terms of trade index rose by 1.2% year-on-year as import prices (-2.5%) fell more than export prices (-1.4%). The income terms of trade index increased by 3.9% as both the net barter terms of trade index (1.2%) and the export volume index (2.8%) rose.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.