Bank of Korea: Base Rate Cut May Raise Household Debt Growth

Macroprudential Policy Reinforcement Expected to Limit Impact

Following the pivot (monetary policy shift) in the second half of last year, the base interest rate, which dropped by 0.75 percentage points (75bp), is projected to increase South Korea's household debt by 0.60 percentage points this year and 1.53 percentage points next year. However, it is analyzed that the increase may be limited due to the government's macroprudential policy stance being in a strengthening phase.

On the 13th, the Bank of Korea revealed this in the issue analysis "Review of the Effects and Implications of the Base Rate Cut" in its Monetary and Credit Policy Report. Using a macroeconometric model to analyze the average past impact, it diagnosed that the 75bp base rate cut since October last year would raise the household debt growth rate by 0.60 percentage points this year and 1.53 percentage points next year, respectively.

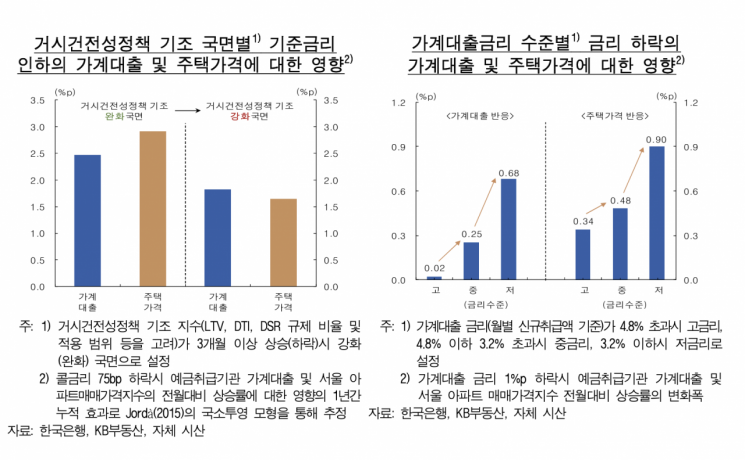

However, since the government's macroprudential policy strengthening stance continues during this rate cut phase, it is expected that the impact of the base rate cut on household debt will be less than in the past. This is because, in the macroprudential policy strengthening phase, the effects of interest rate cuts on housing prices and household debt are estimated to shrink to less than two-thirds of those in the easing phase.

In the macroprudential policy easing phase, a 75bp base rate cut affected household loans and housing prices (Seoul apartment sales price index) by 2.47 percentage points and 2.91 percentage points, respectively, but in the strengthening phase, the impacts were limited to 1.83 percentage points and 1.64 percentage points, respectively. This analysis was conducted by setting the macroprudential policy stance index?considering regulatory ratios and application scopes of Loan-to-Value (LTV), Debt-to-Income (DTI), and Debt Service Ratio (DSR)?to strengthening phase when it rises for more than three months, and easing phase when it falls for more than three months, and analyzing the effects on household loans and housing prices.

It is also analyzed that if further rate cuts are considered in the future, household loans may increase more than expected, intertwined with factors such as a decrease in new housing supply. This is because the impact of interest rate cuts on household debt and housing prices tends to expand nonlinearly as the interest rate level decreases. Empirical analysis of the effects of interest rate declines on household loans and housing prices estimated that under low interest rates, the impact on household loans is about 2.7 times, and on housing prices about 1.9 times greater than under medium interest rates. Based on monthly new loan amounts, household loan interest rates were classified as high interest when exceeding 4.8%, medium interest when between 3.2% and 4.8%, and low interest when below 3.2%.

Meanwhile, the impact of the three rate cuts on inflation is analyzed to be limited. Although the rate cut effect, combined with the elevated exchange rate level, will act as a factor increasing domestic inflationary pressures, it is judged not to the extent of disrupting stable inflation trends. Using a macroeconometric model to analyze the average past impact, it is estimated that the 75bp base rate cut since October last year will raise the inflation rate by 0.09 percentage points this year and 0.20 percentage points next year. This is because the underlying inflation indicators have stabilized around 2%, and the significant slowdown in growth has weakened demand pressures, offsetting upward inflationary pressures.

The exchange rate impact is also expected to be limited. While the base rate cut acts as an upward pressure on the exchange rate through widening domestic-foreign interest rate differentials, the analysis shows that the three base rate cuts so far have had a limited effect on exchange rate trends. Since the end of last year, the won-dollar exchange rate has been more influenced by domestic political uncertainties and movements in the dollar index due to changes in U.S. economic policies. However, it is noted that with increased uncertainty regarding the pace of interest rate cuts by the U.S. Federal Reserve (Fed) and heightened caution in the foreign exchange market, the exchange rate may respond more sensitively to domestic-foreign interest rate differentials, potentially increasing volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.