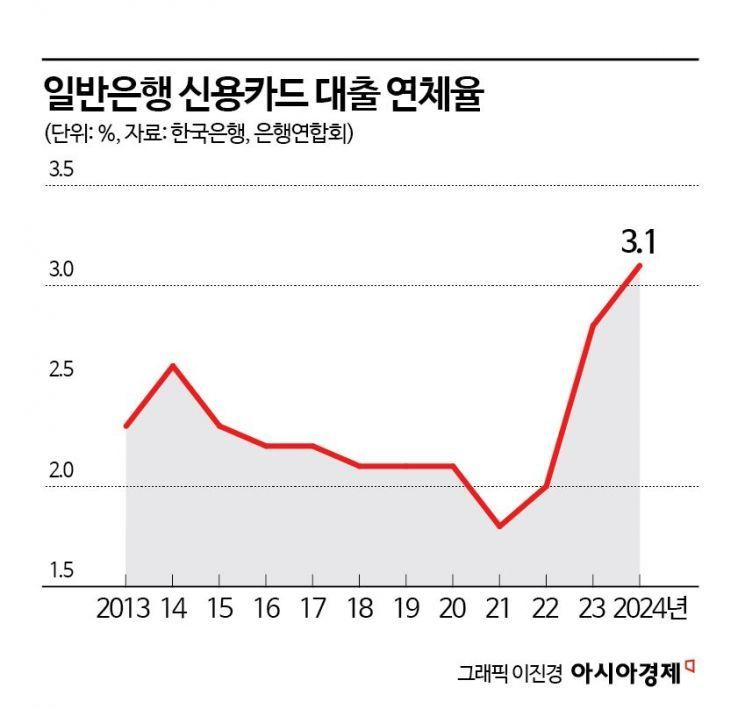

Last Year’s Bank Credit Card Loan Delinquency Rate Reaches 3.1%

Highest Level in 20 Years Since 4.1% During the 2004 Card Crisis

Delinquency Rises in Card Loans and Cash Advances, Key Emergency Funds for Low-Income Earners

There are advertisements related to card loans posted on Myeongdong Street in Jung-gu, Seoul. Photo by Jinhyung Kang aymsdream@

There are advertisements related to card loans posted on Myeongdong Street in Jung-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Last year, the delinquency rate on credit card loans at domestic banks reached its highest level in over 20 years. This is attributed to the prolonged domestic demand slump and economic recession, which have led to an increase in the number of people using credit cards but failing to repay their balances on time.

According to statistics from the Bank of Korea and the Korea Federation of Banks on the 13th, the delinquency rate on credit card loans at domestic general banks last year was 3.1%, up 0.3 percentage points from the previous year. This is the highest figure in 20 years since the credit card crisis in 2004, when it recorded 4.1%.

Here, general banks refer to banks that still operate credit card businesses alongside other services (including regional banks), excluding commercial banks that have spun off their card businesses. The rate reflects the proportion of customers using card loans and credit card cash advances at general banks who were delinquent on principal payments for more than one day.

The delinquency rate on credit card loans at general banks has risen for three consecutive years, from 1.8% in 2021 to 2.0% in 2022, then to 2.8% in 2023, and finally 3.1% last year. The delinquency rate on card loans across all banks, including general banks and specialized banks (such as Industrial Bank of Korea and Export-Import Bank of Korea), was 1.9% last year, also marking a three-year consecutive increase since 2022.

The rise in bank credit card delinquency rates is closely linked to the prolonged economic downturn. South Korea's annual economic growth rates were 2.7% in 2022, 1.4% in 2023, and 2.0% last year, with this year’s growth forecasted to be in the mid-1% range, indicating a persistent low growth below the potential growth rate. In particular, the continued weakness in domestic consumption and construction investment, which are key indicators of the domestic economy, is driving up loan delinquency rates. According to Statistics Korea, domestic retail sales last year decreased by 2.2% compared to the previous year, marking the largest decline in 21 years since 2003 (-3.2%).

Credit card loans tend to have higher interest rates than general bank loans, so they are mainly used by low-credit-score individuals in the lower-income bracket. As the economy worsens, the delinquency rates among these borrowers are also estimated to have increased. A representative from a commercial bank explained, "As the economy deteriorates, more people are borrowing emergency funds through card loans or credit card cash advances and subsequently falling behind on payments."

The delinquency rates of credit card companies affiliated with the four major financial holding companies (KB Kookmin, Shinhan, Hana, and Woori Card) are also on the rise. KB Kookmin Card’s loan delinquency rate increased from 1.03% in 2023 to 1.31% at the end of last year. During the same period, Shinhan rose from 1.45% to 1.51%, Hana from 1.67% to 1.87%, and Woori from 1.22% to 1.44%.

As banks have tightened lending standards, demand for high-interest card loan services such as card loans has surged. According to the Korea Federation of Credit Finance, the card loan balance of nine specialized card companies reached 42.7309 trillion won at the end of January, a 9.0% increase from the same period last year, setting a new record high.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.