Demand Rises as European Countries Strengthen Their Own Defense Capabilities

Second Contract with Poland Imminent... Targeting the 18 Trillion KRW Middle Eastern Market

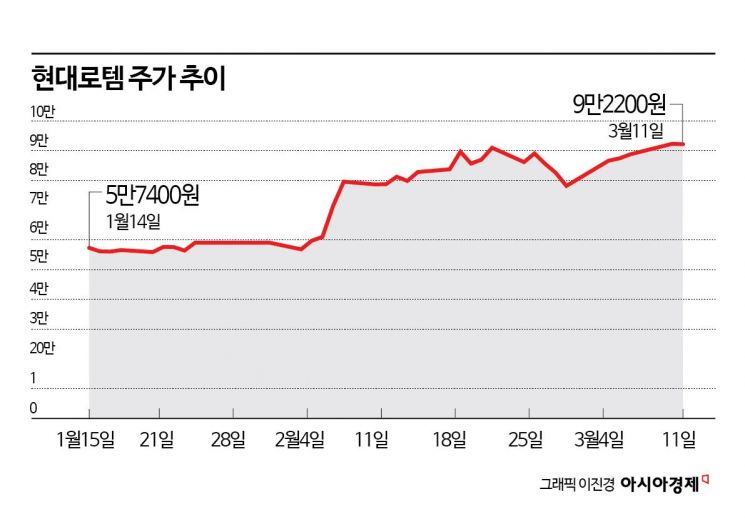

There is a flood of forecasts that Hyundai Rotem's stock price, benefiting from the global defense market tailwind, will rise further. This is thanks to the positive environment created by European countries' moves to strengthen their own defense capabilities and the weakening competition intensity in non-European markets such as the Middle East.

According to the Korea Exchange on the 12th, Hyundai Rotem closed at 92,200 KRW the previous day. It has recorded a rise of over 76% just this year.

Although it has already shown a high upward trend, six securities firms that issued Hyundai Rotem reports in the past month unanimously raised their target prices. Their average target price is 122,500 KRW, indicating more than a 30% upside potential compared to the previous day's closing price.

The reason is the favorable global market conditions. Recently, European countries have been increasing their defense budgets as they strengthen their own defense capabilities. As a result, the market is expected to expand due to increased demand within Europe, while competition intensity in non-European regions is also expected to decrease, creating two positive effects.

In the Middle East market, a non-European region, marketing is expected to be in full swing starting this year as the localization of the K2 tank transmission has been completed. Considering the replacement demand from Saudi Arabia and the United Arab Emirates (UAE), the Middle East tank export market size is estimated to be over 18 trillion KRW.

Moreover, Hyundai Rotem has the capability to respond to the increased demand for European weapon systems. Jang Nam-hyun, a researcher at Korea Investment & Securities, said, "We are preparing for the second contract of K2 tanks with Poland, and some quantities will be produced locally in cooperation with PGZ, a Polish state-owned defense company," adding, "Export expansion utilizing the Polish production base is expected in the future."

The K2 tank contract with Poland is expected to be signed as early as April, covering about 180 units. The second contract is expected to significantly exceed the first contract amount of 4.5 trillion KRW due to the addition of various options and inflation.

Jung Dong-ik, a researcher at KB Securities, said, "There is a high possibility that contracts for recovery tanks, bridge tanks, and obstacle-clearing tanks with Poland will also be concluded, bringing the total contract size to 7 to 9 trillion KRW," and predicted, "Related sales will generate an annual revenue of 500 billion to 700 billion KRW starting from 2027."

He added, "In Romania as well, the first order of 100 units worth 3.2 trillion KRW will be reflected in sales from 2026," and forecasted, "Due to productivity improvements and reduced fixed cost burdens, the operating profit margin of the defense export sector is recording the world's highest level, maintaining high profitability."

Hyundai Rotem's expected consolidated performance for this year is projected to be 5.4 trillion KRW in sales and 654.5 billion KRW in operating profit, representing increases of 23% and 43% respectively compared to the previous year. In particular, the Defense Solutions division is expected to achieve sales of 3.2 trillion KRW and an operating profit margin of 18.5%.

Not only the defense sector but also the Rail Solutions division is expected to continue its growth trend. Lee Sang-hyun, a researcher at BNK Investment & Securities, analyzed, "The Rail Solutions division, which saw a decline in sales last year, is expected to record 1.6 trillion KRW this year, a 13% increase compared to the previous year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.