TSMC to Expand CoWoS-L Reservations

High Heat Risk Resolved... Power Waste Also Reduced

Commercialization to Accelerate if Realized

New Business Opportunities for Korean Semiconductor Companies

SKC to Begin Mass Production Within This Year

Industry attention is focused on AI chip leader Nvidia's move to utilize glass substrates to solve heat dissipation issues. This development opens new business opportunities for domestic companies that have been focusing on glass substrate development.

According to foreign media reports and industry insiders on the 11th, Nvidia recently informed TSMC, which manufactures its chips under contract, of its intention to "significantly increase the reservation proportion for ‘Chip on Wafer on Substrate (CoWoS)-L’ going forward."

CoWoS is an advanced packaging technology proudly developed by TSMC. It bundles multiple small chips into one to enhance performance and reduce power consumption. There are two versions: S, which has lower integration and bandwidth, and L, which is much larger. Nvidia has requested TSMC to produce most of its chips using the L version.

Notably, Nvidia's decision is said to be based on the L version's use of glass substrates instead of silicon as the interposer (the medium connecting components), which greatly improves heat management. Glass substrates help maintain uniform heat expansion when chips increase performance, stabilizing temperature. This prevents overheating and reduces power waste.

Nvidia's focus on glass substrates is interpreted as stemming from its experience with production setbacks of the Blackwell chip. Last year, Nvidia planned to launch the new AI chip Blackwell within the year but had to delay the release due to unresolved unexpected high heat generation during operation. Around November last year, Nvidia announced plans to fix the defects with TSMC and release Blackwell to the market in the first half of this year. TSMC’s announcement on the 3rd to invest an additional 145 trillion won (100 billion dollars) in the U.S. to build five more semiconductor factories appears related to this. Until now, TSMC has only applied CoWoS technology in its factories in Taiwan, but with increased investment and relocation of bases to the U.S., it is expected that chip production using this technology will become possible in U.S. factories as well.

TSMC plans to review Nvidia’s requests at an upcoming regular production meeting attended by executives and then request advance payment from Nvidia. This is to reconfirm Nvidia’s firm intention to use TSMC’s cutting-edge technology through upfront cost payment.

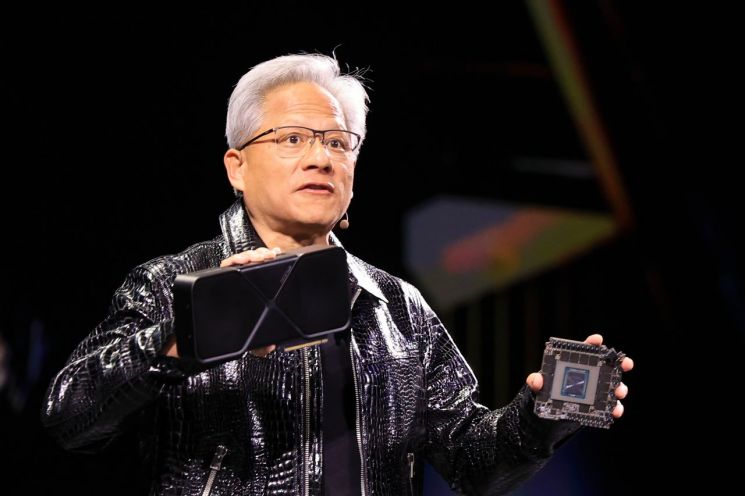

If TSMC accepts Nvidia’s request and it materializes, the commercialization of glass substrates could be accelerated. The Korean semiconductor industry, which has been focusing on glass substrates as the next-generation growth engine in the AI era, may also experience a positive wind. Changes are expected in the production methods of SK Hynix, which has maintained a strong ‘triangular alliance’ with Nvidia and TSMC. SKC, which has devoted efforts to glass substrate development emphasized by SK Group Chairman Chey Tae-won, is also likely to benefit. SKC has expanded its glass substrate business through its subsidiary Absolis and plans to start mass production of glass substrates within this year. Chairman Chey, after meeting Jensen Huang, CEO of Nvidia, at CES 2025, the world’s largest consumer electronics and IT exhibition held in Las Vegas in January, visited SKC’s exhibition booth and lifted SKC’s glass substrate product, saying, "I just sold it (to Nvidia)," showing his keen interest in the related business.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.