Operating Profit in Q4 Last Year Fell Short of Market Expectations

This Year's Operating Profit Forecast Expected to Decrease Compared to Last Year

Copper Price Hike and Defense Sector Recovery Expected to Support Stock

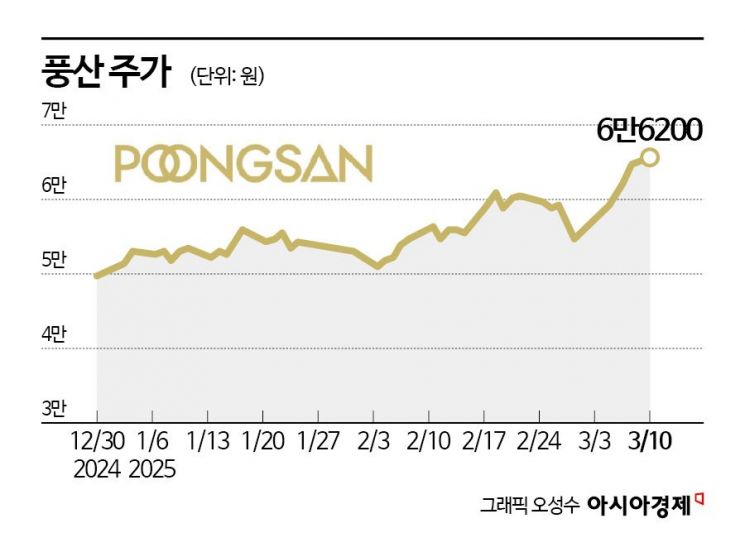

Pungsan's stock price has been steadily trending upward this year. Despite the fourth-quarter earnings last year falling short of market expectations and forecasts that this year's performance will be weaker than last year's, market experts are advising that now is the time to buy Pungsan shares.

According to the financial investment industry on the 11th, Pungsan's stock price has risen 32.5% since the beginning of this year. Considering that the KOSPI rose 7.1% during the same period, the return relative to the market amounts to 25.4 percentage points (P). The market capitalization has surpassed 1.855 trillion KRW.

On a consolidated basis, Pungsan achieved sales of 1.2 trillion KRW and operating profit of 33.8 billion KRW in the fourth quarter of last year. Sales increased by 10.3% compared to the same period the previous year, but operating profit decreased by 41.7%. Seongbong Park, a researcher at Hana Securities, explained, "The operating profit fell significantly short of the market expectation of 99.3 billion KRW due to the payment of performance bonuses amounting to 48 billion KRW and large losses at major subsidiaries."

After announcing the fourth-quarter results last year, Pungsan disclosed its earnings forecast for this year. On a separate basis, it expects to achieve sales of 3.8 trillion KRW and operating profit of 259.4 billion KRW. This represents an increase in sales but a decrease in operating profit compared to last year. The forecast reflects the expectation that profitability will worsen due to a lower export ratio in the defense sector. Yoonsang Kim, a researcher at iM Securities, analyzed, "The defense sector's performance will slightly decline this year," adding, "Although sales will increase, profitability will deteriorate due to a decrease in export ratio and a reduction in urgent delivery orders."

Despite the poor earnings outlook, the stock price has steadily risen this month. Market experts believe there is significant room for upward revision of profit forecasts, considering that this year's projections are conservative. The tariff policies of U.S. President Donald Trump, which could lead to a rise in copper prices, also influenced investor sentiment. Taehwan Lee, a researcher at Daishin Securities, stated, "Considering the recent global economic trends, there is a high possibility of upward revision in Pungsan's non-ferrous metal sector performance," and predicted, "President Trump is expected to impose tariffs not only on steel and aluminum but also on copper." He added, "The possibility of tariffs will lead to preemptive demand, and considering China's stimulus and restricted supply conditions, copper prices have strong potential to rise," emphasizing that "aluminum, classified as a copper substitute, is also subject to tariffs."

Jaeseung Baek, a researcher at Samsung Securities, also explained, "The cost increase in copper mines and the resulting adjustment in concentrate supply will at least provide downward price rigidity," adding, "The possibility of further decline in Pungsan's non-ferrous metal business performance is limited."

The defense sector may temporarily slow down this year but is expected to regain profitability next year. On the 10th of last month, Pungsan signed a large-caliber ammunition supply contract worth 358.5 billion KRW with Hanwha Aerospace. The contract period extends until June 30, 2029. Researcher Baek explained, "This can be interpreted as Pungsan's order aligned with Hanwha Aerospace's execution contract in Poland," adding, "Since high profitability has already been confirmed, profitability is expected to improve again starting next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)