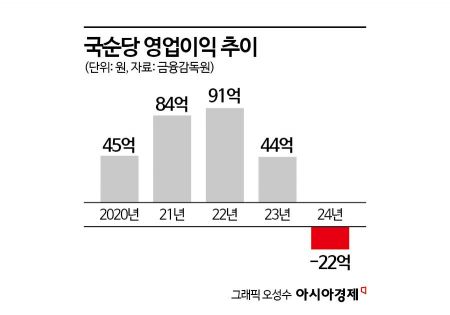

Kooksoondang Records 2.2 Billion KRW Operating Loss Last Year

Demand for Makgeolli Declines Sharply After Endemic Transition

Companies Turn to Overseas Markets Amid Domestic Slump

The Makgeolli craze has cooled down. The takju market, which had rebounded due to increased demand for home drinking during the COVID-19 pandemic, has seen a sharp decline in demand following the transition to an endemic phase, causing the performance of major takju companies to plummet.

According to the Financial Supervisory Service on the 11th, Kooksoondang recorded an operating loss of 2.2 billion KRW last year, turning to a deficit. This marks the first return to a deficit in four years since 2020, when it escaped the red. The decline in Makgeolli demand led to a decrease in sales. Kooksoondang's sales last year were 68.8 billion KRW, down 2% from the previous year.

Kooksoondang had continued operating losses until 2019 due to stagnation in the domestic Makgeolli market but saw a significant rebound during the COVID-19 pandemic. During social distancing periods, the home drinking culture spread mainly among the 20s and 30s age group, greatly increasing demand for premium takju.

However, the situation reversed after the transition to the COVID-19 endemic phase. The home drinking culture slowed down, and consumers turned their attention to whiskey and highballs, leading to a decrease in takju demand. Additionally, intensified competition among liquor companies made it difficult to secure profitability.

According to the Korea Agro-Fisheries & Food Trade Corporation, the domestic Makgeolli market size shrank from 609.5 billion KRW in 2020 to 575.4 billion KRW in 2023. During this period, Bohae Brewery's sales decreased by 5% to 87.6 billion KRW, and Baesangmyun Brewery's sales slightly declined to 30.3 billion KRW from 30.5 billion KRW the previous year.

To offset the sluggish domestic market, Makgeolli companies plan to focus more on overseas markets this year. The K-Food craze has increased interest in Makgeolli abroad, which is a positive factor. According to Korea Customs Service export-import trade statistics, Korea's takju export volume increased from 12,556 tons in 2020 to 15,396 tons in 2022 but slightly decreased to 13,982 tons in 2023. However, it showed a recovery trend again last year with 14,733 tons.

The main export country is the United States. Kooksoondang generates 20% of its total Makgeolli sales from overseas markets. Its representative export product, '100 Billion Prebio Makgeolli,' gained popularity in the U.S., recording export sales of 3 million USD last year. Kooksoondang plans to further expand its business in the U.S. market.

Baesangmyun Brewery has placed three types of 'Neulbom Makgeolli,' 'Simsul,' and 'Bingtanbok' in the large U.S. liquor chain Wine & More and plans to expand exports this year to the central U.S. regions such as Texas and Oklahoma, as well as the eastern regions including New York and Pennsylvania.

Jipyeong Brewery developed export-exclusive Makgeolli products 'JI PYEONG FRESH' and 'JI PYEONG CHESTNUT.' They applied a new sterilization process to extend shelf life and started full-scale sales in the U.S. market this year. Jipyeong Brewery aims to achieve 5 million USD in overseas sales by next year and is expanding its sales network through online platforms and retail channels.

The government is also easing regulations and expanding support measures to revitalize the traditional liquor market. It is expanding liquor tax reduction benefits for small-scale traditional liquor manufacturers and relaxing regulations on sourcing local specialty ingredients. Previously, the top three ingredients used in traditional liquor had to be sourced 100% from local agricultural products, but the criteria will be relaxed to require only a certain percentage in the future.

Additionally, strategies to combine K-Food and traditional liquor to expand overseas sales channels are being pursued. This aims to strengthen the global competitiveness of the traditional liquor industry. A liquor industry official said, "Makgeolli companies have faced difficulties due to their small scale and lack of overseas business know-how," adding, "With active government support, we expect to focus on overseas markets starting this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.