Over $30 Billion in Startup VC Investments in Q1 This Year

Six Companies Including OpenAI Account for 40% of Total Investments

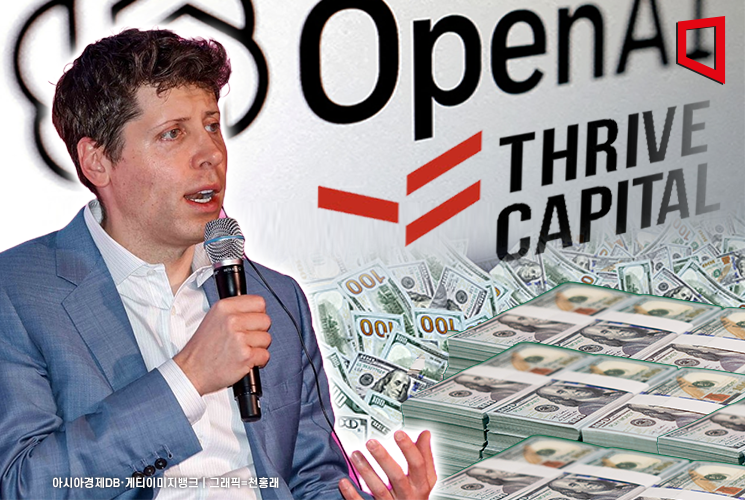

As the artificial intelligence (AI) boom continues, the quarterly investment volume in the U.S. venture capital market is expected to reach its highest level in three years in the first quarter of this year. However, it has been identified that investments are concentrated in a few companies such as OpenAI, resulting in a corporate concentration phenomenon.

The Financial Times (FT), citing data from market research firm PitchBook, reported on the 10th that venture capital investments in startups exceeded $30 billion in the first quarter of this year. In the fourth quarter of last year, U.S. venture capital firms invested about $80 billion, breaking free from two years of sluggishness.

Hemant Taneja, CEO of General Catalyst, a major Silicon Valley venture capital firm, said, "AI is a transformative force that makes startups better companies."

He added, "We considered the question, 'Can the invested company reasonably grow tenfold from now?' and the answer was 'yes.' Therefore, we see it as a reasonable investment."

Venture investments are concentrated in a few companies. Kyle Stanford, research director at PitchBook, explained, "In the fourth quarter of last year, investments in six companies including OpenAI, xAI, and Databricks accounted for 40% of the total," adding, "The companies leading venture capital investments are some elite firms."

There are also many cases of continuous investment in companies once invested. OpenAI is negotiating with SoftBank to raise $40 billion at a corporate valuation of $260 billion. If successful, it will be the largest funding scale ever, surpassing Databricks' $10 billion fundraising at the end of last year.

Anduril, which succeeded in funding last summer, is also recognized with a corporate valuation exceeding $30 billion and is discussing raising at least $2 billion.

CEO Taneja said, "Because it is very difficult to find companies that can make money with AI, venture capital investments are focused on industry-leading companies with a customer base and large markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.