A Structure Advantageous Amid Interest Rate Fluctuations and Rising Prices

Linked to Subscription Economy Traits and YONO (You Only Need One)

Expansion of Customized Services Including Pet Care and Mobility

The 2030 generation is increasingly using funeral service products not as preparations for funerals but as financial investment tools for future consumption. Unlike bank savings or insurance, these products are not affected by interest rate fluctuations and allow users to utilize the promised services at the time of contract with the contracted amount, making them an attractive option to reduce the burden of large expenses and spending.

In particular, as interest rates fall again and inflation rises, the relative economic benefits become more prominent, prompting funeral service companies to focus on customized marketing strategies aimed at securing the 2030 generation as new customers.

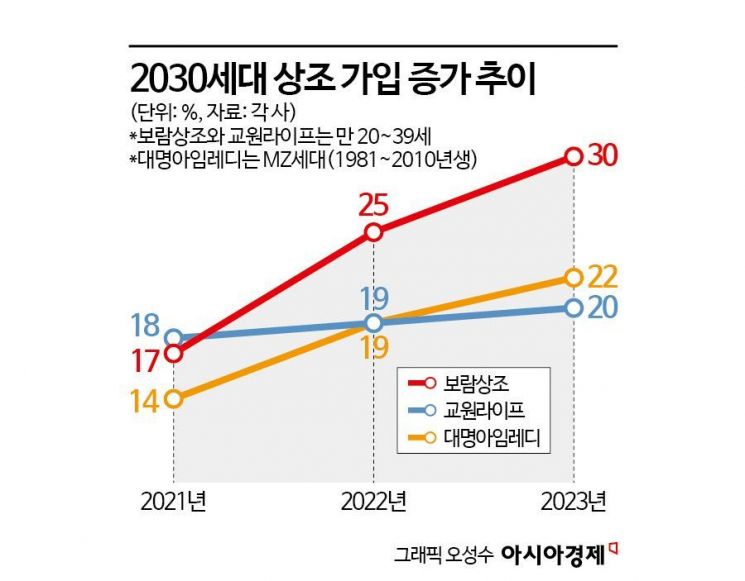

According to the industry on the 10th, the subscription rate of the 2030 generation to funeral service products has been steadily increasing. Boram Sangjo saw the 2030 subscription rate rise from 17% in 2021 to 30% in 2023, and Kyowon Life also expanded from 18% to 20% during the same period. Daemyung I'm Ready increased the MZ generation (born 1981?2010) subscription rate from 14% to 22%, and Freed Life also reported that the number of new contracts from the 2030 generation more than doubled compared to 2021.

Unlike savings or insurance, funeral service products are not affected by interest rate fluctuations. Additionally, since services are provided at the price set at the time of subscription, they are considered an attractive option for the 2030 generation. Especially as the consumer price inflation rate soared to 5.1% in 2022, entering a phase of ultra-high inflation, the advantage of funeral service products increasing economic benefits as prices rise has become more prominent.

Some analysts say this trend did not suddenly appear but was a predictable change. It started in the mid to late 2010s low-interest rate environment when some of the 2030 generation began to perceive funeral service products as financial investment tools.

Instead of low-interest savings, they use funeral service products to prepare travel expenses or wedding funds a few years later. For example, if someone in their early 20s subscribes and fully pays for a funeral service product, they can later convert it into wedding services at the appropriate marriage age, reducing costs. Funeral service companies offer wedding services including wedding hall use and support for Sdeume (studio, dress, makeup).

As the 2030 generation emerges as a blue ocean with high potential for new subscriptions, the funeral service industry is expanding customized products to broaden contact points with them. Freed Life launched a 'Private Mobility Service' this year as part of its membership service, providing KTX discounts and dedicated vehicles with chauffeurs for airport, hospital, wedding, and golf transportation.

Boram Sangjo is implementing a differentiation strategy by introducing pet-related products and bio-health functional foods. Kyowon Life offers an 'LG Subscription Kyowon' bundled product that supports LG appliance subscription fees, reducing the burden of appliance purchases while preparing for future family events. Daemyung I'm Ready provides various combined services such as funeral, travel, and wedding through its online bundled product subscription mall 'Bucket Market.'

An industry official said, "Funeral service companies have long introduced services that can be converted to weddings and travel, but as demand from the 2030 generation has gradually been detected, they have strengthened services accordingly," adding, "While the number of new subscribers in the 2030 generation is increasing, cancellation and churn rates are not high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.