Insurance Fraud Tops 1 Trillion Won for Three Consecutive Years

Automobile Insurance Fraud Reaches 570.4 Billion Won (49.5%) Last Year

People Aged 60 and Over Account for the Highest Proportion at 25.7%

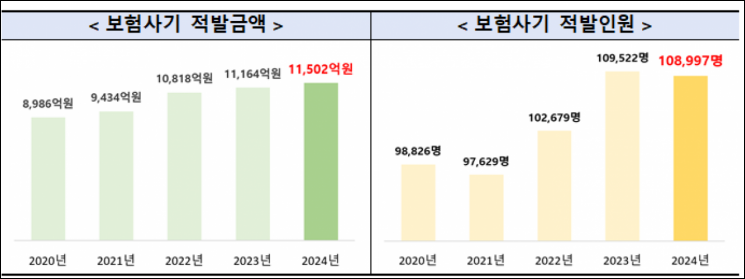

Last year, the amount of insurance fraud detected exceeded 1 trillion won for the third consecutive year, marking an all-time high.

The Financial Supervisory Service announced on the 9th that the amount of insurance fraud detected last year was 1.1502 trillion won, a 3% increase compared to the previous year (1.1164 trillion won). The amount of insurance fraud detected has been steadily rising since it first surpassed 1 trillion won in 2022. The number of people caught for insurance fraud last year was 108,997, a 0.5% decrease compared to the previous year.

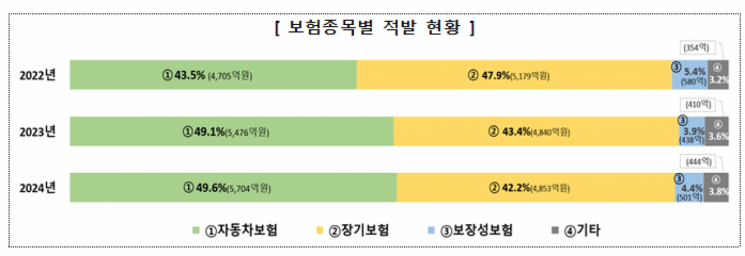

Automobile insurance fraud has been increasing steadily. The amount of automobile insurance fraud detected rose from 470.5 billion won (43.5%) in 2022 to 570.4 billion won (49.5%) last year. Automobile insurance fraud saw the largest increase in the insurance sector compared to the previous year, with 12.6 billion won from staged car accidents and 8.5 billion won from intentional collisions. Long-term insurance decreased from 517.9 billion won (47.9%) in 2022 to 485.3 billion won (42.2%) last year.

The age group committing insurance fraud was highest among those aged 60 and over, accounting for 25.7% (27,998 people). This was followed by those in their 50s at 22.5% (24,528 people), 40s at 19.3% (21,055 people), 30s at 18.1% (19,746 people), and 20s at 13.7% (14,884 people). Compared to the previous year, the number of detected fraudsters aged 60 and over increased by 3,230 (13.0%), while the number of detected fraudsters in all age groups under 50 decreased.

Insurance fraud detection status by insurance type last year. Provided by the Financial Supervisory Service

Insurance fraud detection status by insurance type last year. Provided by the Financial Supervisory Service

Looking at the characteristics of insurance fraud types by age group, people in their 20s and 30s were mostly involved in automobile-related fraud such as intentional collisions and drunk or unlicensed driving. Those aged 50 and over had a higher proportion of hospital-related fraud such as false hospitalization claims.

By occupation, office workers accounted for the largest share of detected fraud at 24.3%, followed by unemployed and day laborers at 11.0%, housewives at 9.2%, transportation workers at 4.3%, and students at 4.3%.

A Financial Supervisory Service official stated, "We will strengthen preventive publicity activities reflecting the age-specific characteristics of the recently increasing insurance fraud," adding, "We also plan to develop tailored countermeasures suited to each type of insurance fraud by category and occupation through cooperation with related organizations to respond more precisely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.