Trade Surplus Gap with the U.S. and China Hits 32-Year Low

Exports to China Plummet, Surge to the U.S.... A "Cross" Approaches

Korea Becomes Taiwan's Largest Trade Deficit Partner Last Year

Concerns Rise Over Possible "Chip Hollowing"

<1> TSMC, the God... Visiting the '2nm' Sanctuary

<2> The '6 Constraints' and Technology Security Holding Back TSMC

<3> The Opening of Unknown Taiwan

<4> Korea-Taiwan, Between Deterrence and Cooperation

Taiwan's trade statistics from last year clearly confirm the principle of 'Wonjungg?nmi (遠中近美: distancing from China and approaching the U.S.)'. While shifting the economic center of gravity toward the U.S., the determination to reduce dependence on China and become self-reliant is becoming increasingly firm year by year.

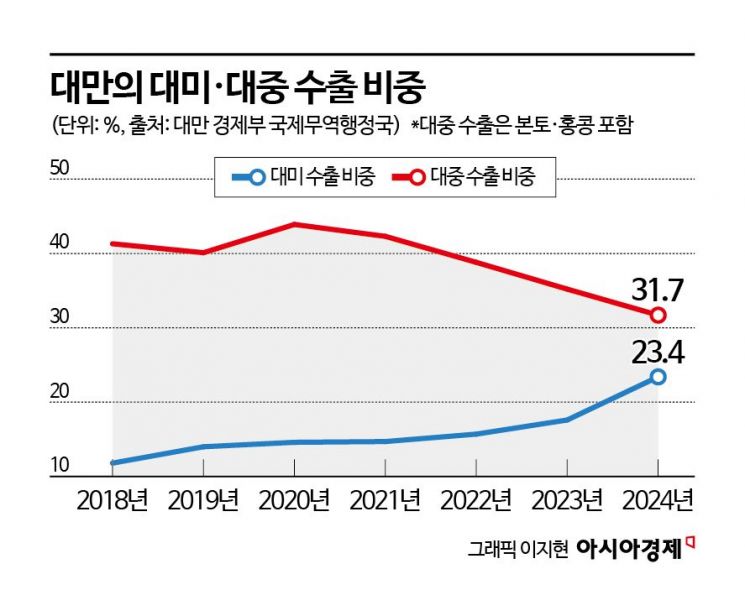

According to Taiwan's Ministry of Finance, Taiwan's trade last year underwent significant changes due to the U.S.-China hegemonic competition, supply chain restructuring, and expanding demand for artificial intelligence (AI). Taiwan's export volume to China remained the highest at $150.6 billion (approximately 218.3 trillion KRW), but its share of total exports dropped to 31.7%, the lowest in 23 years. It had accounted for 43.9% in 2020, nearly half, but has declined continuously for four years until last year, marking the first time such a trend has been observed since the related statistics began.

On the other hand, exports to the U.S. rose to $111.4 billion, accounting for 23.4%, reaching the highest level in 24 years. The share was only 14.6% in 2020. Taiwan's trade surplus with China was $70 billion, and with the U.S. $64.9 billion, narrowing the gap to $5.1 billion. This is the narrowest gap in 32 years.

Trade between Taiwan and Korea also saw significant changes last year. As SK Hynix increased its supply of High Bandwidth Memory (HBM) to TSMC, Taiwan's trade deficit with Korea reached a record high of $22.9 billion last year. Consequently, Korea surpassed Japan ($20.6 billion) to become Taiwan's largest trade deficit partner. Exports to Japan decreased by 17.8% compared to the previous year, the largest drop in 15 years.

Some point out that Taiwan may face the issue of 'chip hollowing' as it rapidly aligns with the U.S. If the U.S. succeeds in relocating a significant portion of Taiwan's advanced semiconductor production bases to the U.S., the ultra-fine processes will be led by the U.S., while legacy (general-purpose) processes will be dominated by mainland China and other third countries.

Hao Nan, a researcher at the China Public Diplomacy Policy Think Tank, Chahar Institute, said, "Taiwan is caught in a dilemma between security and the semiconductor industry," adding, "If Taiwan loses control over semiconductors, its influence in the global market will weaken, and its economy will be exposed to new vulnerabilities." He warned, "Mainland China will continue attempts to dominate the low- and mid-range semiconductor markets by exploiting these changes and pressuring Taiwan. Experts believe Taiwan's semiconductor industry could face 'hollowing' within a few years."

China's military pressure, which may arise from reducing trade with China and relocating semiconductor factories overseas, is also a risk factor surrounding Taiwan. China has declared military strengthening by increasing its defense budget by more than 7% compared to the previous year. China's defense budget has risen by more than 6.6% annually over the past 30 years, resulting in an increase from 720 billion yuan (approximately 144.2 trillion KRW) in 2013 to 1.78 trillion yuan this year, about 2.5 times more.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.