Establishing a Base in Southern Texas to Strengthen Service Capabilities

Accelerating the 'Localization Strategy' with a Goal of 70% Global Sales

Big Tech Contracts Expected Soon... US Sales Projected to Reach 1 Trillion KRW

LS Electric's US Tech Center, which will serve as a forward base for its 'North America strategy,' is set to be completed soon. This will accelerate Chairman Koo Ja-kyun's plan to double the global sales ratio to 70% within five years by expanding local service capabilities. Last year, LS Electric recorded sales worth approximately 700 billion KRW in the US market alone, and this year, riding the power super cycle, it is expected to surpass 1 trillion KRW.

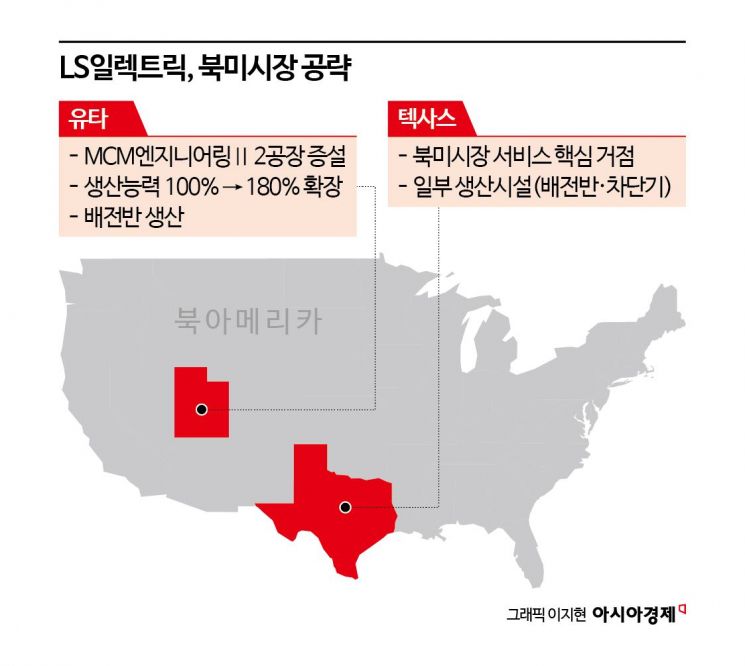

According to the power industry on the 6th, LS Electric's production base under construction in Bastrop, Texas, USA, will be completed this month. In 2023, LS Electric secured a 46,000㎡ site here and began building a Tech Center for sales and service facilities. They also converted part of the site into a 3,300㎡ production plant. This is a key base in the strategy to increase local customers and raise the global sales ratio.

Previously, in 2022, LS Electric signed a contract worth 174.6 billion KRW to supply distribution systems when Samsung Electronics built a foundry plant in Taylor, Texas. The base secured in the adjacent area has developed into an 'aggressive localization strategy.' Additionally, LS Electric acquired MCM Engineering II, a distribution panel manufacturer located in Cedar City, Utah, and completed the expansion of its second plant earlier this year. The plant is already operating at 'full capacity.' An LS Electric official said, "If the existing production capacity (CAPA) is set at 100%, it has now expanded to 180%."

The Bastrop Tech Center focuses on quick response such as customer support services (A/S) for local demand, while the Utah plant specializes in producing distribution panels and circuit breakers. The number of employees at the Bastrop base is currently in the double digits, but plans for additional expansion are being considered in line with the facility's completion.

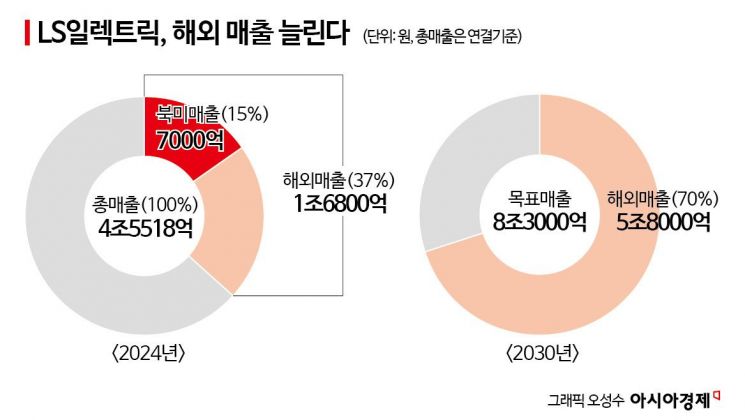

LS Electric's consolidated sales last year were 4.5518 trillion KRW, with the global sales ratio centered on the North American market at about 37% (1.68 trillion KRW). Of this, sales generated in the US alone are known to be close to 700 billion KRW. The proportion of local customers in North American sales also increased significantly from 22% in 2022 to 34% last year. The order backlog at the end of the fourth quarter last year was 3.4 trillion KRW, up 36% compared to the same period the previous year.

Based on its localization strategy, LS Electric plans to raise the overseas sales ratio, currently at 37%, to about 70% by 2030. The sales target for 2030 is set at 8.3 trillion KRW, with the plan to earn 5.8 trillion KRW, which corresponds to 70%, from overseas markets. This is based on the judgment that the power super cycle will continue for the time being as AI data centers rapidly increase.

Chairman Koo Ja-kyun of LS Electric stated at the 'Elex Korea 2025' event on the 12th of last month, "Although I cannot disclose specific companies, the data center projects of US (big tech) are almost at the contract stage." It is expected that new customers will emerge among major big tech companies such as Amazon, Microsoft, and Google.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.