BOK: U.S. Mutual Fund Investments in Korean Securities

Key Characteristics and Implications

Recently, an analysis has emerged indicating that the sensitivity to exchange rate volatility has increased as passive equity funds such as Exchange-Traded Funds (ETFs) have grown in foreign investment in domestic securities. It suggests that more attention should be paid to exchange rate volatility indicators when monitoring global securities fund inflows and outflows.

On the 6th, the Bank of Korea revealed this in its BOK Issue Note titled "Recent Key Characteristics and Implications of U.S. Mutual Fund Investments in Domestic Securities." The report utilized U.S. mutual fund data, which serves as a proxy for foreign investment in domestic securities, providing detailed information on investment strategies, currency hedging forms, and the currency denomination of held bonds. The balance of U.S. mutual funds investing in Korea (bonds + equities) was $135 billion as of the third quarter of last year. Although this accounts for about 15% of the total foreign securities investment in Korea, the growth and fluctuation patterns of these funds are similar, allowing the U.S. mutual fund data to be used to infer the investment behavior of foreign securities investors.

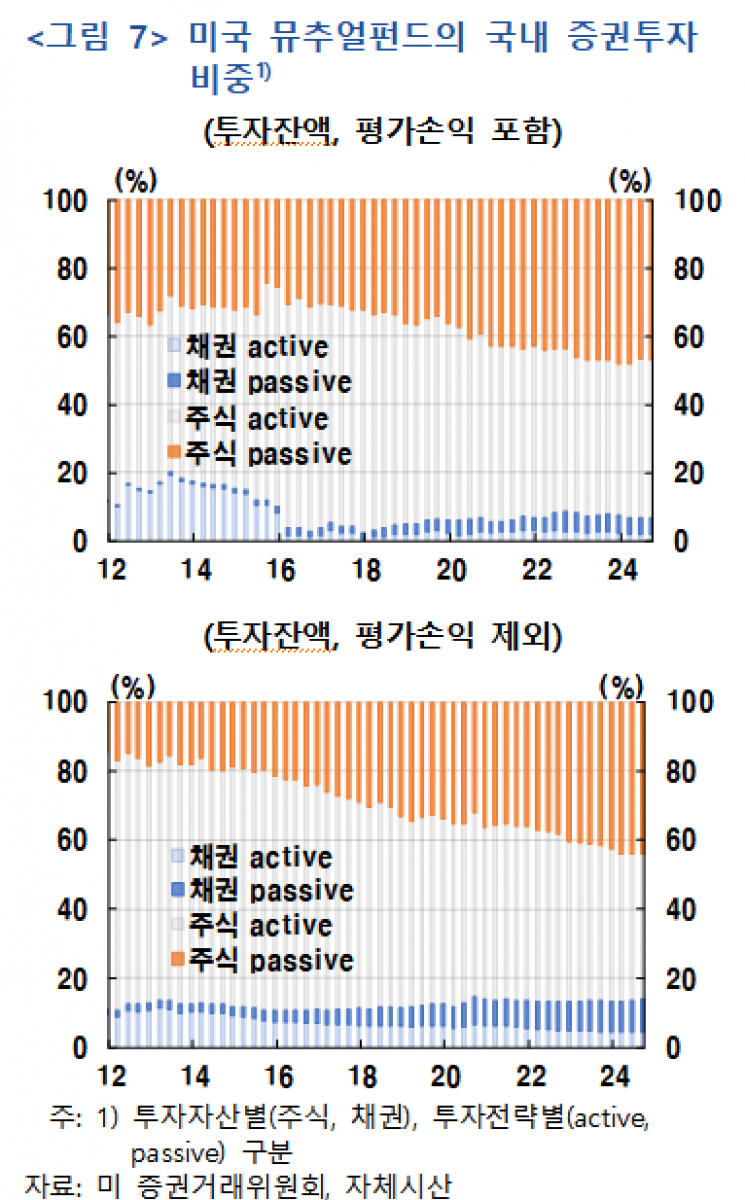

Recently, foreign investment funds in domestic securities have shown net outflows, mainly in equity funds. This trend is also confirmed through the investment patterns of U.S. mutual funds in domestic securities. Since 2019, amid the COVID-19 pandemic, the inflows and outflows of U.S. mutual funds investing in domestic securities have increased in magnitude, and excluding valuation effects, they have generally decreased. However, this is attributed to an overall decline in overseas investments by U.S. mutual funds and is not a phenomenon limited to Korea. The global risk sensitivity of fund inflows and outflows has not increased compared to the past when excluding asset value fluctuations. A notable point is that the proportion of equity passive funds, which are mostly invested without currency hedging, has increased. As of the third quarter of last year, passive equity and bond funds accounted for more than half of the U.S. mutual funds' domestic securities investment balance.

Janghoom Cho, Head of the International Finance Research Team at the Bank of Korea, stated, "Given that these funds are highly sensitive to global exchange rate volatility, it is necessary to pay greater attention to exchange rate volatility indicators when monitoring global securities fund inflows and outflows."

It is expected that after Korea's inclusion in the World Government Bond Index (WGBI) in November, the proportion of bond passive funds with currency hedging among foreign domestic securities investment funds will increase. This is a factor that could weaken the relationship with the won-dollar exchange rate. However, since the proportion of equity passive funds continues to rise, Cho predicted that the future correlation between fund inflows/outflows and exchange rates will be determined by the relative changes in each fund type.

Korea's inclusion in the WGBI is expected to contribute to easing supply-demand imbalances in the foreign currency fund market and lowering government bond yields. He noted, "If demand shifts from government bonds to other bonds such as corporate bonds due to government bond price overvaluation, the overall financing conditions for domestic companies may improve." However, considering that U.S. mutual funds prefer bonds denominated in key currencies such as the U.S. dollar, he analyzed that there will be limitations in lowering the risk premium of won-denominated corporate bonds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.