Korea Investment Trust Management announced on the 6th that it will newly list three types of exchange-traded funds (ETFs) with high utility for pension investments on the 11th.

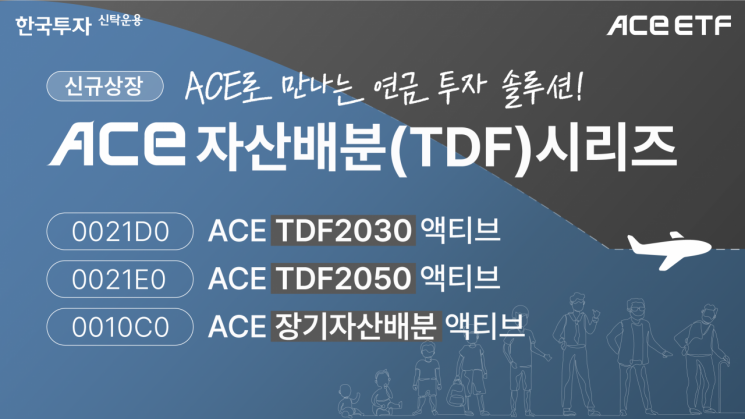

Korea Investment Trust Management will introduce three products: ▲ACE TDF2030 Active ETF ▲ACE TDF2050 Active ETF ▲ACE Long-term Asset Allocation Active ETF.

These target-date funds (TDFs) provide asset allocation according to the target date (vintage) and share the same management strategy. The proportion of risky assets is highest in the order of ACE Long-term Asset Allocation Active ETF, ACE TDF2050 Active ETF, and ACE TDF2030 Active ETF.

The biggest advantage of the three newly listed ETFs is their proven management strategy. These ETFs are managed based on the Long-Term Capital Market Assumptions (LTCMA) optimized for Korean won investors. A representative portfolio consists of a combination of currency-exposed foreign stocks and domestic bonds. LTCMA is also utilized in managing the Korea Investment TDF Self-Managed ETF Focus Fund, which Korea Investment Trust Management launched in October 2022.

According to Fund Guide, over the past year, these funds have ranked first in both returns and risk-adjusted returns (Sharpe ratio) across all vintages.

The proportion of risky assets by product ranges from 40.1% to 99% as of this year. Specifically, ACE TDF2030 Active ETF has 40.1%, ACE TDF2050 Active ETF has 76.8%, and ACE Long-term Asset Allocation Active ETF has 99%.

Products that can be invested 100% within retirement pension accounts are ACE TDF2030 Active ETF and ACE TDF2050 Active ETF, while ACE Long-term Asset Allocation Active ETF can be invested up to 70%. When investing in ACE TDF2050 Active ETF within a retirement pension account, the proportion of risky assets can be maximized.

Kang Seongsu, Executive Director in charge of solutions at Korea Investment Trust Management, introduced, "The ACE TDF ETF series combines the high liquidity and transparency of ETFs with the proven performance of the Korea Investment TDF Self-Managed ETF Focus Fund." He added, "The core management strategy is the glide path independently developed by Korea Investment Trust Management based on the income distribution of Koreans and LTCMA created by analyzing economic cycles spanning several decades."

All three ACE ETF products are dividend-distributing types, and principal loss may occur depending on management results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.