KEF Adds Economic Crisis Question to Corporate Regulation Survey

Responses Indicating 'Worsening Regulatory Environment' Double in One Year

"Assessment of Severe Domestic and International Situation"

97% of domestic companies predicted that an economic crisis will hit South Korea this year. Analysts attribute this to the restructuring of the global order, including tariff wars and changes in the security landscape, which have led to economic instability and dampened corporate sentiment. Additionally, concerns are growing that a crisis comparable to the 1997 foreign exchange crisis will occur this year, as regulations that suppress business activities remain largely unrelieved. Financial conditions of companies have also worsened, with 30% of the top 1,000 companies by sales reporting a deterioration in their financial situation compared to last year.

These findings come from the Korea Employers Federation (KEF)'s 'Corporate Regulation Outlook Survey' and the Korea Economic Association's financial condition survey. Notably, KEF included a question about the possibility of an economic crisis for the first time in this year's outlook survey, reflecting the perception of a severe domestic and international situation.

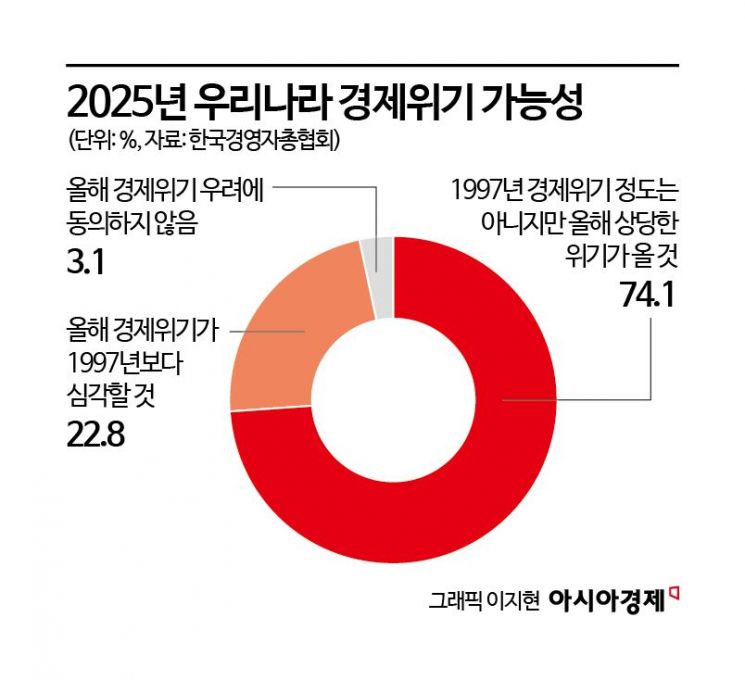

On the 6th, the Korea Employers Federation (KEF) conducted the '2025 Corporate Regulation Outlook Survey' targeting 508 companies with 50 or more employees nationwide. The results showed that 96.9% of respondent companies answered that 'an economic crisis will occur this year.'

Among the respondents, 22.8% said 'the economic crisis this year will be more severe than in 1997,' while 74.1% answered 'it will not be as severe as the 1997 crisis, but a significant crisis will occur this year.' In contrast, only 3.1% disagreed with concerns about an economic crisis this year.

Furthermore, 34.5% of companies forecast that the corporate regulatory environment will 'worsen compared to the previous year.' Responses indicating 'it will be similar to the previous year' accounted for 57.4%, and 'it will improve' was 8.1%. The proportion of companies expecting a worsening regulatory environment more than doubled from 14.8% in last year's survey to this year.

The reasons cited for the expected deterioration in the regulatory environment included 'strengthening of global trade regulations by the U.S. Trump administration' (45.7%), 'strengthening of corporate regulatory legislation by the National Assembly' (29.1%), and 'weakening of the government's will and momentum for regulatory innovation' (26.9%).

The biggest burdens and regulations felt by companies this year were 'increased wage burdens such as the expansion of the scope of ordinary wages,' cited by 38.4% (multiple responses allowed). This was followed by safety regulations such as the Serious Accident Punishment Act (28.3%) and labor hour regulations such as the 52-hour workweek system (22.8%).

Regarding the negative impacts that recent political instability could have on the Korean economy, 47.2% (multiple responses allowed) answered 'weakening export competitiveness due to increased exchange rate volatility,' followed by 'shrinking consumer sentiment and worsening domestic demand' (37.8%) and 'investment sentiment dampened by increased uncertainty' (26.0%).

As the regulatory innovation policies companies most desire from the government, respondents cited 'strengthening the total volume reduction system for regulations' (37.2%, multiple responses allowed), 'strengthening the exemption system for public officials regarding proactive administration' (23.4%), and 'transition to a negative regulation system' (22.4%).

Kim Jaehyun, head of KEF's Regulatory Reform Team, stated, "Due to the strengthening of global trade regulations and domestic political instability, our companies are facing a situation where it is difficult to predict even a step ahead." He emphasized, "Regulatory reform is the most effective policy tool to restore economic vitality by inducing corporate investment and job creation without national budget input."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.