Securities Industry Expects Competitors to Benefit from Homeplus’s Declining Market Share

Negotiation Power with Suppliers May Weaken in Delivery Process

Ultra-Low Price Competition Could Become an Obstacle

Concerns Over Widening Offline Crisis from a Long-Term Perspective

Homeplus, the second-largest domestic hypermarket operator, has entered corporate rehabilitation proceedings due to a liquidity crisis, raising expectations that competitors such as E-Mart and Lotte Mart may benefit from this situation. However, concerns are mixed that the e-commerce market, dominated by players like Coupang and Chinese C-commerce, along with ongoing regulations on offline sales channels, could signal a long-term deterioration in the industry.

According to the securities industry on the 5th, the Seoul Bankruptcy Court decided to commence rehabilitation proceedings for Homeplus, which it had applied for the day before, leading to forecasts that similar discount stores like E-Mart and Lotte Mart could benefit. Kiwoom Securities noted in a report that "it is highly likely that Homeplus applied for corporate rehabilitation due to liquidity difficulties," adding, "If Homeplus experiences a sharp decline in market share or store restructuring during the rehabilitation process, the existing store growth rates of competitors such as E-Mart and Lotte Mart could rebound, potentially leading to upward revisions in earnings estimates."

IBK Investment & Securities also stated, "Homeplus appears to be investing only in maintaining existing stores and has not secured differentiated competitiveness," and added, "Given that a significant portion of asset liquidation has been carried out and the sale of Homeplus Express is not proceeding smoothly, alleviating financial burdens will not be easy." They further commented, "Structural competitiveness is expected to decline, increasing the likelihood that competitors will gain indirect benefits."

Reflecting these expectations, E-Mart’s stock price on the Korea Exchange closed at 80,300 KRW, up 5.66% from the previous trading day. During the session, it reached 80,700 KRW, a 6.18% increase, marking a 52-week high. Lotte Shopping also surged 5.44% to 65,900 KRW compared to the previous close.

While competitors cautiously evaluated the prospect of benefiting from Homeplus’s rehabilitation proceedings, they agreed that Homeplus could face a challenging environment while continuing operations. A representative from a major hypermarket said, "The industry aims to contribute to price stabilization by strengthening discount policies on groceries, which ultimately depends on securing supply through cooperation with producers," adding, "With Homeplus’s financial burden officially recognized through its rehabilitation application, there could be difficulties in negotiations with partners due to concerns over payment settlements."

Although the product categories differ, affiliated companies such as CJ Foodville, Shilla Duty Free, Everland, and CGV have suspended the use of Homeplus gift certificates previously accepted at their outlets due to concerns over delayed repayments. Another industry insider said, "Even if rehabilitation proceedings commence, online and offline operations will continue normally, and payments to partners will be made, so immediate transaction shrinkage is unlikely. However, if Homeplus employees become unsettled or additional store sales occur, competitiveness could decline."

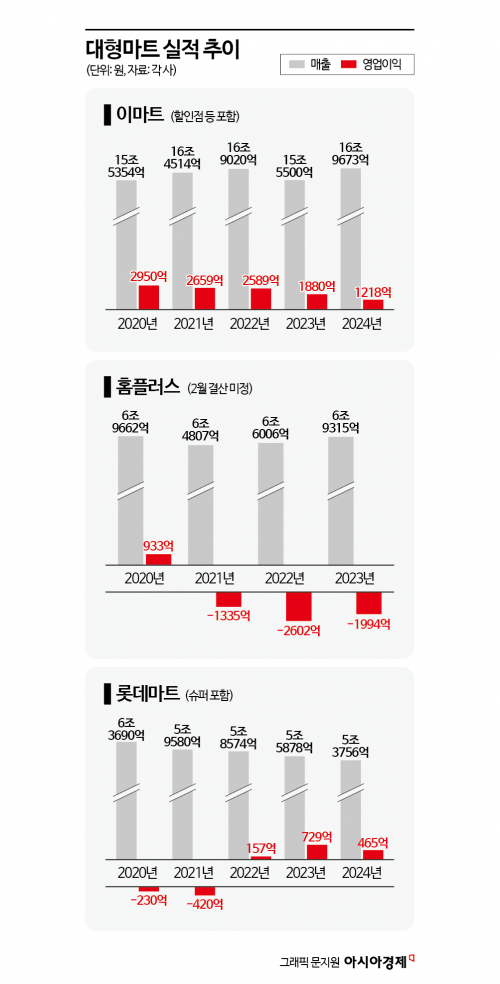

Among the three major hypermarkets, E-Mart and Lotte Mart posted annual operating profits over the past three years, including last year, whereas Homeplus turned to an operating loss of 133.5 billion KRW in 2021 and has continued to post deficits. However, with e-commerce performance, including Coupang’s, rapidly increasing each year and consumers heavily relying on online channels, hypermarkets have been trapped by regulations such as mandatory closures and operating hour restrictions since 2012, inevitably leading to a decline in competitiveness. An industry official said, "We are implementing strategies such as store renovations, new openings, and strengthening the grocery sector to increase offline foot traffic and improve profitability, but the challenging situation persists," adding, "Homeplus’s rehabilitation proceedings reveal the current reality faced by hypermarkets, and there is a strong sense of crisis from a long-term perspective."

Meanwhile, Homeplus explained in a fact-check regarding the rehabilitation proceedings that "the biggest cause of deteriorating performance is the various distribution regulations on hypermarkets, which have created an uneven playing field against online operators, combined with rapidly changing consumer trends leading to decreased sales," and stated, "The sales decline due to mandatory closures of hypermarkets amounts to 1 trillion KRW." They also added, "Distribution is a representative labor-intensive industry with a high proportion of labor costs," and "the increase in labor costs due to regularizing employees and the sharp rise in minimum wage is also one of the causes of performance deterioration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.