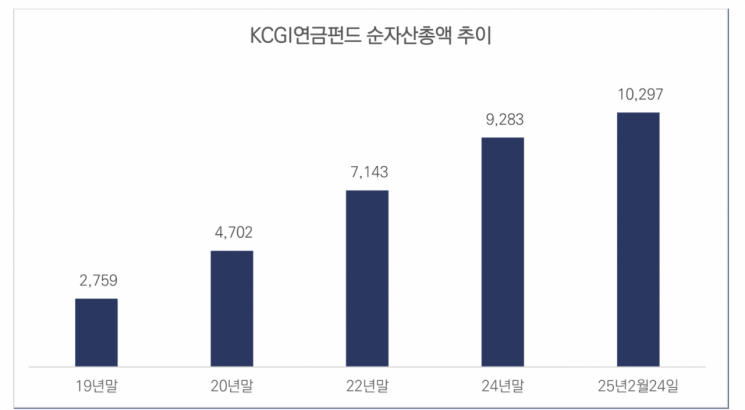

KCGI Asset Management announced on the 5th that the net assets of its managed pension funds have surpassed 1 trillion won.

As of the 24th of last month, the combined amount of retirement pensions and individual pensions (pension savings) managed by KCGI Asset Management recorded 1.0288 trillion won. This represents a 273% increase over 4 years and 2 months compared to 275.9 billion won at the end of 2019. This equates to an average annual growth rate of 37%. Among the 52 asset management companies operating pension funds, it is the 13th to exceed net assets of 1 trillion won.

During the same period, individual pension funds increased by 355%, from 161.5 billion won to 735.1 billion won. Retirement pension funds grew by 157%, from 114.3 billion won to 293.7 billion won over the same period.

A representative from KCGI Asset Management explained, "We have been receiving great responses from customers by promoting the necessity of pensions and tax-saving effects to individual clients and consecutively launching the Simple Choice and TDF series, which allow easy asset allocation by generation."

KCGI Asset Management has been raising awareness about the need for retirement preparation by launching the Simple Choice series in 2018, including age- and generation-tailored funds such as the Junior Fund, Salaryman Fund, and Senior Fund. They have also started financial services that address investment-related questions.

As the first asset management company to launch a fund trading app for individual clients, they accelerated pension asset growth by showcasing their asset allocation capabilities with the introduction of the TDF series in 2020.

They have consistently maintained top-tier returns by managing pension funds primarily focused on stocks suitable for long-term investment. Since the company name change in August 2023, strengthening pension asset management has been set as a key management goal, focusing on improving returns and stability.

The KCGI Salaryman Fund, which attracted the most capital, is a fund that invests in various domestic and global asset classes combining growth and stability, implementing an effective diversification strategy for office workers' retirement preparation, gaining popularity. Recently, it has been selecting investment candidates and rebalancing using a global multi-asset allocation model based on quantitative methods. As of the end of January, the equity ratio is about 96%, with 69% invested in the U.S., 13% in Korea, and 7% in China.

The KCGI Freedom TDF Fund, which automatically adjusts the portfolio according to the retirement timeline, has also grown rapidly since its launch in October 2020. It grew from 7.7 billion won at the end of 2020 to 203.9 billion won in 3 years and 2 months. They have continuously improved their self-developed Korean-style glide path (life-cycle asset allocation curve).

A KCGI Asset Management representative stated, "As the importance of retirement preparation is emphasized and the default option system expands, the growth of the TDF market will accelerate, which will also speed up the inflow of funds into overall pension funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.