Last Month, Baemin and Coupang Eats Recorded 22.53 Million and 10.26 Million Monthly Users, Respectively

Changing Market Environment Requires New Strategies That Carefully Weigh Pros and Cons

The domestic delivery app market environment has rapidly changed this year, causing growing concerns among partner businesses. This is due to Baemin's announcement to end its flat-rate subscription product and the implementation of a win-win fee system, which has equalized the commission rates for self-delivery products of the market's first and second place players, Baemin and Coupang Eats. Since conditions directly linked to sales have all changed, partner businesses now need to devise new strategies that carefully weigh the pros and cons. The situation is also influenced by Coupang Eats accelerating its pursuit and gradually narrowing the gap with the number one player.

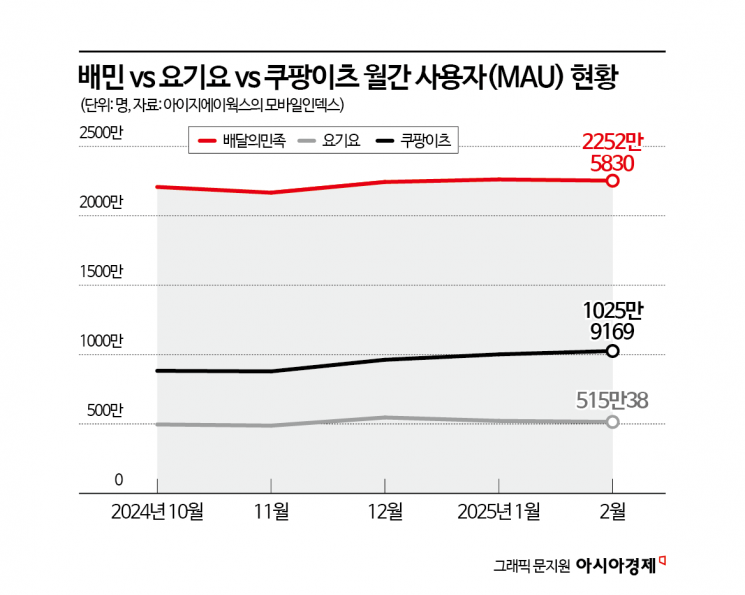

According to Mobile Index by data platform company IGAWorks on the 5th, last month Baemin, Coupang Eats, and Yogiyo recorded monthly active users (MAU) of 22.53 million, 10.26 million, and 5.15 million respectively. Compared to the same period last year, Baemin, the number one, increased by about 600,000 users, while Yogiyo decreased by approximately 880,000 users. The most notable change is the rapid growth of Coupang Eats. Coupang Eats increased by a whopping 4.52 million users over one year, a growth rate of 78.6%. Following January, it surpassed 10 million monthly active users again in February, maintaining a continuous growth trend.

This situation is affecting the entire market. Baemin’s decision to sequentially discontinue its flat-rate subscription product ‘Ultracall,’ priced at 80,000 KRW per month starting next month, is analyzed as a measure taken due to a sense of crisis from Coupang Eats’ pursuit and to secure competitiveness. With the discontinuation of Ultracall, Baemin’s fee plans will consist of the 6.8% commission-based store delivery product ‘Open List’ and the Baemin self-delivery product ‘Baemin 1 Plus,’ which applies the win-win fee system. An industry insider said, "Compared to Coupang Eats, which has a 100% self-delivery structure and only one commission-based fee plan, Baemin’s product, service, and fee plan structure are complicated, which likely accumulated inefficiencies and became an obstacle to expanding competitiveness."

With the removal of the flat-rate subscription product unique to Baemin and the self-delivery product favored by consumers applying the same rate under the win-win fee system for the market’s first and second place players, partner businesses have begun to deliberate. On partner business online communities, opinions range from "We should consolidate orders to the platform with more orders between Baemin and Coupang Eats" to "We should focus on Baemin’s Open List, which has the lowest commission." Concerns about Baemin’s flat-rate product termination are also rising, as using only commission-based plans means that commission burdens increase significantly as sales grow. Counterarguments have been raised citing the drawbacks of Ultracall, known as ‘flag planting,’ fixed cost burdens, and issues with the service quality of delivery agencies, leading to heated debates. In response, a Baemin representative explained, "The termination of Ultracall aims to restructure a service model that no longer provides sufficient value for the cost to store owners or customers in a delivery app market that has already shifted to self-delivery and commission-based plans."

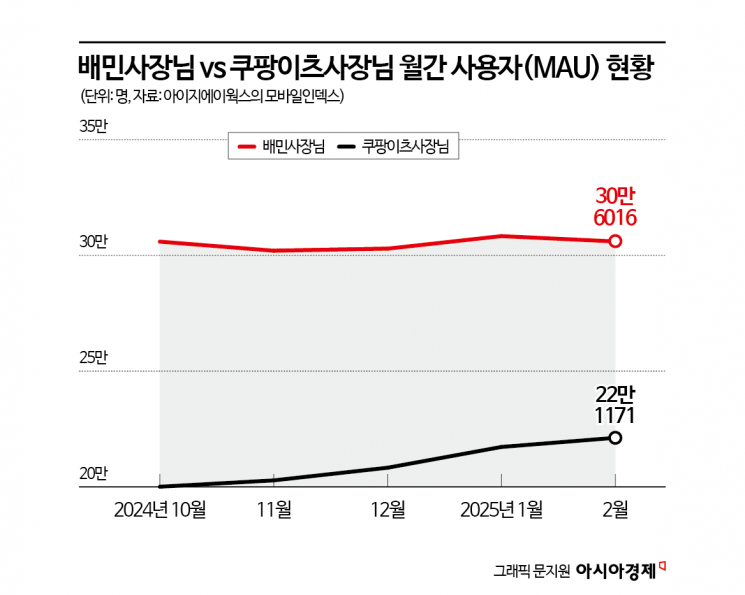

This is also expected to affect the competition between the two companies to secure partner businesses. So far, the number of Coupang Eats partner businesses has steadily increased. According to Mobile Index, last month the monthly active users of the management apps used by Baemin and Coupang Eats partner businesses, ‘Baemin Sajangnim’ and ‘Coupang Eats Sajangnim,’ were 306,000 and 221,000 respectively. Compared to six months ago, Baemin partner businesses decreased by about 13,000, while Coupang Eats increased by about 27,000.

An industry insider said, "At the end of last month, Baemin started operating the win-win fee system, and from next month, major changes such as the sequential termination of flat-rate fees and the application of Coupang Eats’ win-win fee system will follow. Amid these changes, the strategies of partner store owners and whether Coupang Eats’ growth trend can continue will be key factors in future market landscape changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.