Exceeded Market Expectations in Q4 Last Year

"Performance Improvement Expected This Year Through Concerts by BLACKPINK and Others"

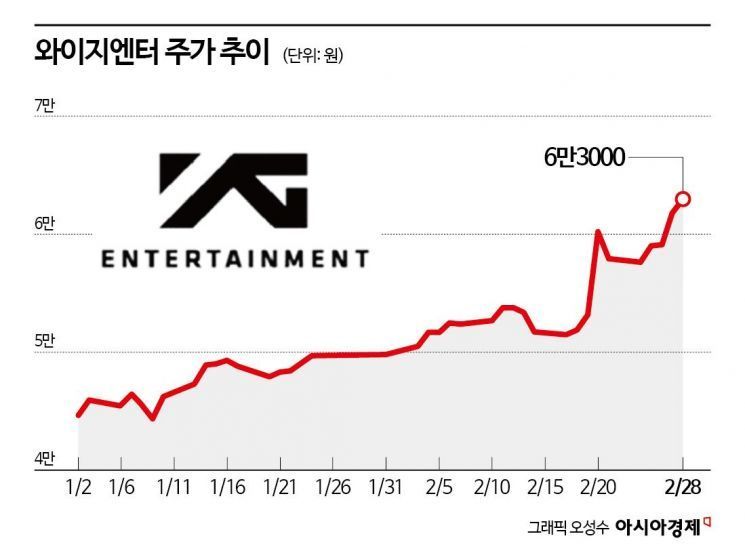

The stock price of YG Entertainment is reaching its highest level of the year. This is attributed to the rapid profit generation by the girl group Baby Monster, as well as expectations of improved performance due to the resumption of activities by groups like BLACKPINK this year.

According to the Korea Exchange on the 4th, YG Entertainment recorded 63,000 KRW on the 28th of last month. This is the highest closing price of the year. Compared to the end of last year, it rose by 37.55%, far surpassing the KOSDAQ increase rate of 9.70% during the same period.

Strong performance in the fourth quarter of last year pushed the stock price up. In the fourth quarter of last year, YG Entertainment's sales and operating profit were 104.1 billion KRW and 1.3 billion KRW, respectively. Although sales decreased by 4.9% compared to the same period last year, operating profit increased by 225.3%. This performance exceeded market expectations.

A key factor in the improved performance is the activities of the low-experience group Baby Monster. Baby Monster released a full-length album last year, which increased album and digital music sales.

Minha Choi, a researcher at Samsung Securities, said, "The aggressive activities of low-experience artists led to performance exceeding market expectations," adding, "Baby Monster's first full album recorded sales of 840,000 copies during the quarter, showing remarkable growth compared to their first mini album." She also added, "TREASURE also contributed by making a comeback with a digital single."

In particular, the performance improvement trend is expected to continue this year following the fourth quarter of last year. Securities firms forecast YG Entertainment's sales and operating profit for this year to be 525.6 billion KRW and 53.3 billion KRW, respectively. Sales are expected to increase by 44.04% year-on-year, and operating profit is expected to turn positive.

The factors for this year's performance improvement include monetization effects from the full-scale activities of both low-experience and high-experience artists. Activities by BLACKPINK, WINNER, and AKMU will resume this year. Additionally, the debut of a new boy group is expected to expand the intellectual property (IP) pipeline.

Minyoung Kim, a researcher at Meritz Securities, emphasized, "Baby Monster is shortening the monetization period by holding a world tour just one year after debut," adding, "BLACKPINK's world tour will start from the third quarter, and significant profit growth is expected to continue until 2026."

Moreover, performances in China are also an anticipated factor. Expectations are rising that the Korean ban on cultural imports (Hanhanryeong), which has been in effect since 2017, may be lifted starting this year. If the ban is lifted, it is expected to positively impact performance.

Hwajeong Lee, a researcher at NH Investment & Securities, explained, "Artists including BLACKPINK, BIGBANG, and Baby Monster all have high recognition in China," adding, "If performances in China resume, significant benefits are expected in terms of concert and merchandise sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.