National Assembly Budget Office Releases Long-term Fiscal Outlook Report

National Pension Fund Depletion Delayed by Two Years Compared to 2023 Forecast

Even with Significant Improvement in Returns, There Are Limits to Preventing the Predicted Crisis

With the increase in the National Pension Service's rate of return, the fiscal outlook has shown some improvement. However, it was reaffirmed that improvements in economic growth rate and returns alone have limitations in preventing the predicted catastrophe.

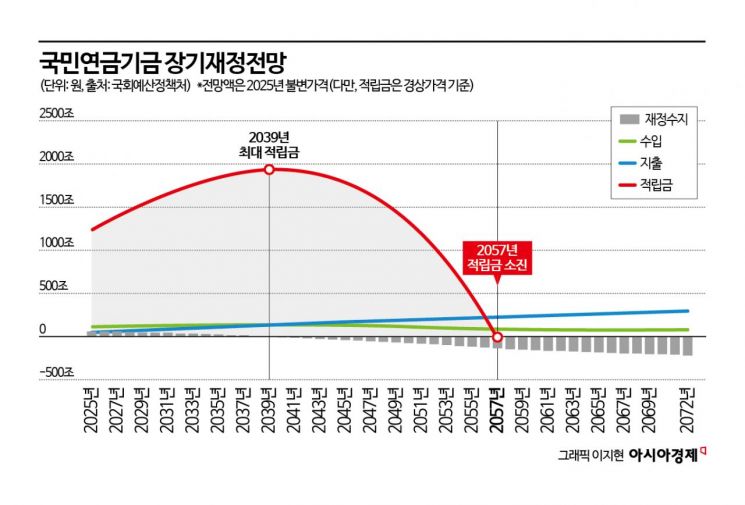

According to the National Assembly Budget Office's report on the "Long-term Fiscal Outlook from 2025 to 2072" released on the 2nd, the National Pension Fund's accumulated reserves are expected to peak in 2039, then turn into a deficit starting in 2040, and the accumulated funds are projected to be completely depleted by 2057. This marks a significant change from the analysis made by the Budget Office two years ago. According to the "Public Pension Reform and Fiscal Outlook" published in 2023, the pension depletion point was projected to be in 2055, which is about two years earlier than the current forecast.

Looking in detail, the short-term financial status of the National Pension worsens, but the long-term trend shows improvement. The previous report from two years ago anticipated a fiscal surplus of 49.2 trillion won in 2030, but the current report reduces this to 44.6 trillion won. The 2023 report forecasted a deficit of 97.4 trillion won around 2050, whereas the current report predicts a deficit of approximately 78.8 trillion won. This gap widens further by 2060. The 2023 report expected a deficit of 197.3 trillion won, but the current report revises this to a deficit of 159.5 trillion won. When compared to the Gross Domestic Product (GDP), this decreases from 5.5% to 4.0 percentage points.

The Budget Office explained that the change in projections is due to updates in the basic data, including the National Pension's actual performance, economic forecasts, and population estimates. The 2023 report was based on the 2022 National Pension performance, economic forecasts, and the population estimates released by Statistics Korea in December 2021, while the current report is based on National Pension performance data up to October 2024 and the December 2023 population estimates from Statistics Korea.

In fact, the National Pension's operating return rate last year recorded the highest level since the fund's establishment in 1988, reaching 15%. This was due to significant improvements in returns from overseas stocks and bonds.

However, regarding the partial improvement in the National Pension's fiscal outlook, the Budget Office expressed that it is difficult to assign great significance. Although the depletion timing changes depending on operating returns, the overall trend remains unchanged.

An official from the Budget Office stated, "The financial situation of the National Pension has already deteriorated as much as it can. At present, a shift of one or two years in the fund depletion timing does not carry much significance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)