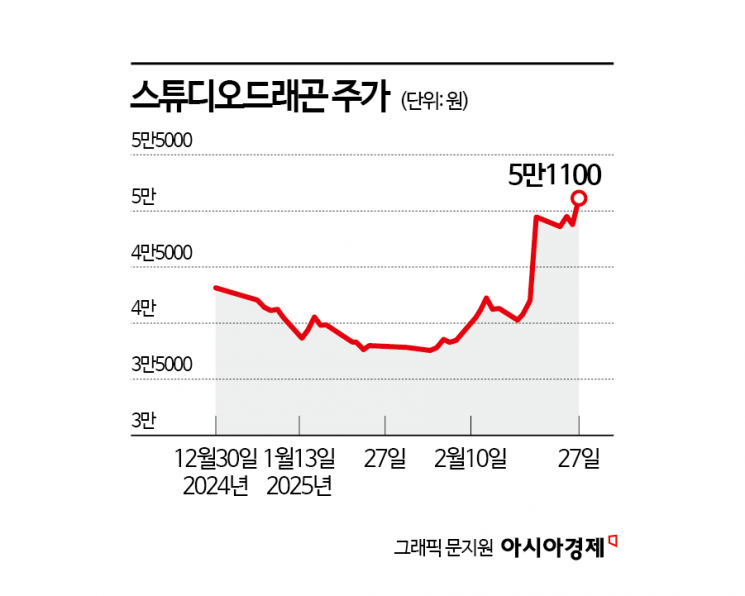

Stock Price Rises 36.1% This Month

Supplying Dramas to Chinese OTT Could Lead to Sharp Profit Increase

As expectations for the lifting of the Chinese government's ban on Korean content (Hallyu ban) grow, the stock price of drama production company Studio Dragon is also rebounding.

According to the financial investment industry on the 28th, Studio Dragon's stock price has risen 36.1% since the beginning of this month. Considering that the KOSDAQ index rose 5.8% during the same period, the return rate compared to the market reaches 30.3 percentage points (P). Foreign and institutional investors led the stock price increase with cumulative net purchases of 11.5 billion KRW and 17.8 billion KRW, respectively. The average purchase prices for foreigners and institutions were 46,315 KRW and 46,189 KRW, respectively, recording an estimated return of about 10%.

Studio Dragon's stock price, which fell 12.8% in January alone this year, rebounded as expectations grew that it could re-enter the Chinese market. Kim Hoe-jae, a researcher at Daishin Securities, explained, "Since the end of last year, a friendly cultural exchange environment with China has been created," adding, "The reopening of the Chinese market is an important event for Studio Dragon's content performance and stock price." He further noted, "China's three major online video service (OTT) subscribers number 330 million, surpassing Netflix's 300 million subscribers," and added, "Content can be sold under conditions similar to Netflix."

Studio Dragon recorded sales of 550.1 billion KRW and operating profit of 36.4 billion KRW on a consolidated basis last year, down 27.0% and 34.9%, respectively, from the previous year. The annual production episodes decreased by 40.0% compared to the previous year, which affected sales.

This year, the company plans to diversify channels to improve performance, expand the supply of works, and produce many popular titles. They are also considering ways to discover new revenue sources such as short-form dramas and artificial intelligence (AI). While seeking growth strategies without relying on the lifting of the Hallyu ban, there is a prospect that the Chinese market may reopen.

Researcher Kim analyzed, "If a tentpole work worth 30 billion KRW is simultaneously broadcast on Chinese OTT platforms, an additional profit of about 20 billion KRW will be generated," adding, "This amount corresponds to 60% of Dragon's operating profit last year." He also added, "Studio Dragon has the capacity to produce about 30 dramas annually," and "Within the production volume, simultaneous broadcasting on global OTT and Chinese OTT is possible, and additional dramas can be produced specifically for Chinese OTT."

Even supplying just one drama per year to Chinese OTT platforms would have a significant effect on increasing operating profit, providing sufficient momentum to raise corporate value.

Ji In-hae, a researcher at Shinhan Investment Corp., analyzed, "It is difficult to fully trust the lifting of the Hallyu ban," adding, "We have no choice but to wait until news of approval from Chinese broadcasting regulatory authorities for 'simultaneous broadcasting of new Korean dramas in China' is heard." However, he noted, "This is a likely period for the distribution of K-content, which has been blocked for eight years, including K-pop performances, dramas, and movies, within China," and predicted, "Recently, the drama production industry has been confused by the issue of Netflix's growing dominance, but China is the only factor that can overturn this landscape."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.