Up 20% from Early-Month 52-Week Low

Stock Price Expected to Rise on Strong Q1 Earnings Outlook

Positive Trend Likely to Continue at Least Until June

LG Innotek is gearing up for a stock price recovery. After hitting a 52-week low earlier this month, LG Innotek has successfully rebounded and is recently maintaining a strong stock price trend. Securities firms predict that the stock price recovery will continue for the time being, supported by solid first-quarter earnings.

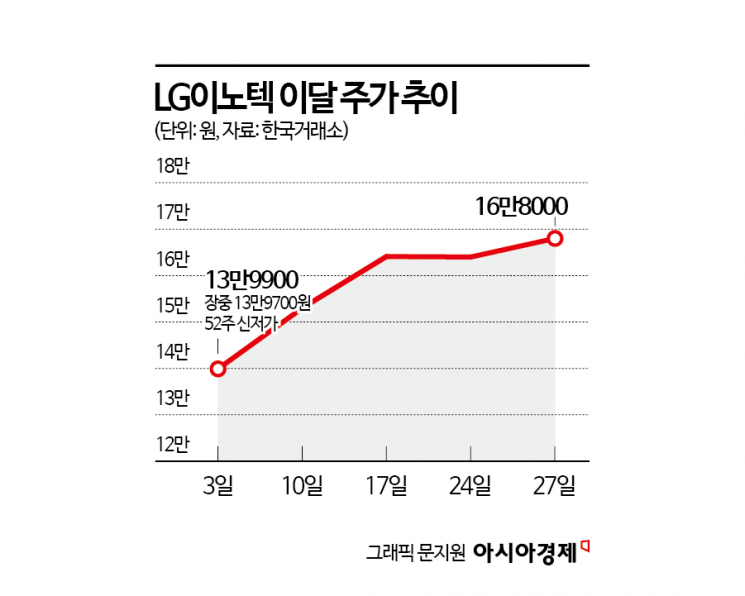

According to the Korea Exchange on the 28th, LG Innotek closed at 168,000 KRW, up 3.96% from the previous day. It has risen about 13% since the beginning of this month. Compared to the 52-week low of 139,700 KRW recorded intraday on the 3rd, it has increased by 20%.

After reaching a 52-week high of 300,000 KRW last July, LG Innotek had been on a downward trend, but this time, after hitting a 52-week low, the stock price direction appears to be changing again. The stock price, which had fallen below 140,000 KRW, has approached 170,000 KRW.

The anticipated strong performance in the first quarter of this year is interpreted as a factor boosting the stock price rebound. iM Securities estimated LG Innotek's first-quarter sales to increase by 7% year-on-year to 4.6 trillion KRW, while operating profit is expected to decrease by 35% to 114.3 billion KRW. This exceeds the consensus (average securities firm forecast) operating profit of 88 billion KRW by 30%. Go Eui-young, a researcher at iM Securities, said, "Although iPhone demand is absolutely weak, it is performing better than the lowered expectations," adding, "In particular, the sales proportion of the iPhone 16 series' Pro and Pro Max models is estimated to have improved by 4 percentage points year-on-year to nearly 68%, which is positive for LG Innotek's camera module blended average selling price (Blended ASP)." He continued, "Substrate materials are also improving, mainly in the display component group, thanks to China's 'iguhwansin' (replacement of old with new) subsidy policy and stockpiling demand in preparation for tariff imposition."

With the expected recovery of sales in China by the North American client (Apple), LG Innotek's stock price is forecasted to be positively affected. Park Jun-seo, a researcher at Mirae Asset Securities, said, "The recovery of the North American client's sales in China is expected to accelerate, as they have submitted an approval application for launching China-specific artificial intelligence (AI) features in cooperation with Alibaba, and global sales of the SE4 model are scheduled to begin within the first half of the year," adding, "The improvement of the AI strategy in the Chinese domestic market is expected to lead to a recovery in investment sentiment, and the increase in sales volume following the launch of the SE4 will continue."

There is a forecast that the stock price will maintain its strong trend for the time being. Researcher Go said, "Although I have maintained a cautious long-term approach to LG Innotek, I believe a positive stock price trend can be expected at least until June," explaining, "First-quarter earnings are expected to exceed consensus, and there are many positive events related to Apple for the time being." iM Securities adjusted LG Innotek's operating profit estimates for 2025 and 2026 upward by 11% and 10%, respectively, and raised the target stock price from 205,000 KRW to 225,000 KRW.

Researcher Park said, "Since sales improvement is expected with the launch of SE4 in the first half and the adoption of China-customized AI, I recommend proactive portfolio expansion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.