Analysis of Local Administrative Licensing Data

Bakery Closure Rate Soars to 18%, Rising for Four Consecutive Years

One in Six Bakeries Closed Last Year

Bakery Franchises Also Hit Hard

In a densely populated residential commercial area in Hwaseong, Gyeonggi Province, Mr. Kim, a man in his 50s who runs a bakery, filed for business closure last month. He decided it was no longer sustainable as debts piled up after the COVID-19 outbreak right after opening, and recently, customer numbers have dwindled. Sales were far from enough to cover rent, ingredient costs, labor, and loans, and he rarely took a proper salary. Mr. Kim lamented, "Even though I closed the business, I have no clear way to make a living. I held on hoping things would improve, but only more debt accumulated. I thought it would be better to work as a delivery rider, so I decided to shut down."

Prolonged domestic demand stagnation has pushed self-employed individuals to the brink. Including Mr. Kim’s store, 182 bakeries nationwide closed last month.

According to an analysis of local administrative licensing data released by the Korea Local Information Research & Development Institute on the 5th, 3,591 bakeries nationwide closed last year, marking the highest number in five years. Since 2020, more than 2,000 bakeries have closed annually: 2,101 in 2020, 2,162 in 2021, 2,721 in 2022, and 3,120 in 2023.

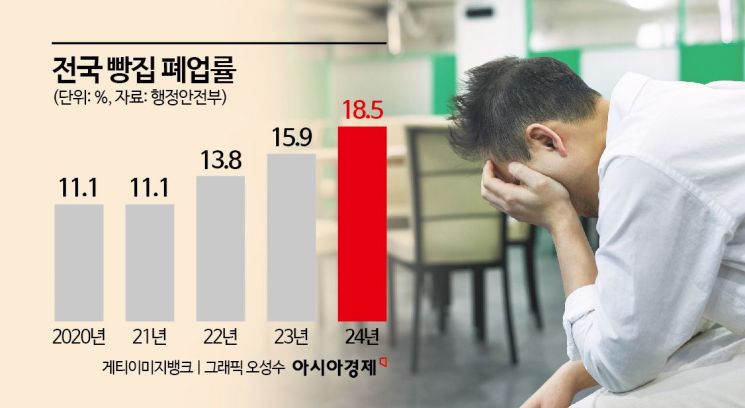

The closure rate has also risen for four consecutive years. The bakery closure rate was 11.1% in 2020, rising to 13.8% in 2022, 15.9% in 2023, and 18.5% last year. The closure rate compares the number of bakeries that closed within a year to the total number of bakeries, meaning that one out of every six bakeries closed last year.

The Ministry of the Interior and Safety publicly shares licensing data from local governments nationwide (17 metropolitan cities and provinces, 228 cities, counties, and districts) through the Korea Local Information Research & Development Institute. This data includes lists of currently operating and closed businesses.

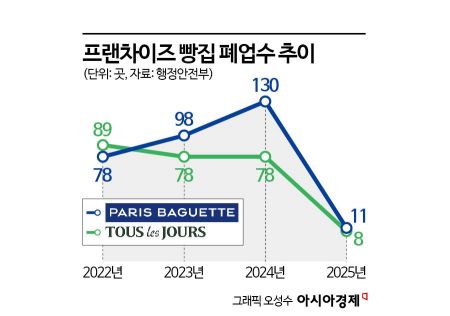

Bakery franchises have not escaped the shadow of the downturn. SPC’s Paris Baguette saw 130 franchise stores close last year, a 32% increase from the previous year. More than 10 franchise owners have already given up this year. CJ Foodville’s Tous Les Jours also closed over 70 franchise stores for three consecutive years.

Until 2023, bakery openings outnumbered closures, so the total number of operating stores slightly increased. However, from 2023, closures surpassed openings. The total number of bakeries decreased by 143 in 2023 and by 138 in 2024.

Bakeries, along with cafes and chicken shops, are industries with relatively low entry barriers. The bakery industry attributes the recent sharp rise in closures to a combination of rising raw material and ingredient costs, minimum wage increases, and weakened consumer sentiment due to economic downturn.

The largest portion of bakery operating costs is raw materials. According to the Federation of Korean Industries, the biggest management costs for self-employed individuals are raw materials and ingredient costs (22.2%), labor costs (21.2%), rent (18.7%), and loan principal and interest repayments (14.2%). Typically, bakery profit margins are around 15%, but soaring raw material prices have significantly reduced these margins. According to Statistics Korea, consumer prices rose 2.3% last year, but prices for agricultural products (grains, vegetables, fruits, etc.) jumped 5.9%. This means that prices for essential baking ingredients like flour, eggs, and milk surged.

Labor costs are also a burden. The current minimum wage is 10,030 KRW per hour, an increase of 170 KRW (1.7%) from the previous year.

Above all, the prolonged recession appears to have pushed self-employed individuals to their limits. While incomes remained stagnant, prices rose, and interest burdens from household debt increased, causing consumers to tighten their wallets. The economic growth rate in the fourth quarter of last year was 0.1% compared to the previous quarter, marking the first time since the 1998 foreign exchange crisis that growth remained in the 0% range for three consecutive quarters. Retail sales fell 2.2% year-on-year last year. The number of closures of general restaurants and cafes reached a record high of 107,526 last year. Closure rates for general restaurants and cafes were 10.4% and 17.3%, respectively.

The prolonged high interest rates have also increased loan burdens for self-employed individuals, further driving up closure rates. The average loan amount for self-employed individuals was 120 million KRW last year. Monthly interest payments during this period were estimated at 843,000 KRW. This means self-employed individuals are bearing an average annual interest rate burden of 8.4%.

For these reasons, analyses suggest that the crisis for self-employed individuals will peak this year. Professor Oh Se-jo of Yonsei University said, "Along with financial support, it is necessary to strengthen the management capabilities of self-employed individuals," adding, "Local governments should step up to develop integrated policies that can provide practical help to self-employed individuals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.