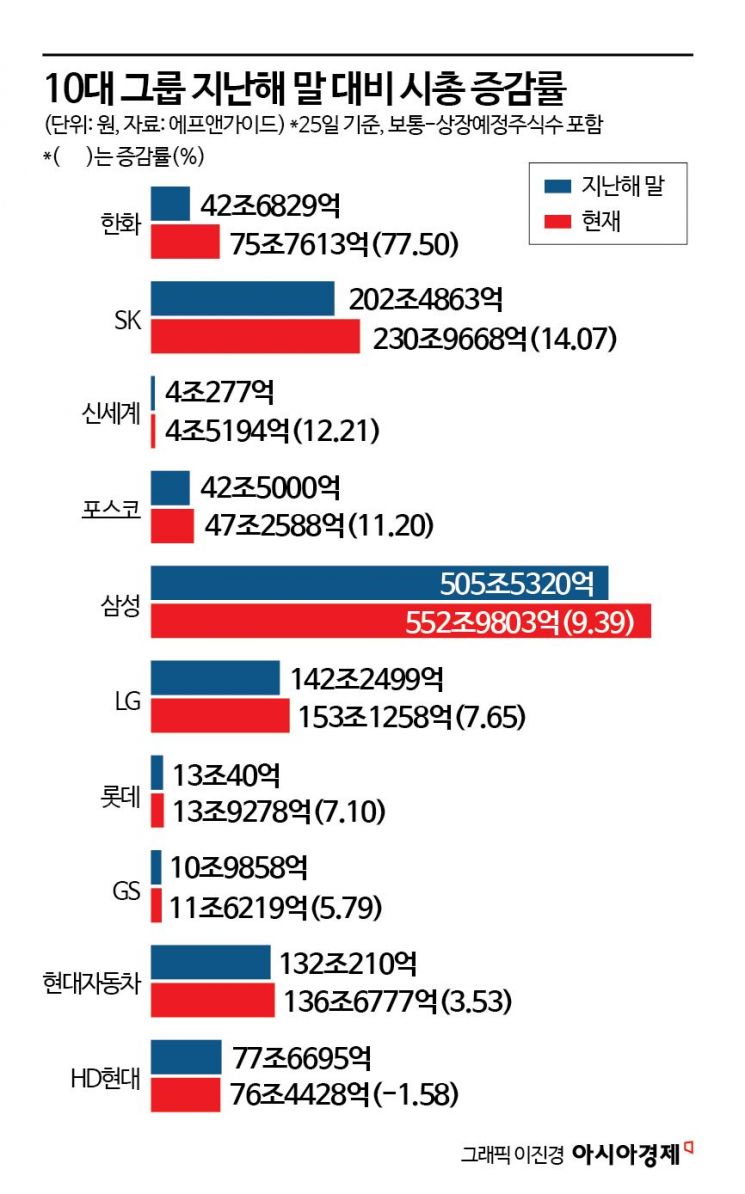

Total Market Cap of Top 10 Conglomerates Rises from 1,173 Trillion Won to 1,303 Trillion Won

Hanwha Group Sees Largest Growth with 77.5% Increase

HD Hyundai Group Alone Declines... Down 1.58%

As the domestic stock market showed a favorable trend this year, the market capitalization of the top 10 conglomerates increased by 130 trillion won. Among the top 10 groups, the market capitalization of 9 groups increased compared to the end of the previous year, with Hanwha Group recording the largest increase in market capitalization.

According to financial information company FnGuide on the 27th, as of the 25th, the total market capitalization of the top 10 groups was 1,303.2825 trillion won. This is an increase of 130.1235 trillion won from 1,173.159 trillion won at the end of last year.

The group with the largest increase in market capitalization this year was Hanwha Group. Hanwha Group's market capitalization rose 77.50% from 42.6829 trillion won at the end of last year to 75.7613 trillion won. Following were SK (14.07%), Shinsegae (12.21%), POSCO (11.20%), Samsung (9.39%), LG (7.65%), Lotte (7.10%), GS (5.79%), and Hyundai Motor (3.53%) in order of market capitalization growth.

Hanwha's defense industry stocks' strength and strong earnings led to all its affiliates' stock prices rising compared to the end of the previous year, resulting in a significant increase in the group's overall market capitalization. The main contributor to the market capitalization increase was Hanwha Aerospace. Hanwha Aerospace's stock price rose 108% this year, the highest among the top 10 conglomerates. Hanwha Ocean followed with a 101.34% increase. Additionally, Hanwha rose 61.52%, Hanwha Vision 48.73%, and Hanwha Systems 46.46%, with half of the top 10 stocks by price increase among the top 10 conglomerates belonging to Hanwha Group. Lee Seung-woong, a researcher at Yuanta Securities, said about Hanwha Aerospace, "In the fourth quarter of last year, sales increased by 56% year-on-year to 4.8 trillion won, and operating profit rose 222.1% to 892.5 billion won, recording a surprise that significantly exceeded the consensus (average securities firm forecast) for three consecutive quarters. Based on an overseas order backlog worth 22 trillion won, steady performance in ground defense is expected to continue for the time being, and considering synergies in marine business with Hanwha Ocean and Hanwha Systems, there is sufficient potential for stock price growth."

HD Hyundai, which had the highest market capitalization growth rate among the top 10 groups last year with a 120% increase, showed a sluggish performance this year and was the only one among the top 10 groups to see a decline in market capitalization. HD Hyundai's market capitalization decreased by 1.58% from 77.6695 trillion won at the end of last year to 76.4428 trillion won. HD Hyundai Mipo (-16.32%) and HD Hyundai Marine Solutions (-16.14%) each fell more than 16%, marking the largest stock price declines among the top 10 conglomerates and contributing to the group's market capitalization decrease. HD Hyundai Electric, which led the group's market capitalization increase last year with a 364.72% rise and ranked first in stock price increase among KOSPI-listed companies, also showed weakness this year with an 8.77% drop in stock price.

Poor earnings were a factor in the stock price weakness. HD Hyundai Mipo, HD Hyundai Marine, and HD Hyundai Electric all posted fourth-quarter results last year that fell short of market expectations. Lee Han-gyeol, a researcher at Kiwoom Securities, said about HD Hyundai Electric, "In the fourth quarter of last year, sales increased 2.3% year-on-year to 815.7 billion won, and operating profit rose 33.4% to 166.3 billion won, significantly below market expectations. The biggest reason for the poor performance was the slowdown in sales growth due to delivery delays of North American power transformers requested by customers," he analyzed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.