Korea Insurance Research Institute Holds New Year's Press Briefing on the 26th

Research to Cover AI and the Role of Insurance, Retirement Pensions, and More

Development of Insurance Trust Index Set as Mid- to Long-Term Goal

The Korea Insurance Research Institute will focus this year on studies related to vehicle repairs, fault ratios, and aging in the automobile insurance sector. It will also conduct evaluation research on the insurance comparison and recommendation service, now in its second year of implementation. Additionally, the institute will strengthen research aligned with new industry trends, such as the integration of insurance and the subscription economy, AI-related accidents, and the role of insurance.

Ahn Cheol-kyung, President of the Korea Insurance Research Institute, is explaining this year's major research projects at the New Year's press briefing held on the 26th at the Korea Insurance Research Institute in Yeouido, Seoul. Photo by Korea Insurance Research Institute

Ahn Cheol-kyung, President of the Korea Insurance Research Institute, is explaining this year's major research projects at the New Year's press briefing held on the 26th at the Korea Insurance Research Institute in Yeouido, Seoul. Photo by Korea Insurance Research Institute

On the 26th, at a New Year's press briefing held at the Korea Insurance Research Institute in Yeouido, Seoul, President Ahn Cheol-kyung stated, "This year, the domestic economy will face a low-interest, high-exchange rate environment," adding, "The insurance industry needs to maintain stable risk underwriting capabilities and conduct crisis situation analysis and preparedness regarding capital and liquidity management in asset management."

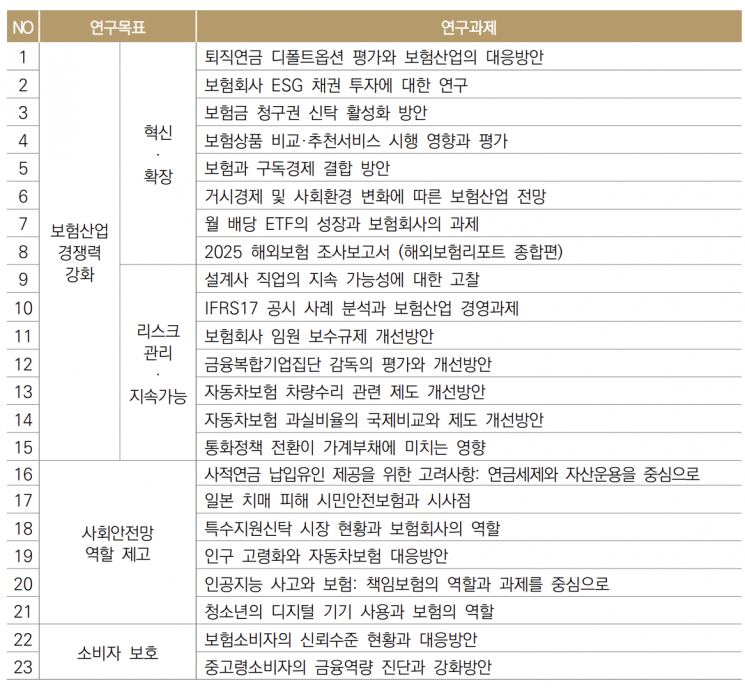

The insurance think tank, Korea Insurance Research Institute, identified key research areas for this year as ▲ strengthening the socio-economic role of the insurance industry ▲ responding to megatrend changes ▲ enhancing consumer trust. It also selected 23 core research projects to implement these goals.

Among the 23 projects, three are dedicated to automobile insurance, demonstrating the institute's commitment to improving automobile insurance systems this year. Under the project "Automobile Insurance Vehicle Repair System Improvement Plan," the institute plans to analyze South Korea's vehicle repair practices, vehicle parts market, and painting and labor markets, comparing them with major countries. It will estimate the scale of insurance money leakage arising from repair costs and seek system improvement measures. The study on "International Comparison of Automobile Insurance Fault Ratios and System Improvement Plans" will compare fault ratio applications in compensation systems of major countries, focusing on high-value vehicles. The findings will be incorporated into proposals to improve South Korea's automobile insurance fault ratio system. The research on "Aging Population and Automobile Insurance Response Measures" will investigate safety driving systems and insurance product characteristics and cases for the elderly, mainly in welfare-advanced countries.

Evaluation research on the insurance comparison and recommendation service, launched in January last year, will also be conducted. Although the service initially started with automobile and multi-line insurance and has since expanded to savings, travel, and pet insurance, it has not been properly activated due to low subscriber numbers. The study will identify issues and propose improvement measures.

This year, the institute will also research ways to combine insurance with the subscription economy, a plan announced by the non-life insurance industry. Currently, consumers mostly have to cancel existing insurance products and switch to new ones to change their insurance. The institute plans to study the development of products that allow consumers to freely subscribe and unsubscribe to insurance according to their needs and desired periods.

Research on the International Financial Reporting Standards (IFRS17), which caused controversy over inflated insurance company performance last year, will also be conducted. Contrary to its intended purpose, IFRS17 focuses on short-term performance, resulting in issues with reliability and transparency of outcomes. The institute will focus on IFRS17 disclosures by overseas insurers for this study.

Research on the role of liability insurance in AI-related accidents will also commence. AI accidents occurring in high-risk and critical areas such as transportation, healthcare, and infrastructure can cause direct harm to life and body and may lead to large-scale disasters, raising significant concerns. The institute plans to conduct research to develop insurance products that prepare for such risks.

In addition, studies will be conducted on various topics such as insurance claim trust, evaluation of default options in retirement pensions, demand for monthly dividend exchange-traded funds (ETFs), and private pensions.

The institute will also respond to diverse insurance research demands through research centers, seminars, forums, and commissioned or joint research with insurance and finance scholars and specialized institutions. It plans to strengthen its capacity to study market issues by adding the Asset Management Research Center, Macroeconomics Research Center, and New Risk Research Center to its research center organization. Through the Industry-Academia Insurance Research Center, it will actively address various issues crossing industry boundaries.

President Ahn said, "While market reform of sales channels and consumer protection were major issues in a supplier-driven market, understanding consumers will be the main challenge in a consumer-driven market," adding, "We will also pursue the development of an insurance trust index as a mid- to long-term goal to enhance consumer trust in insurance."

23 research projects selected as key research areas by the Korea Insurance Research Institute this year. Provided by the Korea Insurance Research Institute.

23 research projects selected as key research areas by the Korea Insurance Research Institute this year. Provided by the Korea Insurance Research Institute.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.