Triple Burden of Unsold Homes, High Interest Rates, and Construction Costs

8 Companies in Top 100 by Contract Ranking Have Debt Ratios Over 400%

Desperate Fight for Survival: Workforce Cut by 70%, Wave of Construction Business Closures

"Government Measures Lacking Financial and Tax Benefits Fall Short"

Mid-sized construction company Angang Construction, based in Seoul (ranked 116th in construction capability evaluation), filed for rehabilitation proceedings (court receivership) on the 26th. This is already the fourth rehabilitation application since the beginning of this year. Starting with Shindonga Construction (ranked 58th), followed by Daejeo Construction (103rd), and Sambutogen (71st), rehabilitation efforts have sparked a 'domino bankruptcy fear.' Although crisis theories emerge every year, the current atmosphere feels unusually serious.

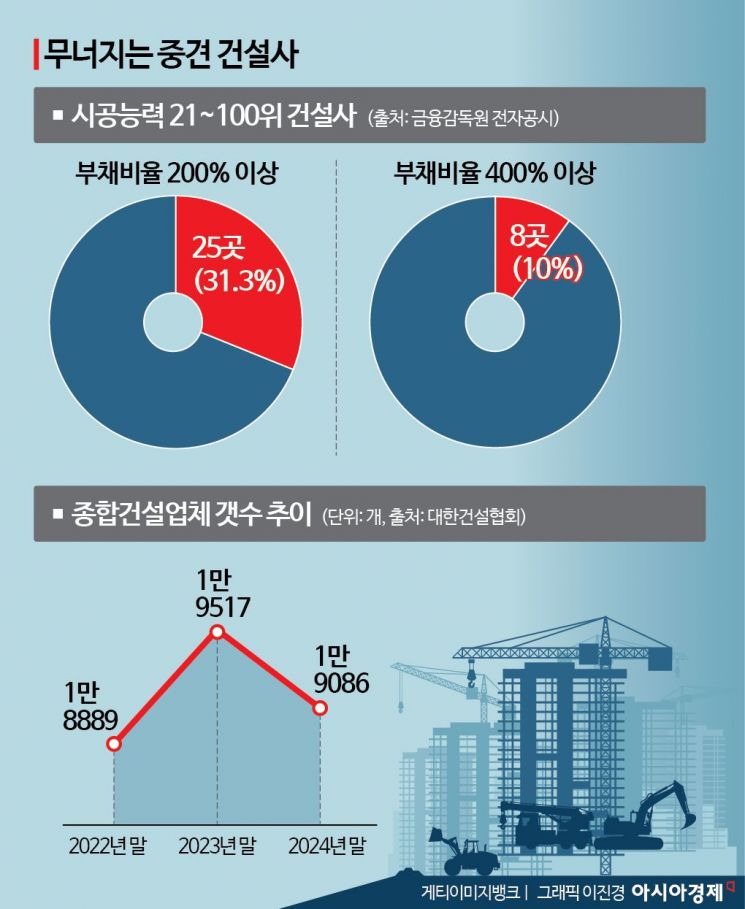

In fact, there are numerous heavily indebted construction companies that could potentially become the 'second Sambutogen.' A comprehensive survey of the latest business reports of 80 construction companies ranked 21st to 100th in construction capability, disclosed on the Financial Supervisory Service's electronic disclosure system on the 27th, revealed that 25 companies (31.3%) have a debt ratio exceeding 200%. The debt ratio is the ratio of debt amount to equity capital. Generally, a debt ratio above 200% signals a red flag for financial soundness. A ratio exceeding 400% is considered a 'potential sign of insolvency.' There are 8 companies (10%) with debt ratios over 400%.

8 Companies with Debt Ratios Over 400%... Rapid Increase in 'Zombie Construction Companies'

Recently, Sambutogen, which filed for rehabilitation proceedings at the court, had a debt ratio of 838%. Shindonga Construction had 429%. Both were long-established construction companies with titles such as 'Construction License No. 1' and '63 Building Constructor,' but they collapsed due to continuous deficits and a rapid increase in debt ratios over a short period. Including these companies, there are a total of 8 companies with debt ratios exceeding 400%. These include Taeyoung Construction (748%), ranked 24th and which applied for a workout last year, Isu Construction (817%) ranked 85th, Daebang Industrial Development (513%) ranked 77th, and HJ Heavy Industries (498%) ranked 36th.

Many mid-sized construction companies have become 'zombie companies' that cannot even pay interest despite earning money. According to the Korea Construction Policy Research Institute, among construction companies audited by external accounting firms (construction external audit companies), the number of companies with an interest coverage ratio below 1 was 1,089 as of 2023. This accounts for 47.5% of the 2,292 companies surveyed. This number increased 1.6 times from 678 companies in 2019 over four years. The interest coverage ratio is the value obtained by dividing operating profit by interest expenses. A ratio below 1 means the company cannot even pay its loan interest.

Growing Domino Bankruptcy Fear Calls for "Effective Countermeasures"

Due to the construction market downturn, improving performance is difficult. Except for some high-end areas in Seoul, the overall housing market is frozen. Malignant unsold units after completion, so-called 'malignant unsold housing,' have reached 21,480 units, the highest in 11 years. Even in apartments that have already succeeded in sales, cases of delayed interim payments or inability to pay the balance are increasing, leading to growing 'sales receivables.' Although the rise in raw material prices has slowed, high construction costs remain a burden.

Mid-sized construction companies are fighting desperately for survival. One mid-sized construction company reduced its workforce by more than 70% through restructuring over the past two years. They also relocated their offices to areas with cheaper rent. Many construction companies have postponed their business plans entirely, waiting for the market to improve. Many eventually close their businesses after enduring hardships. According to the 'Construction Industry Information Review' released by the Korea Construction Association on the 24th, the number of domestic general construction companies was 19,086 as of the fourth quarter of 2024, down 2.2% from 19,517 in 2023.

The government has announced measures to address unsold housing, including purchasing homes through the Korea Land and Housing Corporation (LH), to respond to the industry's crisis, but the industry's reaction has been lukewarm. An industry insider said, "Since financial or tax benefits that could stimulate actual demand were mostly excluded, the measures were insufficient to send a 'signal' that the government is serious about revitalizing the construction market," adding, "We are not asking for blind support. Since the construction industry accounts for about 15% of the GDP and has significant ripple effects, we want the government to actively respond based on companies' self-help efforts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.