Next-Generation Anticancer Drug ADC Nears Commercialization

Samsung Biologics Set to Launch Dedicated Production Line Soon

The next-generation anticancer drug ADC (antibody-drug conjugate), the biggest topic in the domestic pharmaceutical and bio industry, is expected to be commercialized this year. Samsung Biologics, the leading domestic bio CDMO (contract development and manufacturing organization), is preparing for ADC contract manufacturing, and the market is heating up as ADC new drug development and platform technologies from Celltrion, Chong Kun Dang, and Ligakem Bio are gaining attention.

According to the industry on the 25th, Samsung Biologics plans to operate the ADC-dedicated production facility, established at the end of last year based on its CDMO competitiveness, starting from the first quarter of this year. The industry evaluates that orders in the ADC field, which Samsung Biologics has chosen as a future growth engine, are imminent. If ADC orders become full-scale, the investment in the 6th plant may also be accelerated.

ADC is a pharmaceutical composed of an 'antibody' that binds to a specific target antigen on the surface of cancer cells, a 'drug' that kills cancer cells, and a 'linker' that connects these antibodies and drugs. The problem with existing anticancer drugs was that they attacked not only cancer cells but also normal cells, causing side effects. ADC attacks only cancer cells. It is considered a next-generation anticancer drug technology because it can produce a strong anticancer effect while minimizing damage to normal cells. It is also called a 'targeted anticancer drug.'

However, it is not easy to realize technically. This is because it is difficult to optimize the combination of antibody, drug, and linker. If the drug is released before reaching the target cancer cells or deviates from the target, its efficacy is limited. In the worst case, healthy tissues can be damaged. Due to the high technical difficulty, there is no absolute leader in the ADC market yet. This is why our companies, as latecomers, are actively engaging in ADC development.

Celltrion also officially started ADC new drug development this month. On the 3rd, Celltrion submitted an Investigational New Drug (IND) application to the U.S. Food and Drug Administration (FDA) to conduct a global Phase 1 clinical trial of the ADC anticancer drug 'CT-P70.' CT-P70 is an ADC anticancer treatment targeting various solid tumors such as small cell lung cancer, colorectal cancer, and gastric cancer. It targets 'cMET' (cellular growth factor receptor), which is activated in cancer cells and promotes tumor growth. Celltrion plans to conduct the global Phase 1 clinical trial aiming for the first patient dosing by mid-year. The company aims to submit clinical trial applications for three ADC new drugs within this year.

Chong Kun Dang has secured the rights to use three ADC platform technologies from the Netherlands-based Synaffix and is developing ADC anticancer drugs. Ligakem Bio's ADC platform technology, 'Conjuol,' is also gaining attention in the global market. This technology precisely and consistently connects drugs to specific parts of antibodies. It is characterized by solving the problem of drug release into the bloodstream, which was a major side effect of ADCs. Ligakem Bio will collaborate with Samsung Biologics on more than three ADC projects this year.

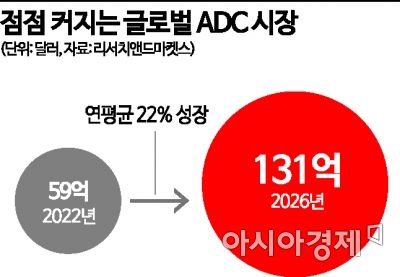

According to the global market research firm Evaluate, ADC market sales increased from $1 billion (about 1.4297 trillion KRW) in 2015 to $10 billion (about 14.297 trillion KRW) in 2023. It is expected to increase to $28 billion (about 40.0316 trillion KRW) by 2028. Kwon Hae-soon, a researcher at Eugene Investment & Securities, said, "The position of ADC in the anticancer drug market is strengthening because it shows high efficacy by replacing chemotherapy with high systemic toxicity as a targeted anticancer drug," adding, "Big pharma's interest in domestic ADC pipelines is also increasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)