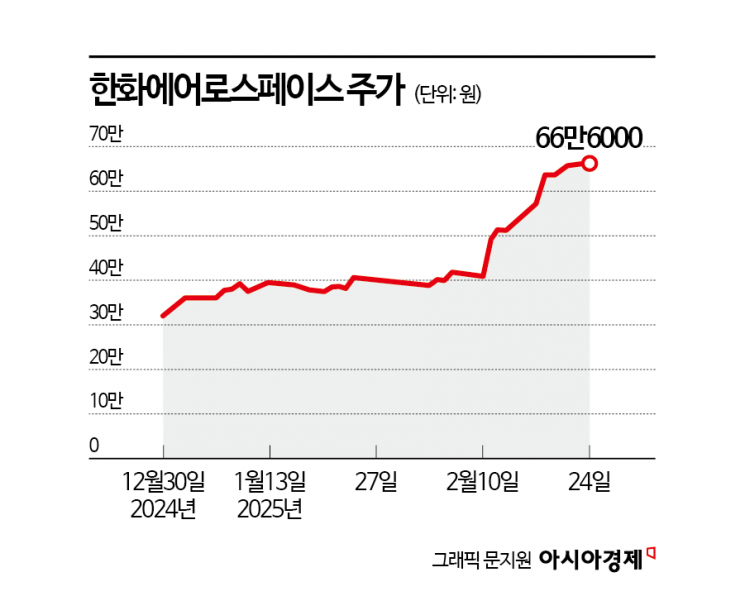

Stock Price Surges from 326,500 KRW to 666,000 KRW Since End of Last Year

President Trump Signs Executive Order on 'Iron Dome'

Hanwha Aerospace's corporate value has doubled compared to the end of last year. It has entered the top 10 in market capitalization on the KOSPI market. As foreign and institutional investors began accumulating shares, the stock price has risen more than 100% since the beginning of this year. Market experts expect Hanwha Aerospace to continue stable growth based on a solid order backlog.

According to the financial investment industry on the 25th, Hanwha Aerospace's stock price rose 103.4% compared to the end of last year. Considering that the KOSPI rose 10.2% during the same period, the market-relative return reached 93.2 percentage points (P). The stock price briefly rose to a record high of 674,000 KRW during trading. Market capitalization increased to 30.36 trillion KRW. Since the beginning of this year, foreign and institutional investors have purchased Hanwha Aerospace shares worth 332.5 billion KRW and 132.8 billion KRW, respectively.

Hanwha Aerospace's sales in the fourth quarter of last year were 4.8311 trillion KRW, and operating profit was 892.5 billion KRW. This represents increases of 56.0% and 222.1%, respectively, compared to the same period last year. Ahn Yudong, a researcher at Kyobo Securities, explained, "Operating profit exceeded the market expectation of 537.8 billion KRW," adding, "The export sector of ground defense increased by 159% year-on-year to 1.85 trillion KRW."

Expectations for Hanwha Aerospace are growing as sales increase and profitability improves. Lee Jiho, a researcher at Meritz Securities, analyzed, "The export profitability of the ground defense sector rose from 28% in the second quarter of last year to 33% in the third quarter and 40% in the fourth quarter," adding, "Since quarterly delivery volume volatility is expected to decrease from this year, expectations for performance improvement led by defense exports will continue."

Since Donald Trump took office as U.S. President, the United States has increasingly made strategic choices prioritizing economic benefits centered on America, moving away from multilateral ideological cooperation. An environment where major countries worldwide need to increase defense spending is being created. On the 27th of last month (local time), President Trump signed an executive order named 'The Iron Dome for America (ID4A).' It includes provisions to build a next-generation missile defense system in the U.S. similar to Israel's Iron Dome missile defense system. An astronomical budget is expected to be invested to equip a state-of-the-art missile defense system.

Hanwha Aerospace and Hanwha Systems are actively responding to Middle Eastern and global air defense demands with a multilayered air defense network equipped with surface-to-air interceptor missile weapon systems capable of responding to various interception altitudes and anti-drone systems, which are key in modern warfare. They have secured core technologies of the 'multilayer air defense solution,' including guided missiles, launchers, and multifunction radars (MFR), which are major components of the Long-range Surface-to-Air Missile system (L-SAM).

The order backlog can predict this year's performance. Choi Junghwan, a researcher at LS Securities, explained, "Last year's ground defense order backlog is estimated at about 32.4 trillion KRW, and aerospace order backlog at about 29 trillion KRW," adding, "Considering undisclosed supply contracts, the ground defense order backlog is expected to be even larger." He continued, "The export ratio of the year-end ground defense order backlog will increase by 10 percentage points this year," emphasizing, "New orders from major recent defense export countries such as Southeast Asia, Eastern Europe, and the Middle East are also possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.