Clearance Marketing Conducted by 11 Out of 15 Life Insurers

Company A Alone Accounts for 32.5% of Total Sales

FSS: "Improvement of Internal Controls Needed for Insurers and GAs"

Even after the Financial Supervisory Service (FSS) conducted supervisory actions on executive term insurance on December 23 last year, some life insurance companies continued their clearance marketing.

The FSS announced on the 24th that, as a result of daily monitoring of 15 life insurance companies from December 23 to 31 last year, 11 companies (73.3%) engaged in clearance marketing by exceeding the number of sales or initial premiums compared to the previous month.

As a result of the Financial Supervisory Service monitoring the regular insurance sales status of executives at 15 life insurance companies. Photo by Financial Supervisory Service

As a result of the Financial Supervisory Service monitoring the regular insurance sales status of executives at 15 life insurance companies. Photo by Financial Supervisory Service

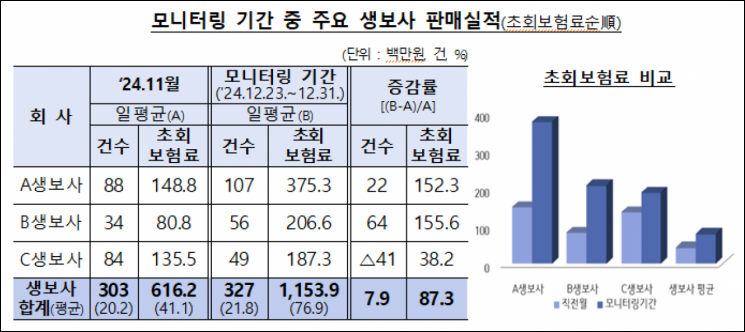

During the monitoring period, the average daily number of contracts was 327, up 7.9% from 303 in the previous month. The average daily initial premium during this period surged by 87.3% to 1,153.01 million KRW from 616 million KRW in the previous month, indicating an increase in sales focused on high-value contracts. Company A sold 644 contracts (initial premiums of 2,252 million KRW) during this period, accounting for 32.5% of the total sales volume of life insurers (1,963 contracts, 6,923 million KRW). The average recruitment commission paid to corporate insurance agencies (GA) during this period was about 872.7% of the initial premium. In some cases, commissions as high as 1,053% were paid. The FSS has selected Company A and related recruitment channels as priority inspection targets.

Executive term insurance is a protection insurance purchased by small and medium-sized enterprises as a corporate expense to prepare for the death of executives. However, incomplete sales practices boasting refund rates of over 120% became problematic, leading the FSS to halt sales of existing products by insurance companies on December 23 last year. The FSS also implemented supervisory actions by restricting executive term insurance policyholders to corporations and distributing product structure improvement guidelines to design refund rates within 100% for the entire period.

The FSS had been inspecting the sales status of executive term insurance targeting some life insurers and GAs even before implementing supervisory actions. It was revealed that some insurers did not comply with internal procedures or relaxed assumptions without grounds during profitability analysis to achieve short-term sales performance, even if they did not meet their own standards. Due to the nature of high-value protection insurance allowing for high commission income, unhealthy sales practices were anticipated in the field, and the commission rates for GAs, the main sales channel, were continuously increased. Insurance purchases were also induced by emphasizing and explaining only tax-saving effects with inaccurate information. It was also discovered that GA-affiliated planners directly provided special benefits such as money to policyholders or insured persons, and some recruitment planners paid premiums through virtual accounts.

Based on the results of this inspection, the FSS plans to improve internal controls for insurance companies and GAs. It also plans to strengthen cooperation with related agencies such as the National Tax Service and prosecution and police agencies. An FSS official stated, "We will conduct comprehensive and multidimensional inspections of the entire process including product design, sales, underwriting, and post-management, and encourage insurance companies and GAs to strengthen internal controls. Regarding route and written contracts and the provision of special benefits, we will track accounts to identify the source of funds and block illegal and illicit transactions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.