Korea Institute of S&T Planning and Evaluation Analysis

A Completely Different Diagnosis from Two Years Ago

Experts have diagnosed that South Korea's semiconductor technology level has mostly been surpassed by China in just two years. The analysis indicates that South Korea is currently lagging behind China in all fields.

According to the 'In-depth Analysis of Technology Levels in Three Major Game-Changer Fields' brief published on the 23rd by the Korea Institute of S&T Planning and Evaluation (KISTEP), a survey of 39 domestic experts found that as of last year, South Korea's basic technological capabilities in the semiconductor sector were behind China in all areas.

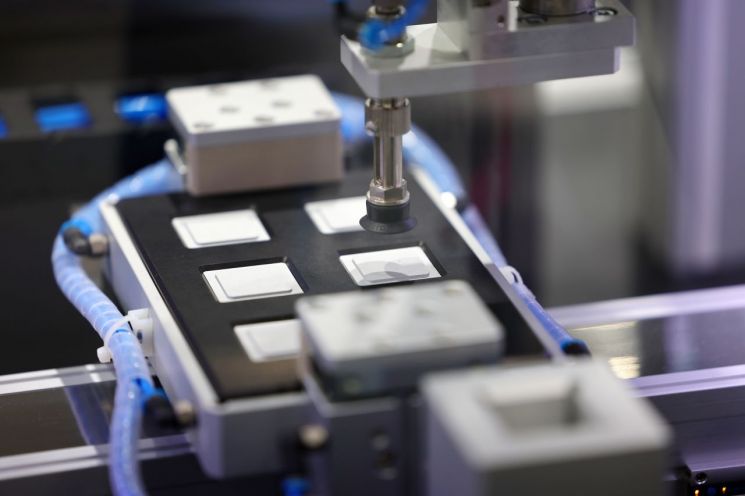

An expert has diagnosed that South Korea's semiconductor technology level has been mostly surpassed by China in just two years. Yonhap News

An expert has diagnosed that South Korea's semiconductor technology level has been mostly surpassed by China in just two years. Yonhap News

When the leading technology country is considered 100%, South Korea ranked second with 90.9% in the high-integration, resistor-based memory technology field, lower than China's 94.1%. Similarly, South Korea's high-performance, low-power artificial intelligence (AI) semiconductor technology stood at 84.1%, below China's 88.3%.

In power semiconductors, South Korea scored 67.5% compared to China's 79.8%, and in next-generation high-performance sensing technology, South Korea had 81.3% versus China's 83.9%, slightly higher. Advanced semiconductor packaging technology was rated equally at 74.2% for both South Korea and China.

The experts who participated in the survey had also taken part in the 2022 technology level evaluation. At that time, they viewed South Korea as leading in high-integration, resistor-based memory technology, advanced semiconductor packaging technology, and next-generation high-performance sensing technology, but this has been reversed in just two years.

When evaluating technology levels from a commercialization perspective, South Korea was found to be ahead of China only in high-integration, resistor-based memory technology and semiconductor advanced packaging technology. In a survey assessing the entire semiconductor sector's technology lifecycle, South Korea led China in process and mass production, but lagged behind in basic, foundational, and design areas.

Future issues expected to impact South Korea's semiconductor technology level include the outflow of core personnel, AI semiconductor technology, US-China rivalry, domestic-centric policies, and supply chain localization. Among these, only AI semiconductor technology was seen as potentially beneficial to South Korea's technology level.

The report pointed out uncertainties in the South Korean semiconductor market due to the rise of Japan and China, US sanctions, and rapid growth in Southeast Asia. It also noted the inauguration of the second Trump administration and the relatively small scale of domestic research and development (R&D) investment, concluding that the outlook is not optimistic.

China advances with technology, the US with tariffs... double setbacks

Recently, China's YMTC (Yangtze Memory Technologies) reportedly succeeded in mass-producing 294-layer NAND. Samsung Electronics took about 4 years and 7 months to move from 128-layer to 286-layer mass production, whereas YMTC took approximately 3 years and 5 months to leap from 128-layer to 294-layer.

Adding to this, the tariff pressure from the Trump administration has created a double setback. On the 10th (local time), President Donald Trump announced, "In the coming weeks, we will look into tariffs not only on steel and aluminum but also on semiconductors, automobiles, pharmaceuticals, and a couple of other items," signaling the imposition of tariffs on semiconductors.

Semiconductors have been subject to zero tariffs among member countries under the Information Technology Agreement (ITA) of the World Trade Organization (WTO) since 1997. However, President Trump has indicated his intention to impose tariffs on semiconductors imported into the United States, contravening this agreement.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)