KIRI Publishes Report on "Institutional Improvement Measures Reflected in Automobile Insurance Loss Ratios"

"Minor Injury Patients Should Shift from 'Compensation' to 'Treatment'-Centered Approach"

"Transparency Needed in Basis for Labor Cost Determination in Property Damage Compensation"

There has been a claim that the future treatment costs (settlement money) paid to minor injury patients under automobile insurance bodily injury compensation violate the principle of indemnity, which states that compensation should cover only the damages incurred. It is suggested that the entire system of bodily injury and property damage compensation should be improved to prevent the deterioration of automobile insurance finances.

According to the report "Institutional Improvement Measures Reflected in Automobile Insurance Loss Ratios" published by the Korea Insurance Research Institute on the 23rd, the loss ratio of automobile insurance at seven major non-life insurance companies rose from 82.6% in July last year to 92.7% in November. While temporary factors such as climate contribute to the worsening loss ratio, it is mainly analyzed that the structural increase in insurance payouts (loss amounts) is the primary cause.

Leakage of insurance payouts is pointed out to be primarily due to the insufficiently stringent bodily injury compensation system for minor injury patients. Minor injury patients correspond to injury grades 12 to 14 and typically require 3 to 4 weeks of treatment. However, it is frequent that these patients remain bedridden for extended periods receiving long-term treatment and claim substantial insurance payouts. To prevent such behavior, insurers pay them future treatment costs in the form of settlement money, but the amount has been increasing, becoming another cause of insurance payout leakage. As of 2023, future treatment costs for minor injury patients amount to 1.43 trillion KRW, while actual medical expenses are 1.29 trillion KRW, meaning future treatment costs exceed actual treatment costs.

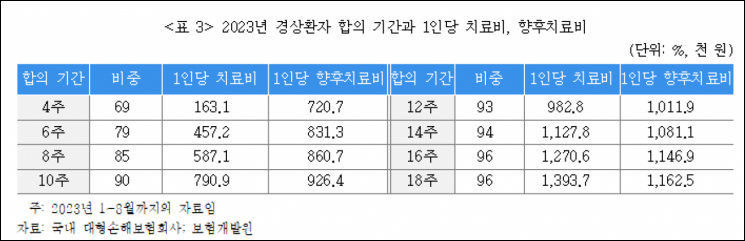

An analysis by the Korea Insurance Research Institute on the settlement period and per capita future treatment costs for minor injury patients showed that the longer the settlement period, the higher the future treatment costs. If a minor injury patient settles within 4 weeks, the per capita future treatment cost is 720,000 KRW. Within 8 weeks, it is 860,000 KRW; 12 weeks, 1,010,000 KRW; and 18 weeks, 1,160,000 KRW. This results from minor injury patients remaining bedridden for extended periods, inducing high future treatment costs. Jeon Yong-sik, Senior Research Fellow at the Korea Insurance Research Institute, pointed out, "Future treatment costs for minor injury patients violate the principle of indemnity," adding, "Since these costs are mainly intended for settlements, they tend to compensate for damages that have not actually occurred."

Another issue raised is the "double compensation" where minor injury patients receive future treatment costs and then undergo treatment for the same traffic accident injuries under the National Health Insurance. This can lead to deterioration of the National Health Insurance finances. Legally, if a patient receives future treatment costs and then gets treatment for the same injury under National Health Insurance, benefits are restricted, but there is no practical way to verify this on the ground. Jeon emphasized, "It is necessary to explore measures to suppress unnecessary treatments by minor injury patients aiming for future treatment costs," and "The compensation-centered practice for minor injury patients should shift to a universally valid treatment-centered approach."

Increases in labor costs and parts costs, as well as excessive repair charges in property damage compensation, are also major factors eroding automobile insurance finances. Property damage compensation payouts have increased from 4.6 trillion KRW in 2018 to 5.6 trillion KRW in 2023, growing at an average annual rate of 3.9%.

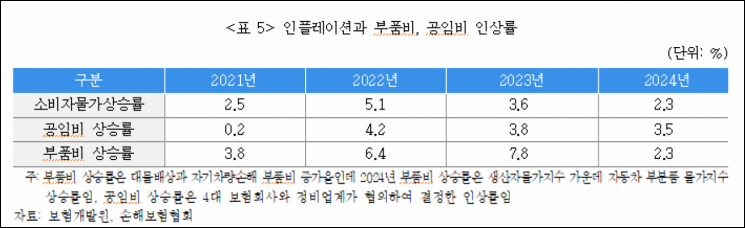

Labor costs are determined annually through consultations between the government and the maintenance industry, but there is a significant difference in opinions between the maintenance and insurance industries. Generally, labor costs account for 22% of repair costs, rising by 4.2% in 2022 and 3.8% in 2023, with a 3.5% increase applied last year. Previously, the Ministry of Land, Infrastructure and Transport decided the hourly labor cost increase rate, but since 2022, it has been determined by the Automobile Insurance Maintenance Council. During last year's negotiation, the maintenance industry proposed a 4.5% increase, while the insurance industry proposed 1.7%, causing conflicts.

Parts costs are influenced by the manufacturing costs of vehicles and vehicle parts, so market-determined prices must be accepted. Repair costs vary significantly by region, with excessive charges occurring in specific areas such as Seoul. Jeon suggested, "Transparency in the basis for determining labor costs should be increased, and measures to curb excessive repair charges should be sought," adding, "The labor cost increase rate for vehicle maintenance should also be agreed upon in accordance with changes in the economic environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)