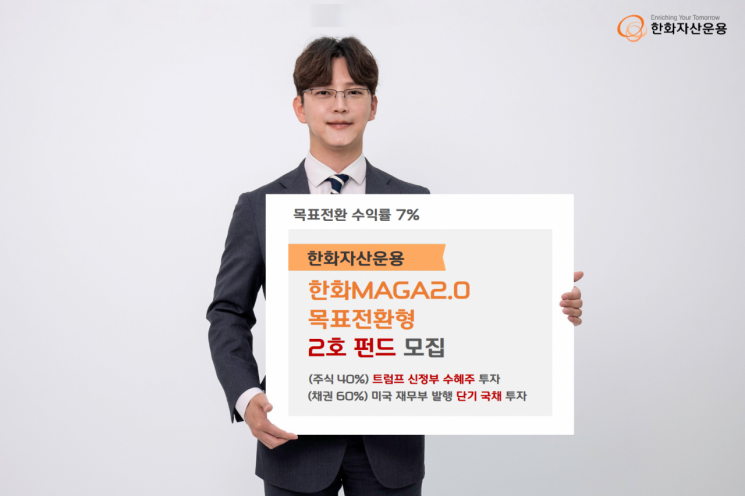

Hanwha Asset Management announced on the 21st that it will begin raising funds for the second 'Hanwha MAGA 2.0 Target Conversion Type' fund, which simultaneously pursues profitability and stability through investments in stocks benefiting from U.S. President Donald Trump's policies and short-term U.S. Treasury bonds.

The Hanwha MAGA 2.0 Target Conversion Type fund invests 40% in overseas stocks expected to benefit from the new Trump administration and 60% in U.S. short-term Treasury bonds with a duration (average recovery period of invested funds) within two years. Once the target return of 7% is achieved, the fund converts to stable bond assets. The fund is directly managed by veteran overseas stock and bond managers with proven track records.

The first Hanwha MAGA 2.0 Target Conversion Type fund raised 52.1 billion KRW in just eight trading days. The acronym 'MAGA' in the fund's name stands for 'Make America Great Again,' President Trump's slogan.

In its second term, the Hanwha MAGA 2.0 Target Conversion Type fund classifies policies into categories such as ▲tariff policies and corporate tax cuts ▲deregulation ▲power grid modernization ▲efficient government, analyzes beneficiary industries, and invests in sectors directly affected.

Wang Seung-mook, head of Hanwha Asset Management's overseas stock management team, said, "Tariff policies and corporate tax cuts will accelerate the relocation of manufacturing and production facilities to the U.S.," and "We expect private industrial goods sectors, such as industrial parts distribution with a high domestic U.S. market share, to benefit."

He added, "In terms of deregulation, easing consumer protection and financial regulations will lead to new product launches and active M&A, benefiting credit card companies and banks."

The power grid modernization policy, coupled with relaxed environmental regulations, contributes to activating investments in power grids necessary for AI data centers, increasing the potential for upgrading the utility sector, a representative defensive sector. Additionally, the government efficiency committee led by Elon Musk aims to eliminate bureaucracy and enhance government efficiency, which is expected to benefit AI software sectors providing productivity improvement solutions.

In the bond sector, anticipating increased inflation and interest rate pressures, the fund seeks stable interest income and security through investments in U.S. short-term Treasury bonds. However, if the 10-year U.S. Treasury yield exceeds the upper limit of the U.S. base rate, the fund secures additional returns by partially including long-term bonds. The overall bond portfolio duration is maintained within two years to ensure stability.

With a strong dollar expected, the fund adopts a basic strategy of open currency exposure. Exceptionally, in cases of exchange rate fluctuations such as a rise of more than 5% within a certain period, currency hedging within the bond portion (approximately 60%) is possible. If hedging is executed, the fund plans to liquidate the hedging position to secure profits if the exchange rate falls by more than 5% compared to the rate at the time of hedging.

Choi Young-jin, head of Hanwha Asset Management's Strategic Business Division, advised, "The MAGA 2.0 Target Conversion Type fund will be a good option for clients seeking medium-risk, medium-return needs, based on a strategy combining the proven profitability of the Hanwha Heracles Developed Countries Active Fund and the demonstrated stability of the Hanwha U.S. Interest Rate Customized Solution Fund."

The second Hanwha MAGA 2.0 Target Conversion Type fund is available for subscription through Kyobo Securities, Kookmin Bank, Mirae Asset Securities, Samsung Securities, Yuanta Securities, Hana Securities, and others. Fundraising runs from the 21st to the 27th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.