4 to 6 Trillion Won in Dollar Deposits Flow In and Out Within a Day

Exchange Rate Volatility and Increased Individual Transactions Drive Fluctuations

Rising Volatility Undermines Stability

Banks' Foreign Currency LCRs Reach Record Highs Due to Active Management

As the high exchange rate and increasing political and economic uncertainties both domestically and internationally intensify, the dollar deposit balances at domestic commercial banks are also fluctuating. Trillions of won flow in and out within a day or two, increasing volatility. Foreign currency deposits, including dollars, are considered a form of 'foreign exchange reserves' accumulated by the private sector, requiring stable management. Banks are increasing their liquidity reserves as the likelihood of rapid market changes grows.

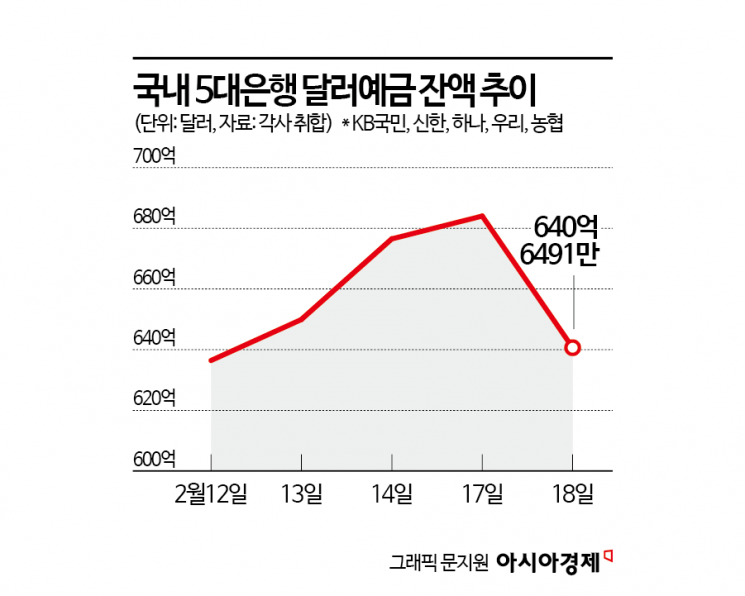

According to the financial sector on the 21st, the total dollar deposit balance of the five major domestic banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) as of the 18th was $64.06491 billion. Considering that it was $68.4331 billion on the previous day, the 17th, $4.3384 billion was withdrawn in a single day. Converted to Korean won on that day, it amounts to approximately 6.2 trillion won.

The opposite situation occurred four days earlier. The deposit balance, which had fluctuated between $63 billion and $64 billion until the 13th of this month, jumped to $67.65207 billion in just one day on the 14th. Approximately 4 trillion won flowed in within a day in Korean won terms. The market viewed this as a stronger dollar buying trend ahead of the U.S. holiday, Presidents' Day (local time on the 17th).

The increased volatility in dollar deposits is fundamentally attributed to the heightened volatility in the exchange rate. Dollar deposits are basically composed of an 80:20 ratio between corporations and individuals. Corporations mainly deposit foreign currency funds, and as the exchange rate experienced sharp fluctuations last year, the dollar deposit balance fluctuated according to the responses of export-import companies settling in dollars.

It is also analyzed that individuals' foreign exchange strategies, involving repeated buying and selling depending on the won-dollar exchange rate fluctuations, have strengthened. A representative from a commercial bank said, "The number of individuals handling dollars has increased due to foreign exchange strategies and U.S. stock investments, and accessibility has improved. The demand to realize profits and the influx of buyers according to exchange rate movements seem to be increasing unpredictable volatility."

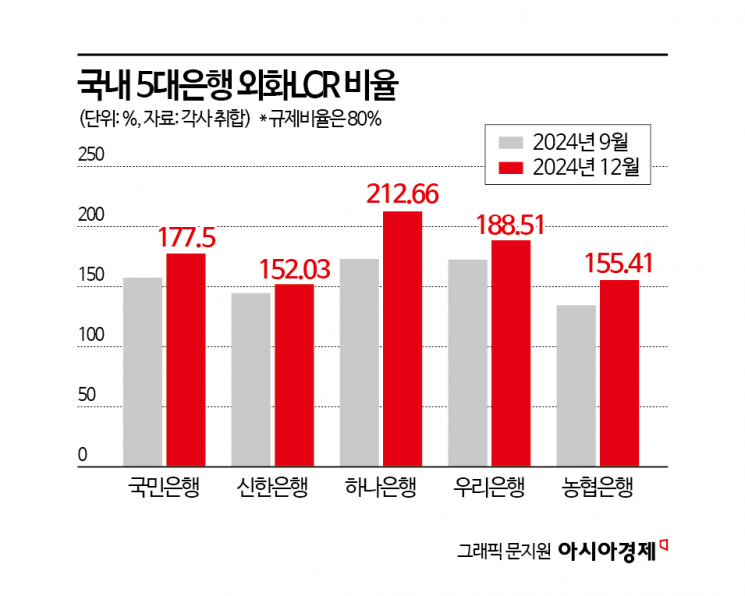

Foreign currency deposits, including dollars, can serve as a 'private sector breakwater' in the foreign exchange market, so relevant authorities are closely monitoring this trend. The government manages the stability of foreign currency deposits by bank through the foreign currency Liquidity Coverage Ratio (LCR). The foreign currency LCR indicates the amount of cash immediately available. It refers to the proportion of liquid assets that must be accumulated to withstand net foreign currency cash outflows for 30 days in a systemic crisis. The government-regulated standard requires this ratio to exceed 80%.

Banks are actively managing their foreign currency LCR. As of December last year, the ratios were ▲Hana Bank 212.66%, ▲Woori Bank 188.51%, ▲Kookmin Bank 177.5%, ▲Nonghyup Bank 155.41%, and ▲Shinhan Bank 152.03%, comfortably exceeding the regulatory ratio. Compared to the end of September last year, all ratios increased, and Hana Bank surpassed 200% for the first time since 2017. Since its foreign exchange transaction volume is higher than other banks, it appears to have taken proactive management measures. A commercial bank official said, "Foreign currency transactions have increased compared to the past, and given the recent unstable market environment in terms of exchange rates and political and economic situations, we are striving to maintain liquidity ratios stably to defend against this."

Despite ample liquidity reserves, the trend to continue increasing foreign currency deposits persists. A commercial bank official said, "Foreign currency liquidity needs to be increased because of the high reliance on foreign currency bonds or borrowings. Since most products allow free deposits and withdrawals, foreign currency procurement can be done cheaply, and because currency exchange is involved, non-interest income can also increase. The increase in foreign currency deposits is not a bad situation for banks either."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)