Top 10 Securities Firms See 67% Increase in Operating Profit Last Year

Five Firms Join the '1 Trillion Won Club'

Korea Investment & Securities Surpasses 1 Trillion Won in Both Operating and Net Profit

Mirae Asset Securities' Operating Profit Jumps 122%

Overseas Stock Commission Fees Drive Performance Improvement

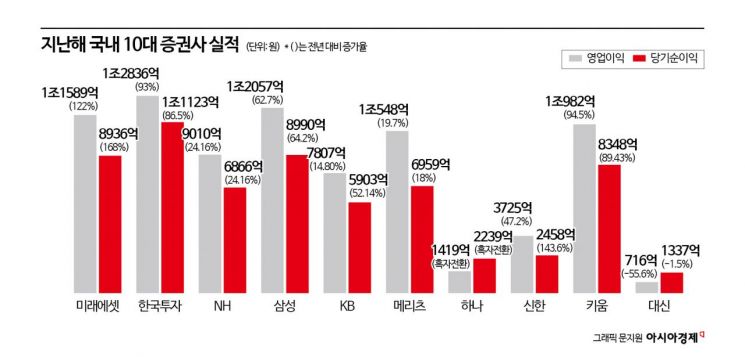

Last year, five out of the top 10 securities firms joined the '1 trillion won club' in operating profit, recording solid performance. Despite the sluggish domestic stock market, a significant increase in overseas stock commission fees contributed to the favorable results. This year, the stock market has been recovering since the beginning of the year, and trading volume has shown a clear upward trend, raising expectations for securities firms' performance.

On the 21st, Asia Economy analyzed the performance data of securities firms disclosed on the Financial Supervisory Service's electronic disclosure system and found that as of December last year, the operating profit of the top 10 securities firms by equity capital was 8.0689 trillion won, a 67% increase compared to the previous year (4.8264 trillion won).

In 2023, there was no member of the 1 trillion won club, but last year, five securities firms?Korea Investment & Securities, Samsung Securities, Mirae Asset Securities, Kiwoom Securities, and Meritz Securities?joined the 1 trillion won club.

Korea Investment & Securities ranked first in both operating profit and net profit last year. Not only did Korea Investment & Securities exceed 1 trillion won in operating profit, but its net profit also surpassed 1 trillion won. On a consolidated basis, Korea Investment & Securities recorded an operating profit of 1.2836 trillion won, a 93.3% increase from the previous year. This is the first time since 2021 that operating profit has exceeded 1 trillion won. During the same period, net profit also rose 86.5% year-on-year to 1.1123 trillion won, surpassing 1 trillion won. Revenue increased by 0.4% year-on-year to 21.6342 trillion won. A representative from Korea Investment & Securities explained, "Sales of bonds and issuance of promissory notes increased, doubling the net operating income related to management compared to the previous year. The balance of financial products held by individual customers also rose significantly from 53 trillion won to about 67 trillion won in one year, which is the largest scale in the domestic financial investment industry."

Mirae Asset Securities showed the largest increase in performance among the top 10 securities firms. Its operating profit last year was 1.1589 trillion won, a 122% increase from the previous year. Net profit during the same period rose 168% to 893.6 billion won. The improvement in ordinary profit was driven mainly by asset management (WM) and trading divisions, including brokerage, and the recognition of about 340 billion won in non-recurring gains such as foreign exchange gains arising from the capital reallocation process of overseas subsidiaries to expand the India business. In particular, the performance improvement of overseas subsidiaries was remarkable. Pre-tax profit increased 243% year-on-year to 166.1 billion won, and the U.S. subsidiary achieved its highest pre-tax profit of 94.5 billion won since its establishment.

Samsung Securities recorded an operating profit of 1.2057 trillion won last year, up 62.7% from the previous year, and net profit increased 64.2% to 899 billion won. Kiwoom Securities' operating profit rose 94.5% to 1.0982 trillion won, and Meritz Securities' operating profit increased 19.7% to 1.0548 trillion won.

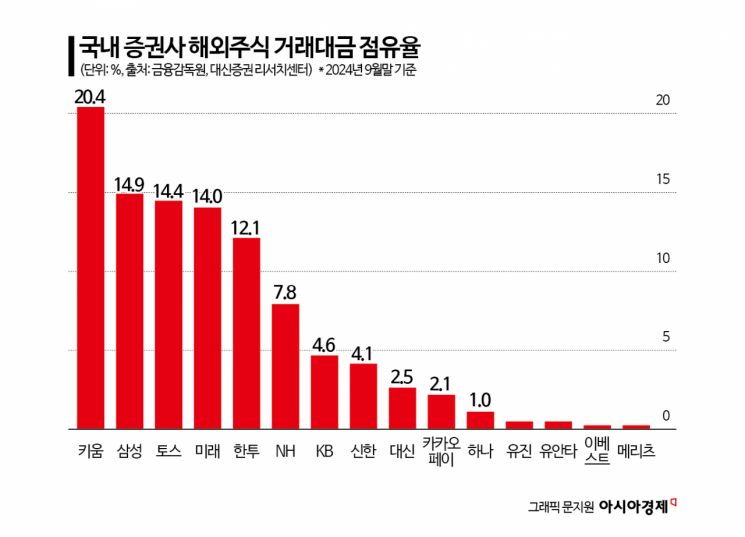

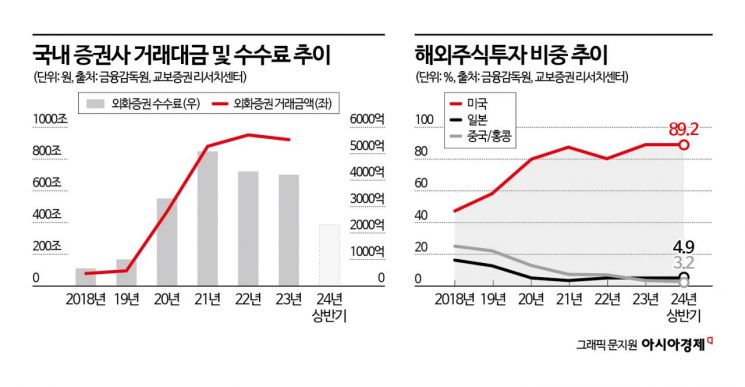

Ji-young Kim, a researcher at Kyobo Securities, analyzed, "The reason for the increase in securities firms' annual performance last year was that in the first half, brokerage revenue increased due to the activation of the domestic stock market, and in the second half, overseas stock investment surged, with securities firms breaking records for the highest contract amounts, leading to increased overseas stock brokerage commission revenue. Additionally, the improvement in operating profit and interest income due to market interest rate stabilization was significant. Furthermore, corporate finance (IB) and asset management (WM) revenues also showed steady levels."

There is interest in whether the favorable performance of securities firms will continue this year. The KOSPI has shown a rapid recovery this year, and trading volume is increasing, raising expectations for performance. This year, the KOSPI rose 10.6%, and the KOSDAQ increased 13.28%. The average daily trading volume of the domestic stock market, which had been below 20 trillion won since July last year, exceeded 21 trillion won this month. Hye-jin Park, a researcher at Daishin Securities, said, "Overseas stock trading volume recorded 87.1 trillion won in January and is still on a steady course. Recently, KOSPI trading volume has also been remarkable; on the 13th, the daily KOSPI trading volume exceeded 17 trillion won, and combined with KOSDAQ, it reached 25.5 trillion won, the highest level in nine months since June 14 last year."

New revenue source development is also positive. Securities firms are increasingly entering the general foreign exchange business. Last year, Kiwoom Securities and Shinhan Investment Corp. obtained licenses for general foreign exchange business, and this year, Samsung Securities, NH Investment & Securities, and Mirae Asset Securities have acquired licenses. Researcher Park evaluated, "Along with the growth of overseas stocks, large securities firms are also entering the general foreign exchange business to discover new revenue sources, and the establishment of alternative trading systems (ATS) could generate additional income for securities firms, which is positive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.