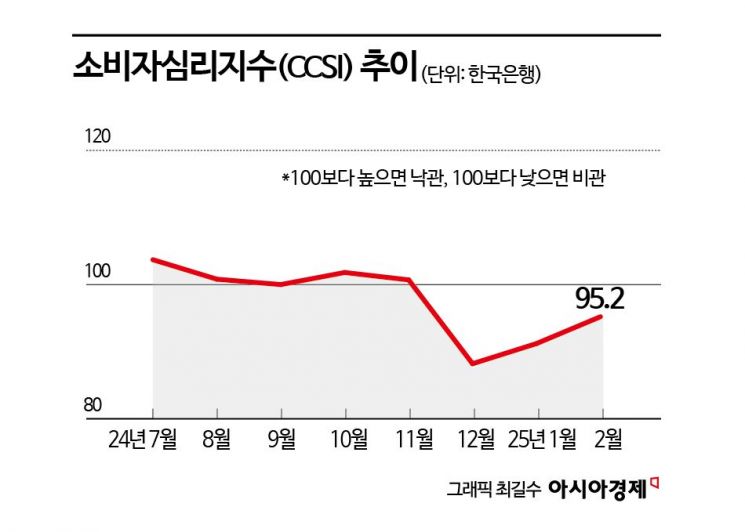

Bank of Korea "February 2025 Consumer Sentiment Survey Results"

Consumer Confidence Index at 95.2... Up 4.0 Points from Previous Month

All Six CCSI Components Remain Below Long-term Average

"Need to Watch for a Shift Toward Sustained Psychological Recovery"

In February, consumer sentiment slightly improved following the previous month, partially recovering from the psychological downturn caused by the emergency martial law situation at the end of last year. However, it still remains below the baseline value of 100, and with ongoing domestic and international uncertainties such as the new U.S. administration's trade policies, it remains to be seen whether this psychological recovery will continue as a trend.

According to the 'February 2025 Consumer Sentiment Survey Results' released by the Bank of Korea on the 20th, the Consumer Confidence Index (CCSI) for this month rose by 4.0 points from the previous month to 95.2. This marks two consecutive months of increase. The recovery in sentiment this month was driven by expectations of stabilization in the domestic political situation and optimism about the government's industrial support policies, showing an upward trend mainly in outlook.

The CCSI is a psychological indicator calculated using six major indices that make up the Consumer Sentiment Index (CSI). The long-term average is set as the baseline value of 100; a value above 100 indicates optimism compared to the long-term average, while a value below 100 indicates pessimism.

The CCSI consistently stayed above 100 from June 2024 (100.9) through July (103.7), August (100.8), September (100.0), October (101.8), and November (100.7), maintaining an optimistic trend. However, it plunged sharply to 88.2 in December due to increased political uncertainty caused by the emergency martial law situation, which dampened consumer sentiment and increased volatility in the domestic financial market. Since last month, a slight recovery trend has continued, with a 3-point rise last month followed by a 4-point increase this month.

Lee Hye-young, team leader of the Economic Sentiment Survey Team at the Economic Statistics Department 1, stated, "Following the government's announcement on the 5th to establish an advanced strategic industry fund exceeding 34 trillion won to support cutting-edge industries and technologies such as batteries and bio sectors, and the passage of a bill on the 11th in the National Assembly's Planning and Finance Committee to increase the tax credit rate for semiconductor companies by 5 percentage points from the current rate, expectations for government industrial support policies have grown," adding, "These expectations were reflected in the recovery of the CCSI in February."

However, it is still uncertain whether the psychological recovery will continue as a trend. The CCSI remains below the baseline value of 100, and all six indices that compose the CCSI are still below their long-term averages. Lee said, "Since the drop in December last year was so significant and the recovery in January and February this year is partial, we need to observe further," adding, "There is still considerable uncertainty regarding U.S. trade policies, and domestic political situations also carry uncertainties about ongoing developments, so it is necessary to monitor the trend."

Future Economic Outlook Up 8 Points... Expectation for Political Uncertainty Resolution in 6 Months

Looking at the sectors, perceptions of household financial conditions showed that the Current Living Conditions CSI (87) remained unchanged for three months, while the outlook segment rose. The Living Conditions Outlook CSI (93) increased by 4 points from the previous month due to expectations of political stability and stock market gains. The Household Income Outlook CSI (97) and Consumption Expenditure Outlook CSI (106) rose by 1 point and 3 points respectively from the previous month. The Consumption Expenditure Outlook CSI increased mainly due to recovery in consumer sentiment, with spending on travel, culture, and entertainment leading the rise.

Regarding perceptions of the economic situation, the Future Economic Outlook CSI (73) jumped 8 points, influenced by expectations of political uncertainty resolution and government industrial support policies. Lee analyzed, "Since this is a forecast for the next six months, it appears that expectations for the resolution of domestic political uncertainty are reflected." The Current Economic Conditions CSI (55) rose by 4 points from the previous month, marking a turnaround. Starting at 69 in early last year and maintaining the low 70s, the Current Economic Conditions CSI plunged to 52 in December last year and has been gradually recovering but still remains well below the long-term average (72). The Interest Rate Level Outlook CSI (99) rose by 2 points, and the Employment Opportunities Outlook CSI (74) increased by 5 points from the previous month.

Household saving sentiment improved, but perceptions of debt conditions worsened. The Current Household Savings CSI (93) remained the same as the previous month, while the Household Savings Outlook CSI (97) rose by 2 points. However, both the Current Household Debt CSI (99) and Household Debt Outlook CSI (97) fell by 1 point from the previous month.

The Price Level Outlook CSI (149) dropped by 2 points from the previous month. The Housing Price Outlook CSI (99) fell by 2 points as nationwide apartment sales prices and transaction volumes slowed. This is the first time since March last year that the Housing Price Outlook CSI fell below 100. However, news about the lifting of land transaction permit zones in areas such as Jamsil-dong in Songpa-gu and Samsung, Daechi, and Cheongdam-dong in Gangnam-gu, which could stimulate housing price sentiment, was not effectively reflected during the survey period. The Wage Level Outlook CSI (118) remained unchanged from the previous month.

The expected inflation rate for the next year fell by 0.1 percentage points from the previous month due to a slowdown in price increases for agricultural and fresh food products and expectations for government price stabilization. The expected inflation rates for 3 years and 5 years remained unchanged at 2.6%. Perceptions of the consumer price inflation rate over the past year were 3.2%, down 0.1 percentage points from the previous month.

The proportion of responses regarding major items expected to affect consumer price increases over the next year were petroleum products (47.4%), agricultural, livestock, and fishery products (46.7%), and public utility charges (46.3%) in that order. Compared to the previous month, the response proportions for petroleum products (up 5.0 percentage points) and public utility charges (up 2.1 percentage points) increased, while the proportion for industrial products decreased by 2.9 percentage points.

This survey was conducted from the 6th to the 13th of this month, targeting 2,500 urban households nationwide (2,321 responses).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.