Chairman Bin Personally Oversees IR Activities in Major Overseas Markets Since Inauguration

Names 'Shareholder Return' as Top Management Priority

Plans to Further Strengthen Engagement With Key Shareholders This Year

BNK Financial Group Chairman Bin Dae-in has chosen Europe as his first overseas schedule of the new year. Since his inauguration, Chairman Bin has increased engagement with major overseas institutional investors in places such as Hong Kong, Singapore, and the United States, positioning himself as the 'BNK Salesman,' and plans to personally attend to key investors again this year.

According to financial circles on the 20th, Chairman Bin Dae-in of BNK Financial Group is scheduled to visit Paris, France, Edinburgh, and London, UK, from February 25 to 28 for a 3-night, 4-day trip. He will meet with overseas institutional investors to announce last year's business performance and explain major management issues.

This will be the third time Chairman Bin meets overseas investors in person. Starting with Hong Kong and Singapore in May last year, and then hosting meetings directly in Chicago and New York in October, he has been increasing engagement with overseas institutional investors. This trip to France and the UK marks Chairman Bin's first overseas schedule of the year and his first time meeting European institutional investors.

A BNK Financial Group official stated, "The chairman personally manages major overseas IR schedules," adding, "This is the first time he is going to Europe."

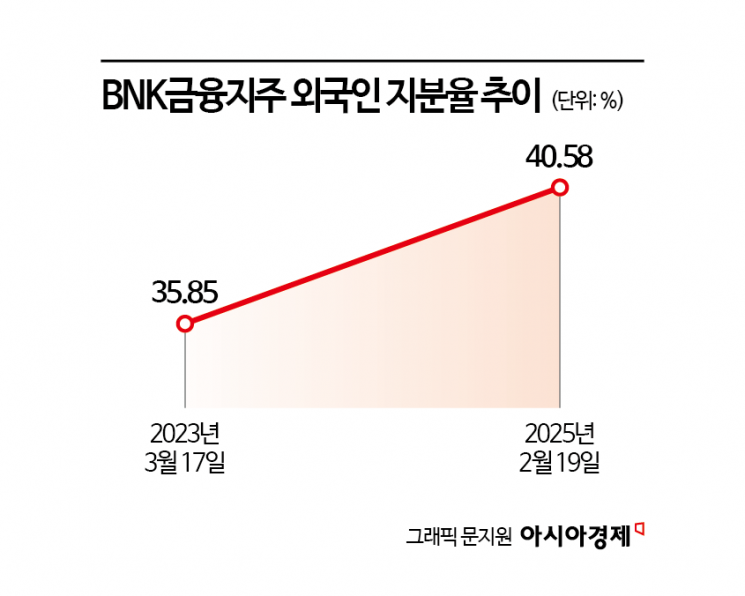

Thanks to Chairman Bin's direct engagement with investors, BNK Financial Group is the only financial holding company that did not experience foreign investor withdrawal after the emergency martial law. As a result, while major financial holding companies recorded double-digit declines over three trading days following the emergency martial law on December 3 last year, BNK Financial Group rose by 5.49%. The foreign ownership ratio increased from 35.85% at the time of Chairman Bin's inauguration to 40.58% as of the 19th.

BNK Financial Group is sending love calls to foreign investors by promising stronger shareholder return policies this year. The company announced it will repurchase 40 billion KRW worth of treasury shares by August. Through its earnings announcement, it presented a total shareholder return ratio in the high 30% range for this year, and it is expected that about 60 billion KRW worth of treasury shares will be repurchased in the second half of the year.

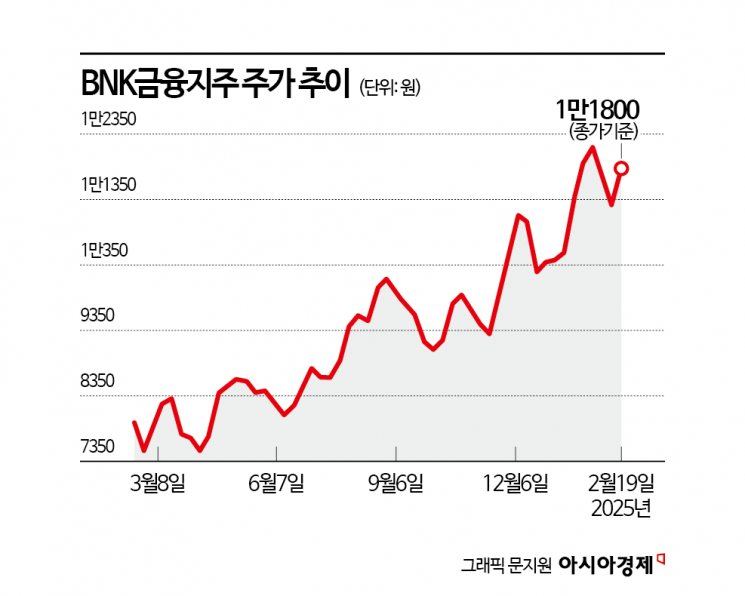

This commitment to shareholder returns and strong performance have also boosted BNK Financial Group's stock price. The company posted a net profit of 802.7 billion KRW last year, a 25.5% increase from the previous year (639.8 billion KRW), marking a record high. The stock price responded accordingly. When Chairman Bin Dae-in took office in March 2023, the stock price was in the 6,000 KRW range and steadily rose to surpass 10,000 KRW for the first time in six years since June 2018. As of the closing price on the 19th, it stood at 11,800 KRW. The highest price was 12,300 KRW, recorded intraday on January 31.

Choi Jung-wook, a researcher at Hana Securities, analyzed, "The announcement of a 40 billion KRW treasury share repurchase and cancellation in the first half of the year, along with a significant upward revision of the total shareholder return ratio until 2027, has greatly increased market trust in the value-up disclosure. The flawless performance that exactly meets expectations in terms of shareholder returns, despite the recent significant rise in stock price, suggests there is considerable room for further gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.