Special Measures Announced at Livelihood Economy Inspection Meeting

Preferential Interest Rates for Purchasing Unsold Units

Expansion of Household Loan Targets for Regional Banks

No Postponement or Easing of DSR Implementation

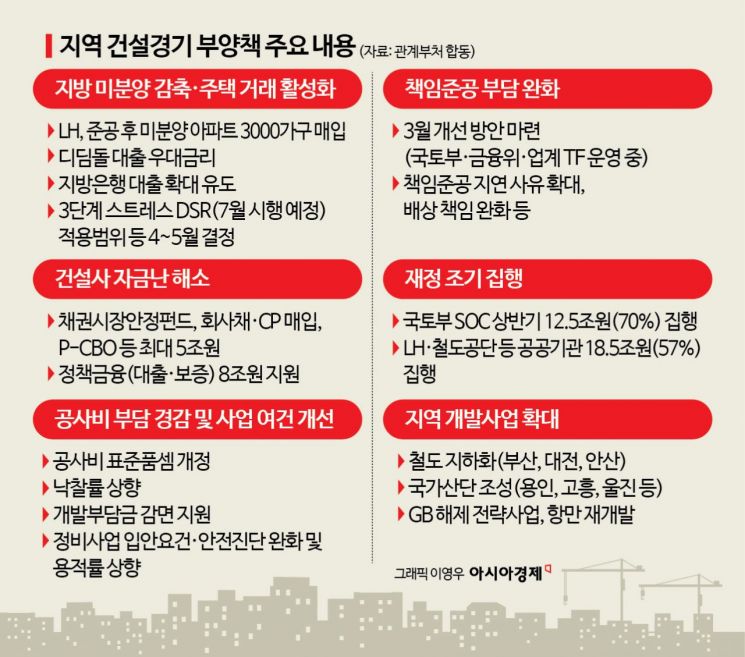

The government has decided to purchase unsold apartments in provincial areas and to apply preferential interest rates when the private sector buys unsold units. A plan to increase household loan targets for regional banks will also be implemented. This measure aims to break the vicious cycle caused by prolonged stagnation in the provincial real estate market, sluggish domestic demand, and delayed economic recovery. The government has settled on not accepting requests from local construction industries and political circles to postpone or ease the application timing of the Debt Service Ratio (DSR).

On the 19th, the government held a Livelihood Economy Inspection Meeting chaired by Acting Prime Minister and Minister of Economy and Finance Choi Sang-mok to discuss the 'Supplementary Measures for Regional Construction Economy.' This plan emerged as calls for drastic measures grew louder due to the increase in unsold houses mainly in provincial areas and the adverse impact of construction industry downturns closely linked to local economies on the Gross Domestic Product (GDP).

◆ LH to Purchase 3,000 Unsold Provincial Apartments at Discounted Prices = To aid the recovery of the provincial real estate market, the Korea Land and Housing Corporation (LH) will directly purchase 3,000 unsold apartments completed in provincial areas at prices lower than the sale price. The specific timing of purchase and the method for calculating the purchase price have not yet been decided. LH typically sets purchase prices based on appraisal values, and the industry expects that clear purchase guidelines will be established depending on region and completion timing.

However, there is skepticism about whether actual results can be achieved, as project owners tend to view discounted sales negatively. The government had announced a purchase policy during the severe unsold housing crisis in 2007, but the actual number of apartments purchased fell far short of the target. At that time, opposition parties and civil society criticized the government’s measures, arguing that using taxes to prevent losses for private construction companies encourages moral hazard.

The government also announced plans to allow purchase-type registered rental housing, previously permitted only for non-apartment properties, to be applied to unsold provincial apartments (85㎡ or less). Purchase-type registered rental housing is a type of private rental housing where private rental operators receive certain tax benefits if they comply with rent caps. This had not been applied to apartments due to concerns about market instability. However, amending the Private Rental Housing Act is required, so cooperation from the National Assembly is necessary.

The Corporate Restructuring (CR) REITs, which were planned to be introduced last year, will be launched in the first half of this year. The government stated that the Housing and Urban Guarantee Corporation (HUG) is conducting preliminary appraisals for about 3,800 units. However, the industry points out that actual coordination will be difficult because REIT operators want to buy unsold apartments at lower prices, while construction companies want to receive as much as possible.

A new measure will be introduced to apply preferential interest rates on Didimdol loans when purchasing unsold provincial apartments. This policy loan is available for low-income households and newlyweds. The specific interest rate level will be decided after discussions within financial authorities. Additionally, plans to support liquidity by reflecting increased household loan targets for financial institutions that increase mortgage lending in provincial areas will proceed as originally planned.

◆ No Postponement or Easing of DSR = The specific scope and ratio of the third-stage stress DSR, scheduled to be implemented in July, will be determined around April to May considering the provincial construction market situation. It was made clear that there will be no postponement of the application timing or regional differentiation. Financial Services Commission Chairman Kim Byung-hwan said at the National Assembly the day before, "There is doubt whether unsold units are due to DSR regulations," and added, "If provincial areas are excluded as requested by political circles, it would undermine policy credibility." He emphasized that the implementation will proceed as planned.

The contents discussed at the meeting are evaluated as minor adjustments such as accelerating fiscal execution or speeding up previously announced institutional improvements. The undergrounding of railroads in Busan, Daejeon, and Ansan will begin basic planning within the first half of this year to accelerate projects. Compensation for the Yongin semiconductor industrial complex, targeted to start construction next year, will begin in the first half of this year, and the industrial complex road project will be ordered as a turnkey (design-build lump-sum contract) within the first half of this year. National and regional strategic projects recognized as exceptions to the total development restriction zone (GB) will be selected within this month.

In addition, regional vitality towns (10 locations) and public-private win-win investment cooperation projects (5 locations) will be publicly recruited next month, with selection and project confirmation by May, and subsidies distributed in the first half of the year. The system will be revised to allow data centers or urban air mobility (UAM) facilities such as vertiports to be established in redevelopment ports. For newly built purchase rental housing, 10% of the purchase amount will be paid at the start of construction. Currently, 50% is paid upon completion of the framework; under the new system, 10% will be paid at the start of construction and the remaining 40% upon completion of the framework.

The revision of the standard unit price, promoted as a measure to reflect realistic construction costs, will be advanced from the originally planned year-end to the first half of this year. Measures to ease financial burdens on construction companies, such as raising bid rates, will be quickly implemented along with related institutional improvements, and the enforcement decree will be amended to apply these measures to construction projects ordered by local governments as well. Currently, these apply only to projects ordered by the central government or public institutions.

The government will also revise the responsibility completion system, which imposes burdens on construction companies in project financing (PF) projects. The extension reasons, previously allowed only for rare cases such as natural disasters, will be expanded, and the debt assumption ratio will be differentiated according to the period even after the responsibility completion deadline. Authorities are reviewing these changes, which are expected to be announced as early as next month.

Plans to provide a 100% exemption of development charges for new projects outside the metropolitan area, simplify maintenance project procedures, and support PF guarantees for non-apartment and non-residential projects will also be pursued. However, since these require legal enactment or amendment, their implementation remains uncertain at this time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.