LF Accelerates Succession Using Goryeo D&L

Chairman Gu Bongeol to Eldest Son Gu Seongmo

Tribonze Renews 'DAKS Shirts' Licensing Contract

Concerns Over Fraternal Management Dispute Likely to Disappear

The owner family of LF, a lifestyle culture company under the 범LG (Beom LG) conglomerate, is accelerating the succession process. Goryeo D&L, considered a key player in the succession, has been increasing its shareholding again this year. Goryeo D&L is the second-largest shareholder of LF, with Gu Seong-mo, the eldest son of Gu Bon-geol, chairman of LF, as the largest shareholder. Since the end of last year, Gu Seong-mo has also started purchasing LF shares.

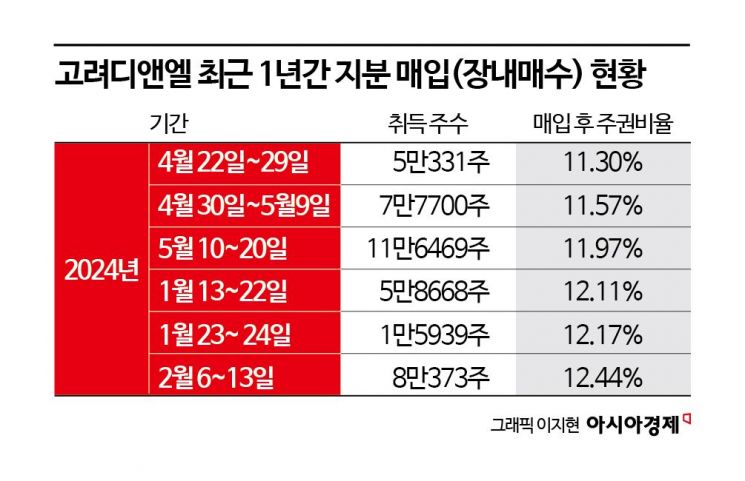

According to the Financial Supervisory Service's electronic disclosure system on the 20th, Goryeo D&L began buying LF shares again from January 13 this year. The last time Goryeo D&L purchased LF shares was in May of last year.

LF's 2nd Largest Shareholder Goryeo D&L Expands Stake to 12.44%

Like last year, Goryeo D&L is gradually buying shares to increase its stake. From January 13 to 24 this year, it purchased about 70,000 shares, raising its stake from 11.57% to 12.17%, and this month it acquired about 96,000 shares, increasing its stake to 12.44%.

Goryeo D&L is a company specializing in landscaping management and horticultural sales, established in 2023 through a spin-off from LF Networks. In this process, Goryeo D&L received all LF shares (1,806,000 shares) held by LF Networks. Since then, Goryeo D&L has been buying LF shares and currently holds the position of the second-largest shareholder.

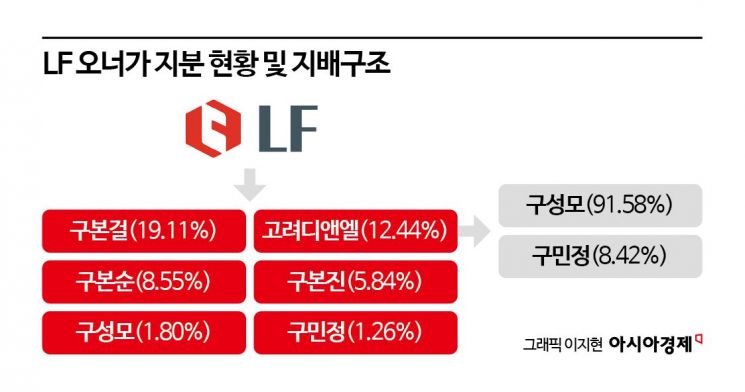

Looking at LF's shareholding structure, Gu Bon-geol, chairman of LF, holds the largest stake at 19.11%, followed by his brothers Gu Bon-sun (8.55%) and Gu Bon-jin (5.84%), his son Gu Seong-mo (1.8%), and his daughter Gu Min-jeong (1.26%).

The owner of Goryeo D&L is Gu Seong-mo, the son of Chairman Gu. With a total stake of 91.58%, it is essentially Gu Seong-mo's personal company. Gu Seong-mo's direct and indirect holdings in LF amount to 14.26%. The remaining 8.42% of Goryeo D&L's shares are held by his sister, Gu Min-jeong.

Gu Seong-mo has also been actively accumulating LF shares since December last year. From December 9 to 30 last year, he purchased about 130,000 shares, and from January 2 to 8 this year, he bought about 45,000 shares. On December 27 last year, he took out a stock-backed loan worth 1 billion KRW (with an interest rate of 5.5%) from NH Investment & Securities to finance his stock purchases.

Industry insiders believe that these share purchases are being made to ensure a stable transfer of management rights from Chairman Gu Bon-geol to Gu Seong-mo. Born in 1957, Chairman Gu is currently known to be directly involved in business operations. Since Gu Seong-mo, born in 1993 (aged 31), will take over management gradually rather than all at once, the process of increasing shares using the unlisted company Goryeo D&L as a leverage for succession is a long-term preparation. Gu Seong-mo joined LF as a manager of the new investment team in September 2023 and went abroad last August to pursue an MBA program.

Conflict with CEO Gu Bon-jin Resolved... 'DAKS Shirts' Licensing Rights Transferred to Tribonz

Since Chairman Gu had long designated Gu Seong-mo as his successor, the possibility of a management dispute is low. Although Gu Bon-geol's brothers, Gu Bon-sun (8.55%) and Gu Bon-jin (5.84%), CEO of LF Networks, hold shares, their influence on the succession is limited.

At the end of last year, concerns about a fraternal management dispute arose when Gu Bon-jin, CEO of LF Networks, submitted a petition to the National Assembly accusing Chairman Gu of illegal acts. However, it has been confirmed that the conflict has since been resolved. At that time, CEO Gu Bon-jin claimed that Chairman Gu unilaterally terminated the license contracts for 'Pastel Sesang' and the DAKS and HAZZYS children's clothing trademarks to enforce unfair demands on LF Networks.

Pastel Sesang is a subsidiary of LF Networks engaged in fashion manufacturing and sales as well as resort business. It produced 'DAKS' and 'HAZZYS' children's clothing under license contracts with LF, but following the end of these contracts, it is in the process of shutting down. LF Networks is an affiliate of LF, with a shareholding structure of Gu Bon-geol (17.5%), Gu Bon-sun (14.6%), and Gu Bon-jin (12.21%).

The conflict between LF and Tribonz over the licensing rights for 'DAKS shirts' has also been resolved. LF recently signed a contract to extend the licensing rights for DAKS shirts with Tribonz. Previously, with the contract set to expire in July, LF planned to select a company through a bidding process rather than renewing the contract. Since Pastel Sesang lost the licensing rights for DAKS and HAZZYS children's clothing and went out of business, there were concerns that Tribonz might also lose the DAKS shirt license.

At that time, several men's shirt manufacturers, including Hyungji I&C, showed strong interest in the bidding. Given DAKS's high recognition among middle-aged and older consumers, acquiring the license was seen as a way to overcome domestic demand slumps. However, in the final bidding stage, LF announced it would shorten the contract period, causing some companies to withdraw, and LF decided to extend the contract period with Tribonz.

An LF official stated, "We introduced the bidding process to find the optimal operator to enhance brand value," adding, "We selected a company that meets all aspects, including contract period and royalties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.