Internal Combustion Engines and Hybrids Still Dominate the Global Market

Vehicle Sharing Gains Popularity Worldwide, While South Korea Remains Cautious

This year, the global automotive market is still expected to see sluggish growth in electric vehicle sales. Analysis suggests that preference for internal combustion engine vehicles and hybrid vehicles will continue to prevail over electric vehicles. Preference for vehicle-sharing services is also expected to spread mainly among younger generations.

On the 18th, Korea Deloitte Group analyzed this through the '2025 Global Automotive Consumer Survey' report, conducted with 31,000 consumers across 30 countries worldwide.

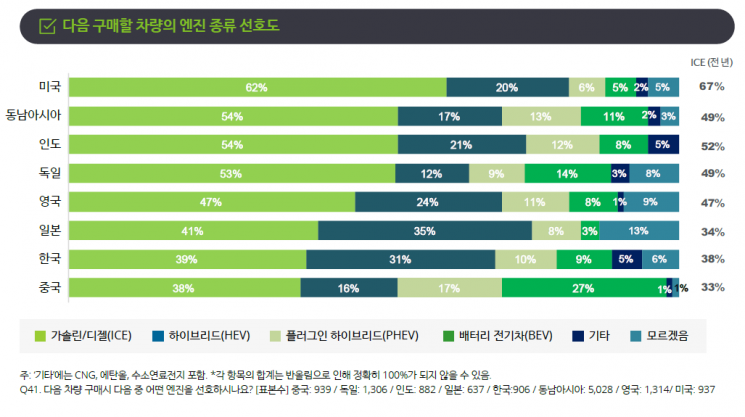

Continued Preference for Internal Combustion Engines and Hybrids

According to the report, preference for internal combustion engine (ICE) vehicles and hybrid vehicles remains stronger than for electric vehicles. In the U.S., 62%, Southeast Asia and India 54%, and Germany 53% of consumers preferred gasoline and diesel (ICE) vehicles. Battery electric vehicle (BEV) preference was only 5%, 11%, 8%, and 14%, respectively. South Korea and Japan recorded hybrid (HEV) preference rates of 31% and 35%, respectively.

Consumers still expressed concerns about electric vehicles regarding long charging times, short driving ranges, costs, lack of charging infrastructure, and battery safety. While Chinese electric vehicle maker 'Ziiker' unveiled a battery that can be charged up to 80% in just 10 minutes and 30 seconds using ultra-fast charging stations, global consumers including those in South Korea responded that fast charging time is more important than charging station accessibility, security, and convenience facilities.

Meanwhile, 31% of South Korean consumers identified complete vehicle manufacturers as the main party responsible for electric vehicle battery post-processing and recycling. This was the second highest rate after Japan (35%). Following were battery manufacturers (23%) and dedicated battery recycling companies (11%). In Japan, 23% of respondents also said vehicle dealers are responsible, the highest along with China.

Consumers who prefer electric vehicles cited reasons for purchase decisions such as fuel cost savings, environmental concerns, quietness, and improved vehicle performance. In South Korea, the order was 'low fuel costs (57%)', 'environmental concerns (43%)', 'low maintenance and management costs (38%)', and 'government incentives and subsidy purchase promotion programs (35%)'.

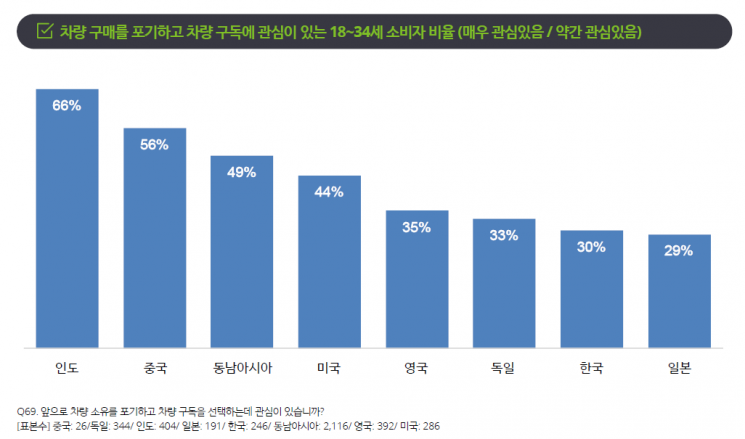

Increasing Preference for Vehicle Sharing Centered on Younger Generations

Among consumers aged 18 to 34, there was a tendency to give up vehicle ownership and consider vehicle subscription services. This appears to reflect a perception aimed at reducing financial burdens amid growing economic uncertainty.

However, preferences for vehicle subscriptions varied by country. In India and China, 70% and 54% respectively responded that they would give up vehicle ownership and use Mobility as a Service (MaaS), the highest rates. However, in South Korea and Japan, despite relatively low vehicle usage frequency, these rates were only 37% and 38%, respectively.

Meanwhile, more than half (55%) of Chinese consumers said they purchase vehicles of the same brand as their previous vehicle, and about one-third said their current vehicle is their first vehicle. This indicates that brand loyalty strategies have become important in the Chinese market. In South Korea (48%), the UK (51%), and the U.S., the majority responded that their current vehicle is different from their previous vehicle.

Regarding preferred brands for the next vehicle purchase, consumers in Japan (76%), India (49%), and South Korea (48%) most frequently answered that they prefer domestic automobile brands. In contrast, only 19% of respondents in the UK gave this answer.

Kim Taehwan, leader of the automotive industry specialist team at Korea Deloitte Group, explained, "The transition to carbon zero-emission vehicles and the trend of software-defined vehicles are emerging as an unstoppable mainstream. Connectivity and advanced driver assistance systems (ADAS) are driving the development of mobility, while a multidimensional approach to autonomous vehicles and MaaS is rapidly emerging."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)