Binggrae Takes the Top Spot in the Domestic Fermented Milk Market with 'Yoplait'

Fermented Milk Gains Momentum as the Milk Market Declines and Competition Intensifies

In the fiercely competitive domestic fermented milk market without an absolute leader, Binggrae emerged victorious last year.

According to Nielsen Korea, a market research firm, on the 17th, Binggrae ranked first in the domestic fermented milk retail market last year with sales of 158 billion KRW and a market share of 16.19%. Meanwhile, Namyang Dairy Products lost its top spot, which it had held for several years. Namyang recorded sales of 156.7 billion KRW last year, with a market share of 16.05%, nearly a 1 percentage point drop from the previous year (16.94%). Following them, Maeil Dairies (13.88%), Pulmuone Danone (12.44%), and Seoul Milk (12.26%) made it into the top five.

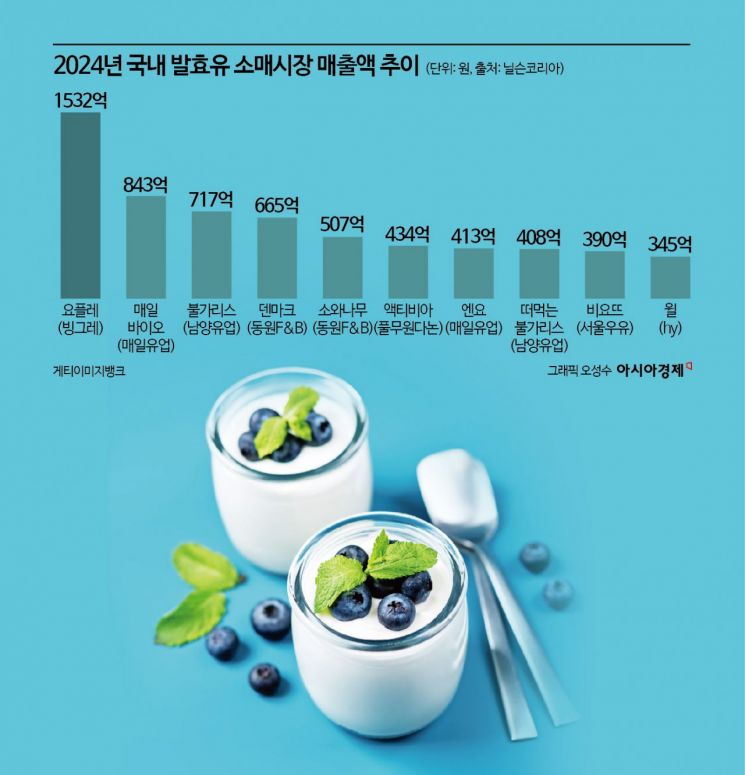

The key factor behind Binggrae's rise from perennial second place to the top was undoubtedly its flagship brand, 'Yoplait.' Looking at the sales rankings by fermented milk brand last year, Binggrae's Yoplait recorded the highest sales at 153.2 billion KRW. This amount is nearly double that of Maeil Dairies' 'Maeil Bio' (84.3 billion KRW), which ranked second. Following these two brands were Namyang Dairy's 'Bulgari' (71.7 billion KRW), Dongwon F&B's 'Denmark' (66.5 billion KRW), and 'Sowanamu' (50.7 billion KRW), each achieving sales exceeding 50 billion KRW.

Binggrae's Yoplait's top brand sales position is attributed to its expanded lineup. In August last year, Binggrae, recognizing the growth potential of the zero-sugar fermented milk market, launched 'Yoplait Zero Drink Sugar-Free Plain.' This year, it further expanded its product range by introducing 'Yoplait Zero Chocoring' last month, along with other low-sugar products such as 'Yoplait Light Banana.' The company plans to focus on expanding its zero lineup, as the healthy lifestyle trend known as healthy pleasure is becoming established across the food industry.

In the case of Namyang Dairy, the decline in sales of its spoonable Bulgari product led to a drop in its ranking. Although Bulgari's sales increased by 0.94% compared to 2023, sales of the spoonable Bulgari decreased by 10.17% last year.

Meanwhile, by type of fermented milk, the spoonable 'Hosang' product group accounted for about half of the market with sales of 466.7 billion KRW and a market share of 47.8%. The 'Drink' product group, which allows spoonable yogurt to be consumed as a beverage, followed with sales of 380.4 billion KRW and a 39.0% share, while the typical fermented milk 'Liquid' product group accounted for the remaining 129.2 billion KRW and 13.3%.

As the white milk market shrinks due to low birth rates and the resulting decrease in infant and child populations, fermented milk is growing as an alternative in the domestic dairy product market. Along with demographic changes, the COVID-19 pandemic ignited growth in the domestic fermented milk market. After the pandemic, increased interest in health management expanded the product range, broadening consumer choices and contributing to market growth. In particular, as consumers increasingly perceive good food as medicine, fermented milk products labeled with nutritional components reflecting the beneficial functions of probiotics?such as nutrition intake, immune enhancement, and physical strength supplementation?have been released and consumed in various forms.

Additionally, the rise in environmentally conscious consumers and those who cannot digest dairy products (lactose intolerance) has increased interest and consumption of plant-based yogurts, further influencing market growth. Recently, functional products have been launched that go beyond simply aiding gut health. Hy, which opened the functional fermented milk market, demonstrated its continued presence last year as its liver health fermented milk 'Coopers' surpassed cumulative sales of 1 billion units.

Dongwon F&B also made a smooth market entry last year by launching 'Denmark High Yogurt,' which contains patented respiratory probiotics introduced by GC Green Cross Wellbeing, along with zinc for immune function, calcium for bone formation, and vitamin D, selling 3 million bottles within a month. Recently, Pulmuone Danone revamped and launched 'We Solution,' enhanced with the individually recognized ingredient 'Honeysuckle Flower Bud Extract (Green Cera-F),' known to protect the gastric mucosa and aid stomach health.

According to market research firm Euromonitor, the domestic fermented milk market size in 2023 was 2.0625 trillion KRW, growing about 2.7% compared to 2022 (2.0091 trillion KRW). With growth expected to have continued last year, the market is projected to reach approximately 2.2498 trillion KRW by 2026.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.