70% of U.S. Sales Produced Locally

Collaboration with GM on EV Commercial Vehicles Expected

The automotive industry is on high alert over concerns that the United States, which accounts for half of South Korea's automobile exports, may impose tariffs on imported cars. U.S. President Donald Trump has announced plans to introduce import car tariffs around April 2, but confusion is growing as the targets and methods of imposition have not yet been determined. The domestic automotive industry is expanding local production systems while preparing countermeasures through strategic cooperation in the U.S.

According to industry sources on the 17th, U.S. President Donald Trump said on the 14th (local time), "I plan to announce tariffs on imported cars around April 2." With a specific timeline for imposing car tariffs emerging, attention is focused on what countermeasures will be prepared during the remaining period.

According to the Korea International Trade Association, as of the end of last year, South Korea's total automobile export value was $70.789 billion (approximately 102.198 trillion KRW), of which exports to the U.S. amounted to $34.744 billion (approximately 50.159 trillion KRW), accounting for 49.1%. Automobiles, the top export item to the U.S., have been sold duty-free in the U.S. since 2016 under the Korea-U.S. Free Trade Agreement (FTA).

There are concerns that if President Trump imposes tariffs, price competitiveness will immediately decline. However, it is still unclear whether a uniform tariff rate will be applied to all imported cars or if tariffs will be differentiated by country.

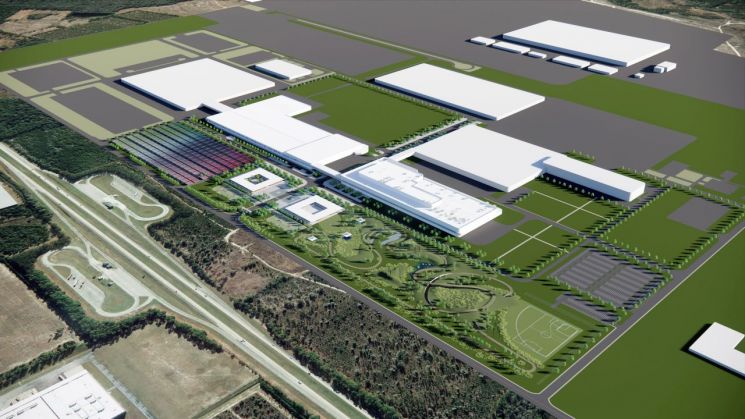

Hyundai Motor Group has proposed increasing local production in the U.S. in the mid to long term. The plan is to raise the production capacity of the Hyundai Motor Group Meta Plant America (HMGMA) in Georgia, which began operations last October, from 300,000 units to 500,000 units annually. Adding the Alabama plant (360,000 units per year) and Kia's Georgia plant (340,000 units per year) will establish a production system of 1.2 million units in the U.S. Last year, Hyundai Motor Group produced 70% of its total U.S. sales volume of 1.7 million units locally.

Hyundai is focusing on quickly increasing HMGMA's operating rate while adjusting production facilities to focus on popular models in the U.S., such as hybrids.

Hyundai is also strengthening direct communication with the Trump administration to seek ways to overcome tariff barriers. Recently, Hyundai Motor Group Chairman Chung Eui-sun met with Donald Trump Jr., the eldest son of President Trump, at a golf tournament in the U.S. Although it is unlikely they discussed tariffs directly, this meeting could serve as a positive factor in future negotiations with the U.S.

A Hyundai Motor official said, "We are thoroughly reviewing the uncertain direction and sustainability of U.S. trade policies. We are internally establishing various business strategies and building consultation channels with the Korean government to respond swiftly to Korea-U.S. tariff negotiations."

Cooperation with other automakers is also being strengthened. Hyundai plans to pursue cost reduction and efficiency improvements through joint procurement of items and collaboration on EV commercial vehicle production with U.S. General Motors (GM).

GM produces the Buick Encore GX, Buick Envision crossover, Chevrolet Trailblazer, and Chevrolet Trax crossover at its Korean plants and exported 407,000 units to the U.S. last year. The industry also anticipates the possibility of 'rebadging' cooperation, where both companies release the same vehicles under different brands.

The damage to the automotive industry from U.S. tariff measures is expected to reach up to 6 trillion KRW. According to the Korea Institute for Industrial Economics & Trade, the export impact from universal automobile tariffs is estimated at up to 5.9 trillion KRW. KB Securities projected that if the U.S. imposes a 10% tariff on Korean cars, Hyundai's operating profit could decrease by 1.9 trillion KRW and Kia's by 2.4 trillion KRW.

However, some argue that since tariffs would also burden U.S. automakers, it remains to be seen whether the tariffs will actually be imposed. Jim Farley, CEO of Ford, recently criticized, "Trump has said he wants to strengthen the U.S. automotive industry and increase U.S. car production, but what we are seeing so far is high costs and a lot of confusion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.