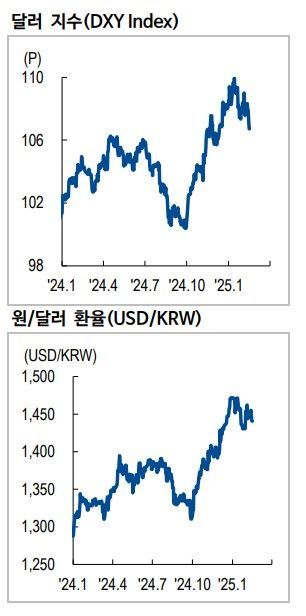

The Bank of Korea's base rate cut is unlikely to act as an additional factor for won depreciation at the current won-dollar exchange rate level, according to an assessment. Despite the so-called 'Trump tariff' uncertainty, the dollar index, which represents the value of the dollar against the six major currencies, has been declining recently. Furthermore, looking solely at the direction of money, the atmosphere is expected to be quite different from the previous won depreciation trend.

On the 17th, Kwon Amin, a researcher at NH Investment & Securities, stated in a report titled "Drawing the Line Between Won-Dollar Exchange Rate and Korea's Rate Cut" that "the Bank of Korea's rate cut factor, which has already been priced in by interest rates, is unlikely to cause further won depreciation at the current level," adding, "The driving forces of the won are, in order, the dollar and major currencies, relative interest rate differentials, and absolute interest rates." The Bank of Korea is scheduled to hold a Monetary Policy Committee (MPC) meeting on the 25th to decide on monetary policy, with the market leaning toward a rate cut in February.

Researcher Kwon noted, "In Korea, where political uncertainty persists, the growth rate and base interest rate differentials with the U.S. currently support the high exchange rate trend," but he also forecasted, "Nevertheless, the won-dollar exchange rate is expected to follow a high-low trajectory, falling to the 1,300 won level within the year, linked to the gradual decline of the dollar index." Regarding this, investors' interest lies in whether the won-dollar exchange rate decline can materialize despite the Bank of Korea's base rate cut within the year."

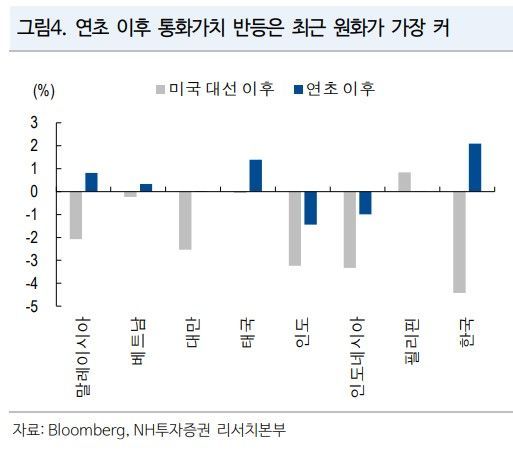

He explained, "Market interest rates have already priced in three cuts this year, and since the beginning of the year, the won has shown the largest rebound in currency value." He continued, "Above all, in the long term, the exchange rate is still most importantly linked to the dollar and the yuan," emphasizing, "The Korea-U.S. interest rate differential, often cited as a reason for won depreciation, has weak explanatory power compared to global currencies, and Korea's absolute interest rate actually shows a negative correlation with the won's value."

Additionally, Researcher Kwon pointed out that the dollar index has fallen to the 106 level despite the U.S.'s steady tariff mentions, analyzing that "the direction of money is important for Korea." The U.S. Citi Economic Surprise Index has turned negative, and the dollar long betting, which was strongly concentrated at the end of the year, has also slowed down.

He diagnosed, "The core of won depreciation in this cycle can be summarized as a slowdown in liquidity (current account) in the real economy and an expansion of domestic investors' overseas investment (dollar outflow burden)," adding, "Considering the recent recovery trend in the current account, the dollar outflow burden from domestic investors' overseas investment is also judged to have passed its peak cyclically. In other words, looking only at the direction of money, the atmosphere will be different from the previous won depreciation trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.