Last Year’s Bank Performance: Shinhan > Hana > KB Kookmin > Woori

Shinhan Reclaims Top Spot After Six Years

"Large Provisions" Push KB Kookmin Down to Third Place

This Year, Cost and Corporate Credit Risk Management Will Be Key Amid Policy Pivot

The annual performance rankings of the four major domestic commercial banks were affected by one-time expenses such as loss provisions for Hong Kong H-Share Index (Hang Seng China Enterprises Index·HSCEI) equity-linked securities (ELS). KB Kookmin Bank set aside the largest provisions, causing its ranking to drop, allowing Shinhan Bank to reclaim the leading bank position for the first time in six years. With additional base rate cuts expected this year and limited prospects for expanding interest income, cost management and corporate credit risk control are expected to determine the rankings.

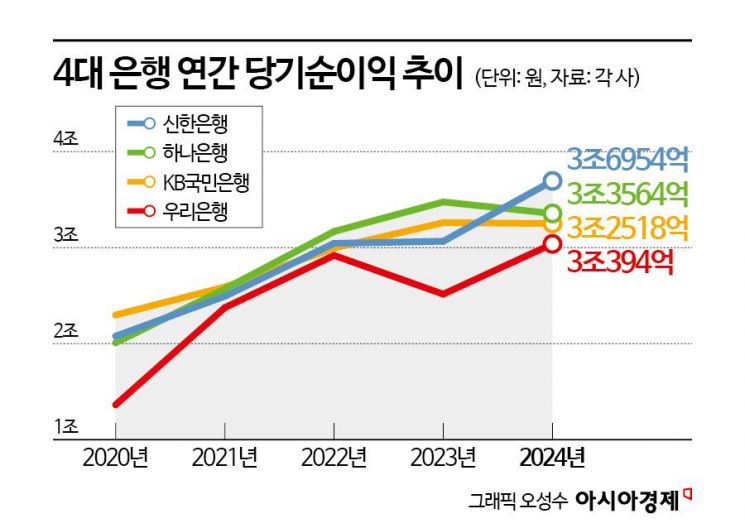

According to the financial industry on the 17th, last year’s net income of the four major banks ranked as Shinhan Bank, Hana Bank, KB Kookmin Bank, and Woori Bank. Shinhan Bank recorded an all-time high net income of 3.6954 trillion won, achieving the top spot for the first time since 2018.

Overall, all four banks achieved the '3 trillion won club' as loan assets increased. Hana Bank, which maintained the leading bank position for two consecutive years, saw its net income decrease by 3.5% compared to the previous year, losing the top spot but still maintaining over 3.3564 trillion won. KB Kookmin Bank followed with 3.2518 trillion won. Woori Bank recorded 3.0394 trillion won, surpassing 3 trillion won for the first time with a 21.3% increase in one year.

The banking sector generally evaluates that the loss provisions for Hong Kong H-Share Index ELS compensation essentially determined the performance. Last year, the significant losses from Hong Kong H-Share Index ELS were recognized as mis-selling, leading to compensation decisions, and each bank set aside provisions that impacted their results. In particular, KB Kookmin Bank set aside the largest provisions at 862 billion won, which eroded its performance. Shinhan Bank set aside 240.7 billion won (excluding reversals), Hana Bank 179.9 billion won, and Woori Bank 7.5 billion won, showing a large gap.

An official from a commercial bank said, "KB Kookmin Bank’s household won-denominated loan balance is overwhelming, making it practically difficult to win in terms of interest income or net interest margin." He added, "Other banks have competed for first place by increasing global operations and corporate loans, but this time, one-time expenses determined the rankings." KB Kookmin Bank had the highest interest income at 10.2239 trillion won and the highest net interest margin (NIM) at 1.78%, a representative profitability indicator, but ranked third in annual net income.

This year, with total loan management starting from the beginning of the year and a high possibility of base rate cuts, the environment that allowed relatively easy profits is unlikely to continue. Kim Young-do, senior researcher at the Korea Institute of Finance, said, "The era of achieving results through stable household loan expansion has already passed," adding, "We are facing a challenging domestic and international management environment with no easy factors, including a slowdown in the real economy, the start of a base rate pivot (policy shift), and the introduction of value-up policies."

The banking sector expects that cost management and corporate credit risk control will determine the leading bank this year. An official from a commercial bank said, "Since competition must occur under the same conditions, ultimately, how efficiently costs are managed will become important," adding, "Banks that increase sound loans and reduce risk-weighted assets (RWA) will show noticeable performance improvements." Another official from a commercial bank said, "Usually, when large corporations face credit issues, rankings are determined based on the provisions banks have set aside," and predicted, "Given the widespread assessment that companies are facing difficulties this year, provisions for bad corporate loans are likely to determine the rankings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.