Domestic and External Uncertainties, Exchange Rate Risks "Eased Compared to January"

"Delayed Domestic Demand Recovery"... Deepening Concerns Over Low Growth

Inflation Deemed "Stable"... Still Monitoring Variables Like Exchange Rate

'Rate hike or freeze.' As the second Monetary Policy Meeting of the Bank of Korea (BOK) to decide the base interest rate direction this year approaches in about a week, the market's final variable checks have begun in earnest. At the first meeting this year, 'the base interest rate was frozen at 3.0%' due to key domestic and international political and economic variables and increased exchange rate volatility. The market viewed that the 'uncertainty fog' brought by these two factors has eased compared to January. On the other hand, concerns about delayed domestic demand recovery, expanding downward pressure on the economy, and entrenched low growth have increased. This analysis supports a 'rate cut in February.'

'Trump Risk' Status... "Some of the Uncertainty Fog Has Lifted"

At the January meeting, the Monetary Policy Committee members commonly pointed out concerns about the direction of U.S. economic policy following President Trump's election. In particular, the uncertainty surrounding unpredictable tariff policies supported a 'pause in rate hikes.'

Since the meeting last month, the recent assessment of President Trump's tariff threat level is that it is 'weaker than pre-inauguration promises.' Especially, the one-month delay in tariffs on Canada and Mexico increased the perception that 'tariffs are a negotiation tool.' Although tariffs on China were enforced, they were imposed at 10%, far below the promised 60%, and China's retaliation was limited to a 10% tariff on some items. Instead of the widely feared universal tariff pledge, mutual tariffs were announced, and this was also granted a grace period until early April, which acted as a relief factor.

However, confirmation of the impact on exports and the foreign exchange market is still necessary. Following President Trump's announcement that from the 12th of next month, a 25% tariff will be imposed on all steel and aluminum, and mentioning the introduction of automobile tariffs around April 2nd, as well as future semiconductor tariff announcements, a red light has been turned on for Korea's exports to the U.S. Jaeyoung Oh, a researcher at KB Securities, said, "Korea's trade surplus with the U.S. increased to $65.5 billion last year, centered on automobiles ($34.7 billion), making Korea the 8th largest country with a U.S. trade surplus," adding, "If U.S. pressure related to semiconductor and automobile tariffs mentioned by Trump intensifies, domestic impacts will be inevitable."

Has Exchange Rate Risk Decreased? Volatility ↓ and Signs of Won Recovery

The foreign exchange market has also somewhat calmed since the early this month’s news of a one-month delay in tariffs on Canada and Mexico by the U.S. A representative example is the won-dollar exchange rate. The won-dollar exchange rate, which surged due to the global strong dollar issue combined with an emergency situation, remains at a high level around 1450 won but its volatility has decreased. As of 3:30 PM, the closing average exchange rate rose to 1436.78 won in December last year, then to 1455.50 won last month, but has slightly eased to 1451.81 won as of the 14th of this month.

The market also observed that the impact of domestic political uncertainty on the exchange rate has likely subsided. Bank of Korea Governor Changyong Lee mentioned at a press conference right after the rate decision last month that the won-dollar exchange rate rose about 30 won due to political risk. The nominal effective exchange rate, a key exchange rate indicator for the Monetary Policy Committee, slightly rebounded to 90.31 as of February 11, raising expectations for won value recovery. The nominal effective exchange rate is a weighted average exchange rate that considers trade volumes with major trading partners to assess the won's value.

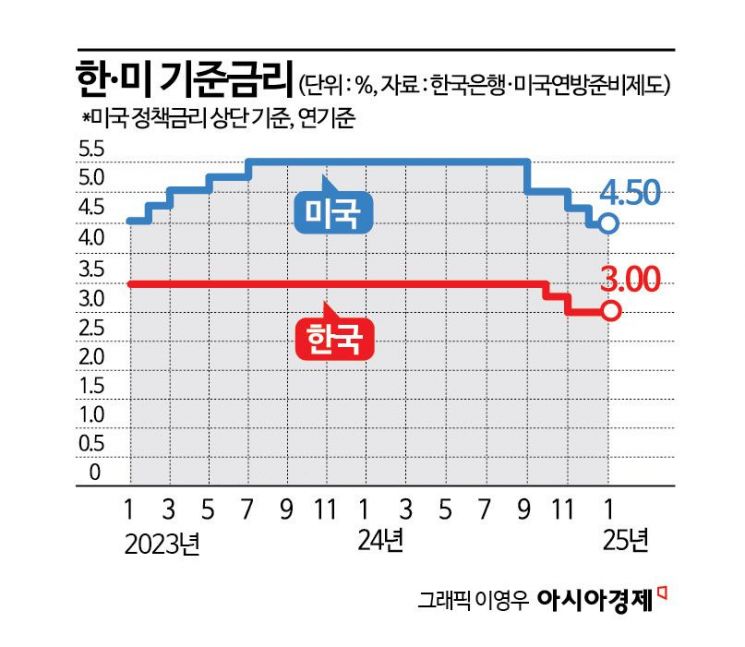

However, external factors remain important variables for the exchange rate. The market expects foreign exchange market volatility to continue depending on the progress of various tariff negotiations set to conclude by March-April. The possibility of the U.S. Federal Reserve (Fed) adjusting the pace of policy rate cuts has also increased since the January meeting. The widening interest rate differential between Korea and the U.S. acts as upward pressure on the exchange rate. The Monetary Policy Committee is expected to continue closely monitoring the negative impact of the won-dollar exchange rate on financial stability for the time being.

President Donald Trump signed a proclamation imposing a 25% tariff without exceptions on steel and aluminum products imported into the United States, and stated that tariffs on automobiles and semiconductors are also under consideration. On the 13th, containers were piled up at Pyeongtaek Port in Gyeonggi Province. 2025.2.13. Photo by Kang Jin-hyung

President Donald Trump signed a proclamation imposing a 25% tariff without exceptions on steel and aluminum products imported into the United States, and stated that tariffs on automobiles and semiconductors are also under consideration. On the 13th, containers were piled up at Pyeongtaek Port in Gyeonggi Province. 2025.2.13. Photo by Kang Jin-hyung

"Delayed Domestic Demand Recovery"... Deepened Low Growth Concerns

There is growing support for the forecast that domestic demand recovery will be slower than expected this year due to weakened consumption and investment sentiment. Concerns about domestic political uncertainty have eased compared to the January meeting but remain one of the factors hindering economic agents' psychological recovery. The consumer sentiment index in January was 91.2, up 3.0 points from the previous month but still below the baseline of 100.

The Ministry of Economy and Finance mentioned in the February issue of the 'Recent Economic Trends (Green Book)' on the 14th that "Recently, our economy has experienced delayed domestic demand recovery, including consumption and construction investment, and persistent employment difficulties centered on vulnerable sectors." Retail sales in December last year decreased by 0.6% from the previous month and 3.3% year-on-year. Construction investment increased by 1.3% month-on-month but decreased by 8.3% year-on-year. Employment in January increased by 135,000 compared to the same month last year, but construction employment decreased by 169,000, the largest drop since the 2013 industrial classification revision. Manufacturing employment also declined for the seventh consecutive month, and youth employment decreased by 218,000.

Above all, with the economic outlook to be announced along with the February rate decision expected to significantly lower expectations compared to November, concerns about downward economic growth risks have increased. The Bank of Korea stated last month that Korea's economic growth rate this year is expected to be 1.6?1.7%, below the November forecast of 1.9%. Some expect the revised economic outlook on that day to lower the growth forecast to around 1.5%. The slowdown in export growth due to the U.S.-originated tariff war is also expected to increase the scale of risks.

Inflation Seen as 'Stable' Despite... Checking Variables Like Exchange Rate

Meanwhile, inflation, a major variable affecting interest rates, is unlikely to be a decisive factor at this month's meeting. Although last month's consumer price inflation rate exceeded expectations at 2.2%, the general market assessment is that domestic inflation this year will remain stable around the target level (2.0%). The rapid rise in the exchange rate exerts upward pressure on prices, while the low demand pressure due to sluggish domestic economy exerts downward pressure, and these effects are expected to offset each other. However, the elevated exchange rate level, international oil price movements, and related uncertainties such as domestic and international economic trends need to be continuously monitored.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.