Semiconductor IP Company... Up 36% Compared to End of Last Year

China Accounted for 46% of Last Year's Sales... Expected to Benefit from "China's AI Ambition"

The stock price of Chips&Media continues to rise. This is due to the expected benefits from the growth of the Chinese artificial intelligence (AI) market amid the US-China conflict.

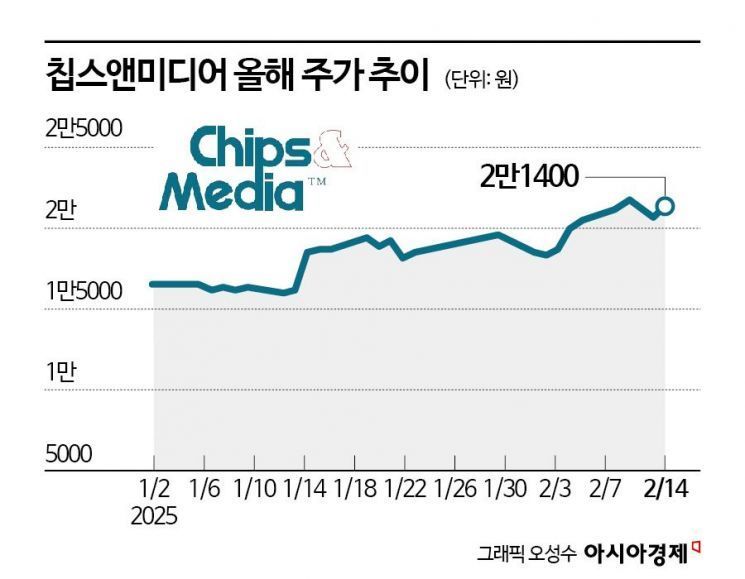

According to the financial investment industry on the 17th, Chips&Media closed at 21,400 KRW on the 14th of this month. This is a 36.13% increase compared to the end of last year. During the same period, the KOSDAQ rose by 11.52%.

Chips&Media is a semiconductor intellectual property (IP) company established in 2003. It entered the KOSDAQ in 2015. IP is a kind of blueprint embedded in semiconductor chips to perform specific functions. Chips&Media specializes in video IP. Video IP is embedded in multimedia semiconductor chips and is responsible for video recording and playback functions. It is applied across a wide range of devices, from mobile devices to video electronics and automobiles.

The rise in stock price is driven by performance and growth expectations. In the fourth quarter of last year, sales and operating profit were 9.1 billion KRW and 2.9 billion KRW, respectively. This represents increases of 24.5% and 26.9% compared to the same period the previous year. New license sales along with AI semiconductor sales to China contributed to the improved performance.

Jongseon Park, a researcher at Eugene Investment & Securities, said, "We achieved the highest quarterly sales due to an increase in the amount per license contract," adding, "The positive aspect of the fourth-quarter performance is that high profitability was maintained."

Along with this, expectations for benefits from the intensifying AI competition between the US and China are also high. This is because China's AI investment is expected to expand due to US semiconductor regulations targeting China. Last year, China accounted for 46% of Chips&Media's total sales. The company also established a distributor and a joint venture (JV) in China.

Junyoung Park, a researcher at Hyundai Motor Securities, explained, "Due to the intensifying competition between the US and China, attempts by China to develop AI chips independently are expected to increase," adding, "With the recent acceleration in the development of large language models (LLMs) in the Chinese-speaking region, including DeepSeek, Chips&Media, which supplies IP to Chinese AI semiconductors, is likely to benefit."

Future performance growth is also anticipated. The expansion of the AI PC and data center AI SoC (system-on-chip) markets is increasing demand for high-performance semiconductors. Hyundai Motor Securities forecasted Chips&Media's sales and operating profit this year to be 32 billion KRW and 9 billion KRW, respectively.

Researcher Junyoung Park emphasized, "Chips&Media is expected to achieve continuous growth due to the benefits from the growth of the Chinese AI chip market and on-device AI."

Researcher Jongseon Park also stressed, "Due to the US-China trade dispute in the semiconductor sector, the number of Chinese customers is steadily increasing," and added, "We expect full-scale royalty sales from Chinese AI customers and others."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.