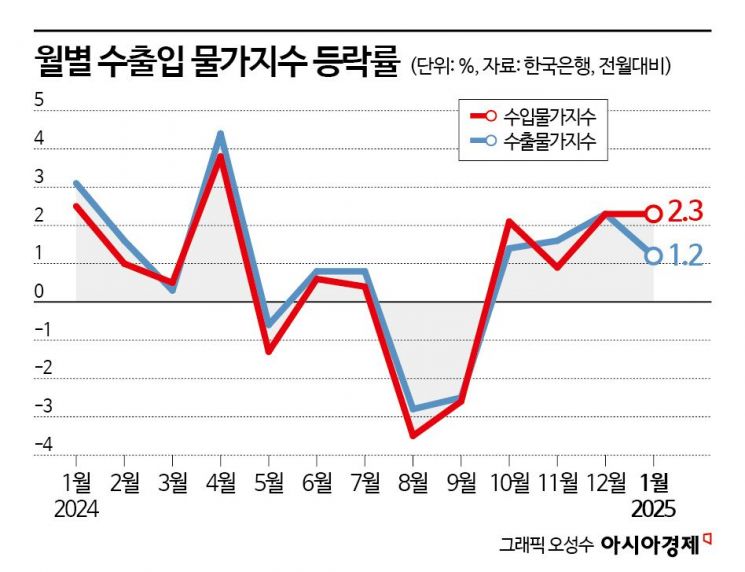

Import Prices Rise 2.3% in January from Previous Month

Driven by High Won-Dollar Exchange Rate and International Oil Prices

The import price index has been rising for four consecutive months as the won-dollar exchange rate and international oil prices continue their high-level march. Since the rise in import prices is reflected in consumer prices with a time lag, it is analyzed that the pressure on consumer price inflation has also increased.

According to the 'January 2025 Export and Import Price Index and Trade Index (Provisional)' released by the Bank of Korea on the 14th, last month’s import prices (based on the Korean won) rose by 2.3% month-on-month, mainly due to the increase in international oil prices and the won-dollar exchange rate, especially in mineral products such as crude oil. Compared to the same period last year, prices jumped 6.6%, led by increases in mineral products and chemical products.

The rise in import prices is due to significant increases in international oil prices and the won-dollar exchange rate. The monthly average price of Dubai crude oil rose 9.8% month-on-month from $73.23 per barrel in December last year to $80.41 last month. It also increased 2.0% compared to the same month last year. The average won-dollar exchange rate also rose from 1,434.42 won in December last year to 1,455.79 won last month, up 1.5% month-on-month and 10.0% year-on-year.

By usage, raw materials rose 4.4% month-on-month, mainly due to mineral products such as crude oil (4.5%). Intermediate goods increased 1.6% month-on-month, with coal and petroleum products (3.5%) and chemical products (2.0%) rising. Capital goods and consumer goods rose 0.8% and 1.0% month-on-month, respectively. Excluding the exchange rate effect, import prices based on contract currency rose 1.1% month-on-month last month but fell 1.8% year-on-year.

The continued rise in import prices raises concerns about upward pressure on consumer prices. Lee Moon-hee, head of the Price Statistics Team 1 at the Bank of Korea’s Economic Statistics Department, said, "In the case of consumer goods, prices of imported consumer goods can be immediately reflected in consumer prices. Intermediate goods and capital goods will affect consumer prices with a time lag." The timing of reflection may vary depending on how quickly companies pass on increased cost burdens to consumer prices.

However, it is uncertain whether the upward trend in import prices will continue through this month. Both the won-dollar exchange rate and international oil prices have shown signs of stagnation, leaving open the possibility of a downward turn. The impact of U.S. President Donald Trump’s tariff policies also remains highly uncertain, and it is analyzed that further observation is needed to assess future effects.

President Donald Trump signed a proclamation imposing a 25% tariff without exceptions on steel and aluminum products imported into the United States, and stated that tariffs on automobiles and semiconductors are also under consideration. On the 13th, containers were piled up at Pyeongtaek Port in Gyeonggi Province. 2025.2.13. Photo by Kang Jin-hyung

President Donald Trump signed a proclamation imposing a 25% tariff without exceptions on steel and aluminum products imported into the United States, and stated that tariffs on automobiles and semiconductors are also under consideration. On the 13th, containers were piled up at Pyeongtaek Port in Gyeonggi Province. 2025.2.13. Photo by Kang Jin-hyung

Last month, export prices rose 1.2% month-on-month due to increases in coal and petroleum products and chemical products influenced by the rise in the won-dollar exchange rate and international oil prices. Compared to the same month last year, export prices increased 8.5%, mainly in computers, electronics, and optical devices. By item, agricultural, forestry, and fishery products fell 0.8%, while manufactured goods rose 1.2% month-on-month due to increases in coal and petroleum products (7.3%) and chemical products (1.4%) influenced by rising international oil prices and global supply conditions. Export prices based on contract currency fell 0.1% month-on-month last month and declined 0.5% year-on-year.

The export volume index, which shows changes in export-import conditions, fell 10.7% year-on-year in January. The export value index decreased by 11.1%. This was due to a reduction in working days caused by the long Lunar New Year holiday and maintenance of production facilities, resulting in decreases in transport equipment, coal, and petroleum products. During the same period, the import volume index fell 3.8% year-on-year due to decreases in mineral products and chemical products. The import value index also dropped 7.1%.

The net barter terms of trade index rose 3.1% year-on-year as import prices (-3.4%), mainly for mineral products such as crude oil, fell more than export prices (-0.4%). The income terms of trade index fell 7.9% as the net barter terms of trade index (3.1%) rose but the export volume index (-10.7%) declined.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.