Foreign Currency Loans at Four Major Banks Up 15% in One Year

Risk Exposure Calculated in Won Terms

Rising Exchange Rate Increases Won-Converted Amount, Impacting Capital Soundness

As the high exchange rate trend continues, the risk to banks' soundness is increasing. The scale of foreign currency loans has grown compared to last year, and with the exchange rate also entering an upward trend, concerns are rising about the expansion of exposure (risk exposure).

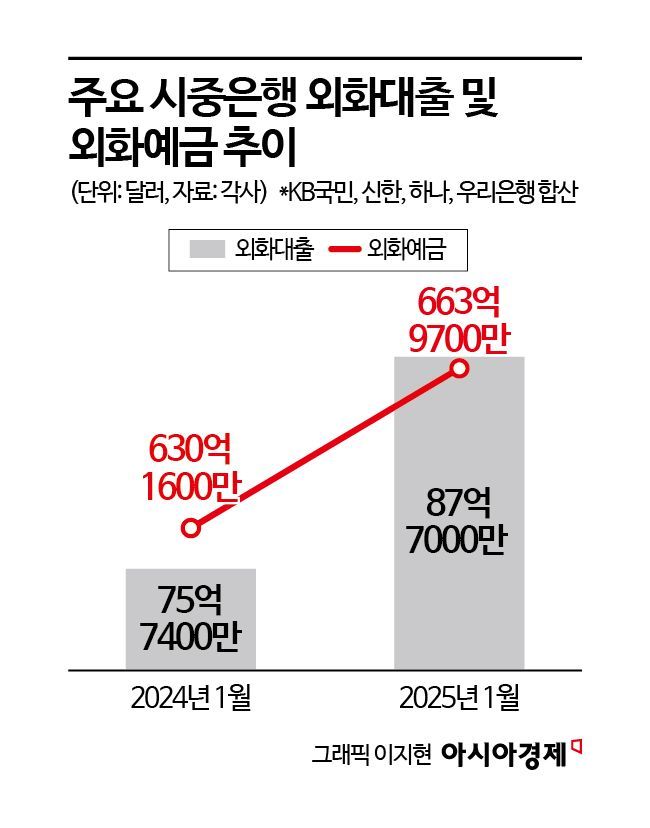

According to the banking sector on the 14th, as of January this year, the outstanding foreign currency loans of the four major domestic banks (KB Kookmin, Shinhan, Hana, and Woori Bank) totaled $8.77 billion. This is an increase of $250 million compared to the end of last year ($8.522 billion). Compared to one year ago ($7.574 billion), it increased by 15.8%. When converted to Korean won as of the previous day, this amount increased by KRW 1,732,047,200,000.

Foreign currency loans refer to loans provided by banks in foreign currencies such as the dollar or yen. The main borrowers are mostly import-export companies. The increase in foreign currency loans over the past year is attributed to the heightened volatility of the won-dollar exchange rate. As the exchange rate rose, import-export companies’ payment amounts increased, and it appears that the shortfall was covered by foreign currency loans from banks. There was likely also demand to secure dollars in advance in preparation for the possibility of further exchange rate increases.

The problem is that an increase in foreign currency loans during periods of high exchange rates can also affect banks' soundness management. All loans are assigned risk weights based on borrower creditworthiness to calculate risk-weighted assets (RWA). The same applies to foreign currency loans, which are based on the amount converted into Korean won. As the exchange rate rises, the won-converted amount of foreign currency loans also increases, inevitably causing RWA to grow.

Both the banks’ soundness indicators, the capital adequacy ratio (BIS) and the common equity tier 1 ratio (CET1), are based on risk-weighted assets. When RWA increases, the banks’ capital ratios decline, leading to a deterioration in soundness. The four major financial holding companies have announced plans to maintain CET1 above 13% while expanding shareholder returns.

The banking sector currently views the impact on soundness indicators as not yet at a worrisome level. However, with the inauguration of the new Trump administration in the U.S. and the possibility of additional exchange rate increases this year due to tariff pressures, they are closely monitoring the situation. A representative from a commercial bank said, "During periods when the exchange rate rises, if foreign currency loans increase rapidly, exposure can grow," adding, "We plan to strengthen risk management by reviewing the scale of foreign currency loans and the dollar ratio."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.