Daedong Gear and Jeonjin Construction Robot Hit Record Highs

Automobile and Secondary Battery Stocks Rebound on Hopes of Tariff Exemption

The domestic stock market once again fluctuated with a single word from U.S. President Donald Trump. Rebuilding stocks surged on news that Ukraine ceasefire negotiations had gained momentum, while crude oil ETFs (exchange-traded funds) plummeted. Automobile and secondary battery stocks, which had been sluggish earlier this month, also rebounded as if nothing had happened amid expectations that they might be exempt from tariffs. The securities industry forecasts that this kind of sector leadership rotation will continue for the time being.

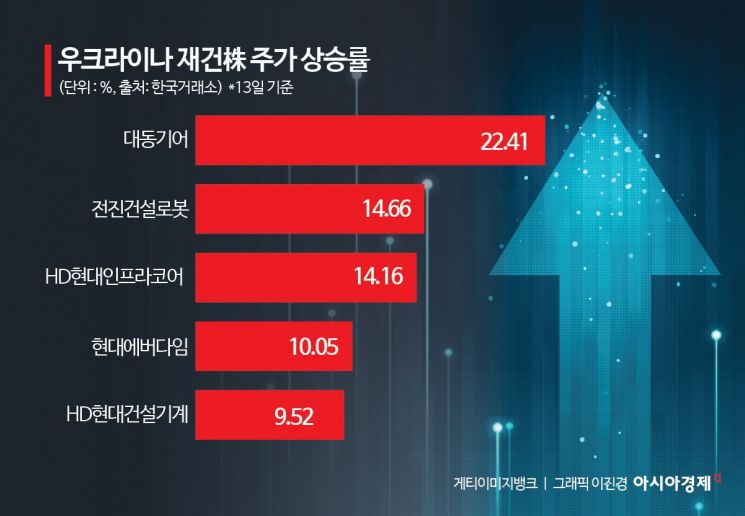

On the 13th, the clear winners in the domestic stock market, which closed higher across the board, were the Ukraine reconstruction stocks. Leading the charge was Daedong Gear (22.41%), which signed a tractor supply contract and became the exclusive importer of agricultural machinery from Ukraine, hitting a 52-week high. Hyundai Group affiliates also joined the rally with new highs, including HD Hyundai Infracore (14.16%), a comprehensive machinery company, Hyundai Everdigm (10.05%), a fire truck manufacturer, and HD Hyundai Construction Equipment (9.52%), a construction equipment company.

All the factors driving the stock price increases on that day came from President Trump's statements. He raised investor sentiment by announcing on his social media that he had agreed with Russian President Vladimir Putin to immediately start Ukraine ceasefire negotiations and to conduct mutual visits. Lotte Chemical, which has recorded losses for three consecutive years, also saw its stock price jump 10% as the expectation of a ceasefire led to a drop in international oil prices, which acted as a positive factor. On the other hand, domestic crude oil ETFs such as KIWOOM U.S. Oil Energy Company (-3.05%) were hit hard by the oil price decline.

Since the change of administration at the White House last month, the domestic stock market has sharply reflected the fortunes of related sectors with every word and action of President Trump. For example, automobile stocks including Hyundai Motor and secondary battery stocks had been declining due to President Trump's tariff bombs and the cancellation of electric vehicle promotion policies. However, news from U.S. House Speaker Mike Johnson the day before that these stocks might be exempt from tariffs led to a rebound as if nothing had happened. Since President Trump's inauguration, foreign investors had sold Hyundai Motor shares worth 645 billion KRW (ranked second in net sales) from the 21st of last month to the 12th of this month, but on the 13th, when the news was announced, they bought 81.2 billion KRW worth, ranking first in net purchases.

The securities industry expects this sector rotation trend in the domestic stock market to continue for the time being. Choi Jaewon, a researcher at Kiwoom Securities, explained, "The domestic stock market has shown a strong rebound momentum as a retracement following excessive adjustments since the beginning of the year. Given the ongoing poor performance of large sectors, it is likely that a momentum-driven market by individual stocks will continue." Lee Seonghoon, another researcher at Kiwoom Securities, also evaluated, "The rotation within leading sectors and themes driven by continuous positive news flow will remain valid for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.