Stock Price Up 64% This Year, Market Cap Reaches 7.9 Trillion KRW

Strong Performance Last Year Fuels Growth Expectations for 2024

Benefiting from Data Center Investment Boom

LS Electric's corporate value is rapidly growing after achieving results that exceeded market expectations in the fourth quarter of last year. The expectation that the trend of performance improvement will continue this year is leading to a rise in stock prices. Recently, foreign and institutional investors have been actively buying shares, driving the stock price up.

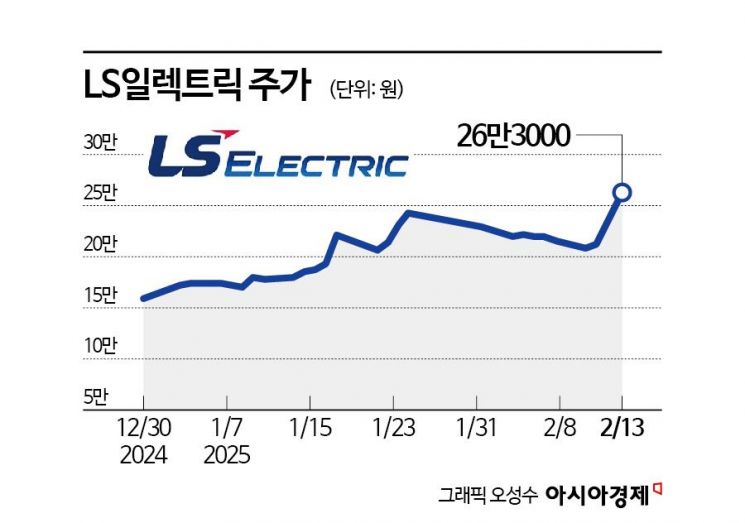

According to the financial investment industry on the 14th, LS Electric's stock price has risen 63.6% since the beginning of this year. During the same period, the KOSPI increased by 7.7%. The market capitalization has expanded to 7.9 trillion KRW. Foreign and institutional investors are concentrating on accumulating shares. Over four days from the 10th to the previous day, foreigners and institutions recorded net purchases of 51.4 billion KRW and 45.7 billion KRW, respectively.

LS Electric holds about a 63% market share in the domestic low- and high-voltage power equipment sector. In preparation for increased investment in power grids alongside the evolution of artificial intelligence (AI) technology, the company is also investing heavily to expand its ultra-high voltage transformer production capacity. In June last year, it made an expansion investment worth about 100 billion KRW for ultra-high voltage transformer production. In September last year, it acquired a 51% stake in KOC Electric, a domestic transformer manufacturer. This is a strategic move to expand ultra-high voltage transformer production capacity.

In the fourth quarter of last year, on a consolidated basis, LS Electric recorded sales of 1.3595 trillion KRW and operating profit of 119.9 billion KRW, representing increases of 32% and 76% compared to the same period the previous year. Seong Jong-hwa, a researcher at LS Securities, explained, "The key factor behind achieving results that exceeded market expectations was the boom in ultra-high voltage transformers centered on the Korean and North American markets," adding, "The exchange rate effect and the reflection of KOC Electric's consolidated results also contributed."

The proportion of new orders from the North American region has been rapidly increasing among last year's new orders. The sales proportion of North America in the power business rose from 17% in 2023 to 20% last year. North American ultra-high voltage transformer sales increased by 426%, from 13.7 billion KRW in 2023 to 72.1 billion KRW in 2024.

Along with improved performance, the confidence of Koo Ja-kyun, chairman of LS Electric, has also influenced the rise in corporate value. On the morning of the 12th, Chairman Koo visited the venue of 'ELEX Korea 2025,' the largest smart power and energy exhibition in Korea, stating, "The U.S. data center project is almost at the contract stage," and "Visible results are expected by the end of this year or around next year."

Expectations are growing that the company will continue to grow based on solid technological capabilities. Lee Dong-heon, a researcher at Shinhan Investment Corp., analyzed, "LS Electric showcased its comprehensive technological capabilities across the company, including data center power equipment, all-in-one power supply systems, superconducting fault current limiters (SFCL), and superconducting cables (SC)," adding, "It demonstrated scalability based on robust technology and productivity."

According to Bloomberg New Energy Finance, the global power grid investment scale is expected to grow from 235 billion USD in 2020 to 532 billion USD by 2030. There is active movement to build large-scale data centers to operate generative AI. Demand for power infrastructure and systems, such as ultra-high voltage transformers and distribution panels, to support AI-utilizing devices is also rapidly increasing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.